The benefits of GuardBondsTM

Funds that can be held to maturity - just like a bond

A defined maturity date helps to alleviate short-term volatility concerns, as the high probability of the portfolio's short-term investment grade bonds maturing at par means investors are less likely to experience capital losses1.

1 Assumes that investors hold the funds until their maturity date. The value of these funds will fluctuate from day to day, and may be impacted by subscriptions and redemptions, and an investor will be subject to market risks if they sell their units prior to the fund(s) maturity date.

Greater clarity of income

Each GuardBondsTM fund seeks to hold its bonds until maturity, which provides investors with a greater amount of clarity on the level of income that will be generated relative to traditional bond funds that don’t have defined maturity dates or that sell their bond holdings before they mature.

Actively managed, focused on tax-efficiency

Overseen by Guardian Capital LP’s experienced Fixed Income team, GuardBondsTM funds seek to maximize total return potential and aim to mitigate risk by being selective rather than tracking an index. Tax efficiency is improved2 through this selection process by prioritizing bond issuances trading at a discount.

2 Tax efficiency is dependent upon the proportion of discount bonds held by a GuardBondsTM fund, which cannot be predicted and is expected to fluctuate over time, depending on prevailing market conditions as well as the impact and timing of subscriptions and redemptions. When a discount bond matures at par value the price appreciation is treated as a capital gain, which is taxed more favorably than interest income.

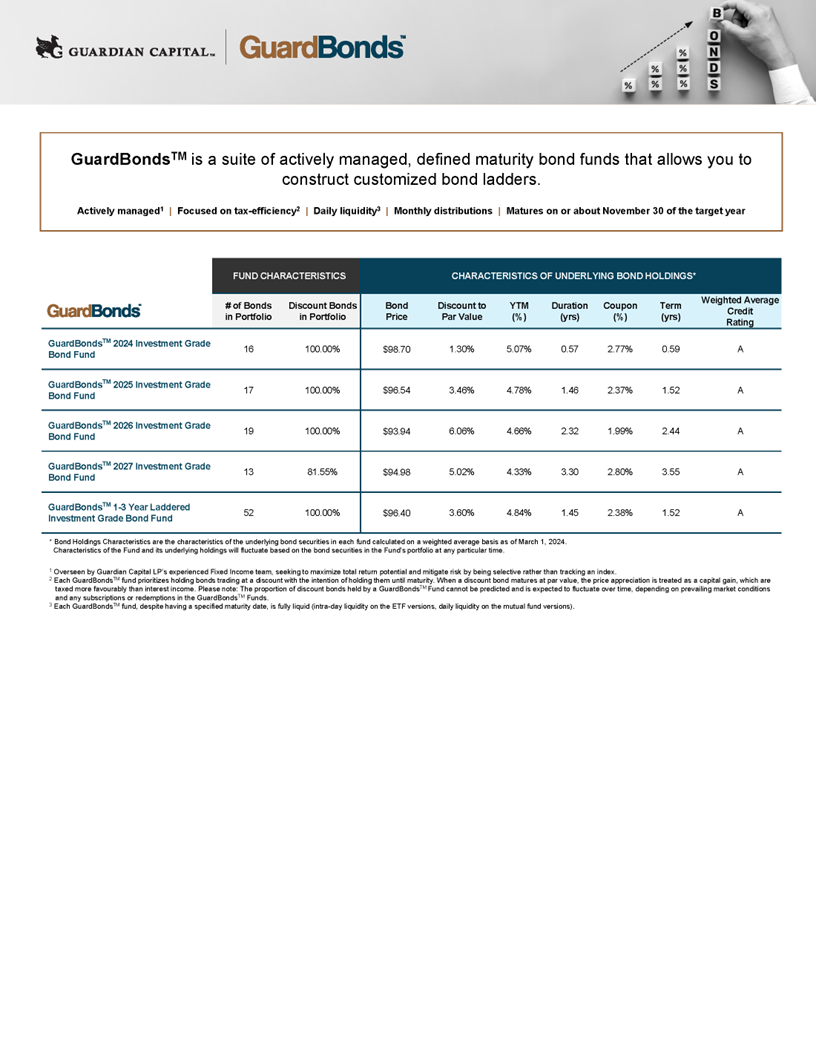

How GuardBondsTM compare

What is a bond ladder?

A bond ladder is a simple concept that entails purchasing bonds that mature at different dates, usually based on calendar years.

At the outset, an investor may choose to weight a portfolio across several consecutive years equally, like rungs on a ladder. With each passing year, the investor is essentially taking a step up the ladder – the shortest maturity bond(s) will mature (the lowest rung on the ladder), cash proceeds will be received, and the investor will then climb up another rung by buying bonds maturing further out (adding a new rung to the top of the ladder).

With a ready-made bond ladder like GuardBondsTM 1-3 Year Laddered Investment Grade Bond Fund, this process is handled for you automatically.

Why use a bond ladder?

Investors tend to use bond ladders for a number of important reasons.

Mitigate interest rate risk

Diversifying across different defined maturity dates aims to help smooth out overall portfolio volatility caused by interest rate changes, versus keeping all your eggs in one basket.

Alignment with cash needs

Bond ladders, or defined maturity date solutions like GuardBondsTM, allow you to align your investments to when you know you'll need cash on hand to fund various expenses.

Greater peace of mind

When building your own bond ladder, you know when your principal will be returned based on the defined maturity date of the bonds in the portfolio which helps alleviate the worry about short-term price or market volatility.

How is tax efficiency achieved?

Depending on changes in interest rates over time, existing bonds available in the market can be priced at a discount or at a premium to their original issue price (par value).

Each GuardBondsTM fund prioritizes owning discount bonds^, striving to generate a higher proportion of capital gains relative to interest income to maximize tax efficiency. Capital gains are taxed more favourably than interest income, as illustrated.

*Hypothetical example for illustrative purposes only. This is a generic illustration and is not representative of an investor’s actual experience. The example outcome shown above is dependent upon the proportion of income vs. capital gains generally. Tax rates applied are based on an Ontario resident in the highest tax bracket (53.53% on interest income and 26.76% net on capital gains).

Please note: The proportion of discount bonds held by a GuardBondsTM Fund cannot be predicted and is expected to fluctuate over time, depending on prevailing market conditions and any subscriptions or redemptions in the GuardBondsTM Funds.

^A bond that trades below its par value is referred to as a “discount bond”. As the bond gets closer to maturity, its price increases to eventually converge to par value.

What happens at maturity?

As each GuardBondsTM fund has a defined maturity date, the underlying bond holdings will mature at various times during that maturity date calendar year. As each bond holding matures, and the fund receives cash proceeds, the cash will be deployed into money market securities to continue earning income until the fund reaches its maturity or termination date on November 30 of its maturity date year, as specified in the fund name. A simplified example, for illustrative purposes: