Modern investment solutions that aim to directly address the income and longevity concerns of retirees

GuardPath™ Longevity Solutions are innovative new portfolio longevity solutions designed to guard investors’ long-term financial security by maximizing cash flow in a risk-managed decumulation framework and through significant lump-sum payouts to surviving unitholders.

8%

GuardPath™

Managed

Decumulation1

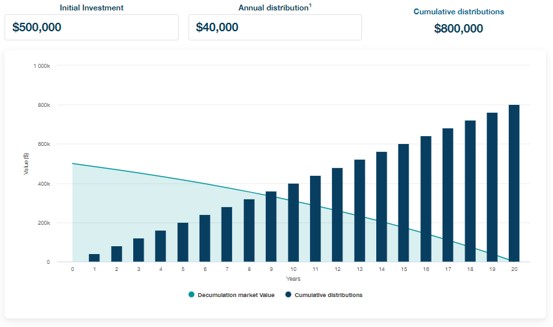

GuardPath™ Managed Decumulation:

One of the first solutions in Canada designed to optimize the utility of invested capital during retirement. It seeks to deliver attractive, steady cash flow over a 20-year period through sophisticated risk management techniques aiming to extend portfolio longevity.

6.5%

Hybrid

Tontine

Series1

Hybrid Tontine Series:

Combines the strength of the GuardPath™ Managed Decumulation and GuardPath™ Modern Tontine solutions to offer a holistic solution for the entirety of retirement. This first-of-its kind solution is specifically designed to optimize the utility of invested capital during retirement through steady cash flow for 20 years, coupled with significant payouts to surviving unitholders in 20 years.

GuardPath™

Modern

Tontine

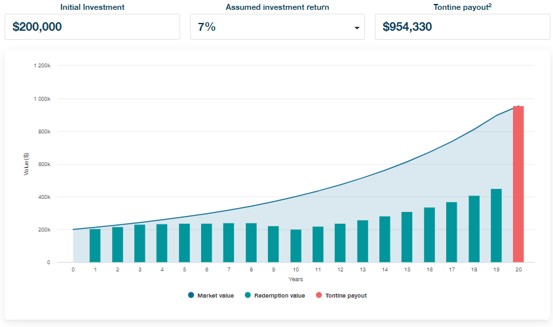

GuardPath™ Modern Tontine:

The first investment solution in Canada seeking to deliver financial security to retirees in their later years of life, designed to provide significant payouts to surviving unitholders in 20 years based on compound growth and the pooling of survivorship credits.

Access to Institutional Asset Management

At Guardian Capital LP, we have been managing institutional client assets since 19622, with clients ranging from private businesses to sovereign wealth funds. Now, retail investors can reap the benefits of these institutions’ thorough vetting processes when they invest in our strategies.

By making these institutional strategies and teams available to retail investors, we’re levelling the playing field.

About Guardian CapitalFund Codes & Details

Speak to your Financial Advisor about how these innovative solutions may be incorporated into your broader retirement portfolio.

| Fund Name | Fund Code | Series | Management Fee |

|---|---|---|---|

| GuardPath™ Managed Decumulation 2042 | GMF 100 | A | 1.35% |

| GuardPath™ Managed Decumulation 2042 | GMF 101 | F | 0.60% |

| GuardPath™ Managed Decumulation 2042 | GMF 200 | Hybrid Tontine Series A | 1.35% |

| GuardPath™ Managed Decumulation 2042 | GMF 201 | Hybrid Tontine Series F | 0.60% |

| GuardPath™ Managed Decumulation 2042 | GPMD | ETF | 0.60% |

| GuardPath™ Modern Tontine 2042 Trust | GMF 300 | A | 1.60% |

| GuardPath™ Modern Tontine 2042 Trust | GMF 301 | F | 0.60% |

Interactive Calculators

1. Reflects initial target distribution rate for Series F units and may be subject to change over time. Please refer to the section on Risks in the prospectus for more information on the risks associated with this distribution. Series A units of the Managed Decumulation Fund and Hybrid Tontine Series are also available, but have different management fees and distribution rates due to the trailer fee commission, and performance may be lower as a result.

2. Guardian Capital LP is a wholly owned subsidiary of Guardian Capital Group Limited and the successor to its original investment management business, which was founded in 1962.

Unlike traditional mutual funds or exchange traded funds (“ETFs”), the GuardPath Longevity Solutions are unique investment fund structures and investors should carefully consider whether his or her financial condition and investment objectives are aligned with these retirement-focused investments. The Units may be suitable for an investor primarily concerned about having sufficient income in retirement, especially in the later years of their life. The Units may not be suitable for an investor whose primary objective is to leave capital behind for their estate. The GuardPath Longevity Solutions are not insurance companies, the units are not insurance or annuity contracts and unitholders will not have the protections of insurance laws. Distributions provided by the GuardPath Longevity Solutions are not guaranteed or backed by an insurance company or any third party. The long-term total return and the sustainability of the rate of distributions of the GuardPath Managed Decumulation Fund may be impacted by volatility and sequence of returns risk. Payments from the GuardPath Modern Tontine Trust are tied to the life of the unitholder and, accordingly, people with serious or life-threatening health issues should not invest in the GuardPath Modern Tontine Trust, as the amount that a unitholder will receive upon redemption (either voluntary or upon death) will be lower than the then current NAV per unit, as detailed in the prospectus. The long-term total return of the GuardPath Modern Tontine Trust will be impacted by actual redemption rates, and may increase or decline as mortality rates or voluntary redemptions increase or decline. This is not a complete list of the risks associated with an investment in these GuardPath Longevity Solutions. Please read the prospectus for complete details.