Press Release Guardian Capital Announces January 2024 Distributions for Guardian Capital ETFs TORONTO, January 17, 2024 – Guardian Capital LP […]

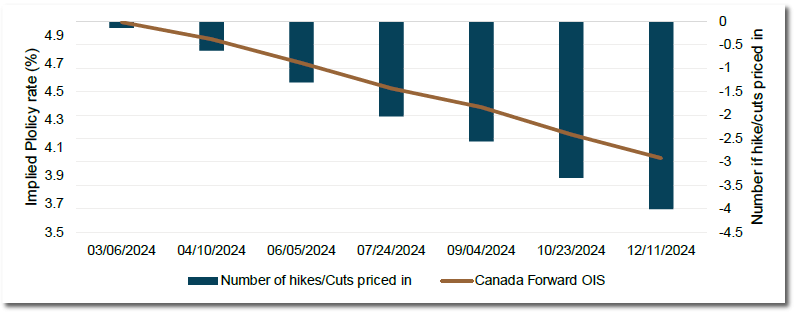

Investors today have an opportunity to take advantage of the current high yields being offered in the fixed income space before the transition in Canada into a widely anticipated period of interest rate cuts on the horizon. According to Bloomberg, the market is currently pricing in six interest cuts in 2024 by the Bank of Canada. Six cuts are an aggressive rate-cut forecast, but it suggests that the market is assuming rates have peaked.

For those looking to invest in cash-alternatives to generate an attractive yield from relatively low-risk securities, we believe strategies offering some degree of certainty at these current higher yields are likely more attractive than flexible cash-alternative instruments, like high-interest savings accounts (HISAs), HISA ETFs/Funds, and money market funds, investing monthly income at declining interest rates.

Reinvestment risk on cash

Reinvestment risk is a non-quantifiable risk in that it is not a risk of loss as much as a risk of declining future returns. Most flexible cash-alternative options rely on ultra-short holding periods to create cash yields that keep pace with interest rates.

This feature was a huge bonus in 2022 and early 2023 as interest rates rose, and the shorter end of the interest rate curve delivered higher yields that allowed investors to generate high relative returns in cash and cash alternative investments. At the same time, bond investors suffered, as higher interest rates pushed their total returns into negative territory. In 2024, the opposite value proposition may be on the horizon, with cash alternatives potentially offering a lower relative return profile given the view of declining interest rates (see chart below), while bond investors stand to benefit.

Canadian cash alternatives derive their interest rates off a spread pegged to the overnight indexed swap (OIS) rate set by the Bank of Canada, so as this rate potentially declines, we would anticipate the yields on these cash alternative strategies also to decline. This scenario could create opportunities for investors to look at “locking in” the current higher interest rates.

For illustrative purposes only.

Source: Guardian Capital LP based on data from Bloomberg as of January 29, 2024. Orange line shows Canada forward overnight indexed swap rates, often used as a gauge of the market’s expectations for the Bank of Canada’s overnight rate. Dates shown on the chart represent the scheduled rate policy-setting dates for the Bank of Canada in 2024. The blue bars correspond to the number of 0.25% cuts the Canada forward OIS represents relative to the current target overnight rate of 5.00%.

Taking advantage of high rates

Here is a snapshot of the current level of interest rates in popular cash-savings vehicles in Canada. You can see the going rate for low-risk cash alternatives is roughly 5%, with the yields on HISA ETFs having declined noticeably since OSFI changed liquidity requirements on the high interest savings deposits that these ETF invest in. An October 31, 2023, article in Investment Executive noted observed gross yields on HISA ETFs between 5.30% and 5.50%, much higher than the current range of 4.90%-5.00%. It’s worth noting that T-Bills offer a higher relative yield than most HISAs currently if investors have an immediate need for monthly income.

| Name | Ticker | Gross Yield |

| Guardian Ultra-Short Canadian T-Bill Fund | GCTB | 5.06% (YTM at cost) |

| GuardBondsTM 2024 Investment Grade Bond Fund | GBFA | 5.41% (YTM) |

| Horizons High Interest Savings ETF | CASH | 4.98% |

| High Interest Savings Account Fund | HISA | 5.18% |

| CI High Interest Savings ETFs | CSAV | 4.95% |

| Purpose High Interest Savings ETF | PSA | 5.04% |

| Horizons 0-3 Month T-Bill ETF | CBIL | 4.93% (YTM) |

| BMO 1-Year Non-Cashable GIC | N/A | 4.65% |

Example for illustrative purposes only. This example includes a small selection of cash alternative investments, and by no means is representative of all the cash alternative investment options available. Gross yields do not reflect the impact of fees, which would decrease the yield and represent the weighted-average yield of underlying securities and the actual yield experienced by investors may differ materially.

Source: Publicly available records from Horizons ETFs Management (Canada) Inc., Evolve Funds Group Inc., CI Investments Inc., Purpose Investments Inc., Guardian Capital LP and Bank of Montreal (BMO) websites as of January 29, 2023. Yield to Maturity (YTM) is the annualized, weighted average Yield to Maturity of each of the underlying securities in the portfolio, net of cash, but inclusive of cash-alternative investments like money market securities. Yield to Maturity represents the annualized expected rate of return earned on the bonds based on the assumption that they are held to maturity and all coupon payments are made on time and reinvested at the same rate. YTM at Cost is the weighted average Yield to Maturity at Cost of each of the underlying T-Bill securities in the portfolio, net of cash. Yield to Maturity at Cost means the percentage rate of return paid if the T-Bill security is held to its maturity date from the original time of purchase. The calculation is based on the coupon rate, length of time to maturity, and original price of the underlying T-Bill securities. Neither YTM nor YTM at Cost are the yield, distribution rate or performance return of the Fund(s) and are not intended to represent the distribution or return experience of any unitholder.

On the cash-alternative spectrum, GICs and other defined maturity strategies offer a potentially better risk/reward profile because investors can “lock in” a higher yield level. By using the term “locked-in,” we suggest that it is possible to achieve a higher level of yield by purchasing one of these products now, even if the ultimate current yield-to-maturity on these strategies varies.

You may want to consider GuardBondsTM 2024 Investment Grade Bond Fund – available as a mutual fund (Series A and F) and ETF (ticker GBFA: Cboe). The Fund’s primary objective is to provide income over a pre-determined time horizon by investing in a portfolio consisting primarily of Canadian dollar-denominated investment grade bonds with an effective maturity in 2024 (with the termination date anticipated as on or about November 30, 2024).

By having a maturity date that is less than 10 months, GBFA essentially takes on the characteristics of a money-market strategy, although it does have credit risk associated with the underlying bonds, which currently have an average credit rating of A.

However, with the Fund primarily buying discount bonds and holding them to maturity, this essentially secures a higher level of yield-to-maturity. For investors willing to wait to earn these proceeds at the Fund’s maturity date in November, GBFA can be a powerful way to help enhance the yield of the cash or cash-alternative bucket within an investor’s portfolio.

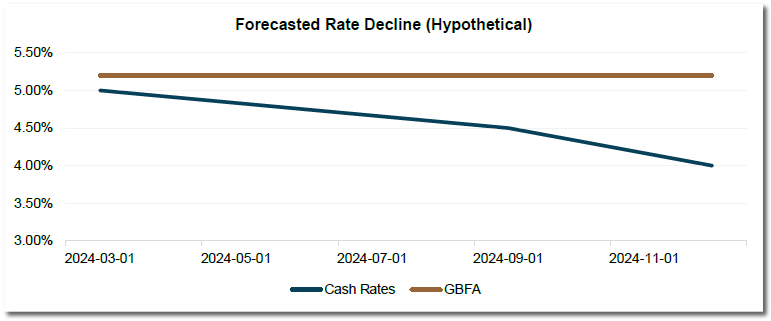

The chart below shows the forecasted decline in yields on the Bank of Canada’s target overnight rate vs. the current yield-to-maturity of the portfolio holdings of GBFA. As interest rates decline, GBFA is built to deliver a higher level of steady return, making interest rate moves irrelevant when you have a defined maturity!

For illustrative purposes only.

Source: Guardian Capital LP based on data from Bloomberg as of January 29, 2024. Assumptions: This chart uses a more conservative interest rate path than the Bloomberg forward OIS as used in Chart 1 and assumes a 4% overnight rate by Q4 of 2024, less than the six forecasted rate cuts. It also assumes a steady yield-to-maturity for the holder of the GBFA fund net of fees – approximately 5.2%. There is variance in these types of forecasts, including fees, trading expenses and the potential impact of subscriptions and redemptions on the Fund. Overall, we would still expect a strong yield spread to be achieved by GBFA if interest rates decline in 2024.

Unlike a GIC, GBFA provides monthly income and, we believe, will benefit from a higher yield spread which, historically, has been harvested from owning high-quality investment-grade corporate credit.

Consider GBFA and these three key reasons for your immediate target cash alternative:

As rates decline, don’t leave yield on the table. Use GBFA to provide a consistent yield for 2024!

DISCLAIMER

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

*Use of Simulated Model Examples – The forecast model has been prepared for illustrative purposes only, to help show the potential impact of interest rate declines and potential investment outcomes. Simulated returns are not the returns of any particular investor, account or portfolio and there is no guarantee that these same results will be achieved by investors. The reliance on hypothetical, simulated returns come with inherent risks and limitations. There are frequently material differences between hypothetical results and the actual results achieved by a particular investment strategy. Hypothetical performance calculations cannot account for the impact of certain financial or market risks on actual holdings or trading. There are numerous other factors related to the markets in general, and the implementation of any specific investment strategy, which cannot be fully accounted for the in the preparation of hypothetical results; all of which can adversely affect actual results. Hypothetical, simulated performance is not indicative of future results, and no representation is being made that any investor will, or is likely, to achieve gains, losses or outcomes similar to those illustrated. Please consider these and other factors carefully and do not place undue reliance on modeled or forward-looking information. This illustration is not intended to represent the investment experience of any particular investor.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is a significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Please read the prospectus, Fund Facts or ETF Facts before investing. Important information, including a summary of the risks, about each Fund is contained in its respective offering documents. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund and exchange traded fund (ETF) investments. You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on a stock exchange. If the units are purchased or sold on a stock exchange, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. For ETF Units and mutual funds other than money market funds, unit values change frequently. For money market mutual fund Units, there can be no assurances that these mutual fund Units will be able to maintain their net asset value per unit at a constant amount or that the full amount of your investment in the fund will be returned to you. Mutual fund and ETF securities, including money market funds, are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. Mutual funds and ETFs are not guaranteed, and past performance may not be repeated.

Guardian Capital LP is the Manager of the GuardBondsTM funds. Guardian Capital LP is a wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm, the shares of which are listed on the Toronto Stock Exchange. For further information on Guardian Capital LP or its affiliates, please visit www.guardiancapital.com. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.

Published date: February 16, 2024