Another upside surprise spurs further repricing of the Fed Once again, inflation data has provided an upside surprise, with the […]

Following last week’s surprisingly firm inflation data announcement1, markets quickly upped their expectations for the path of policy rates in Canada. The Bank of Canada (Bank) decision-makers, however, were not swayed. Instead, today (October 26), the Bank raised its overnight policy rate target by 50 basis points (to 3.75%), a smaller than-anticipated increase than markets had expected (+75bps). This is a step down from the 75bps increase in September and 100bps hike in July (the balance sheet reduction policy continues unchanged).

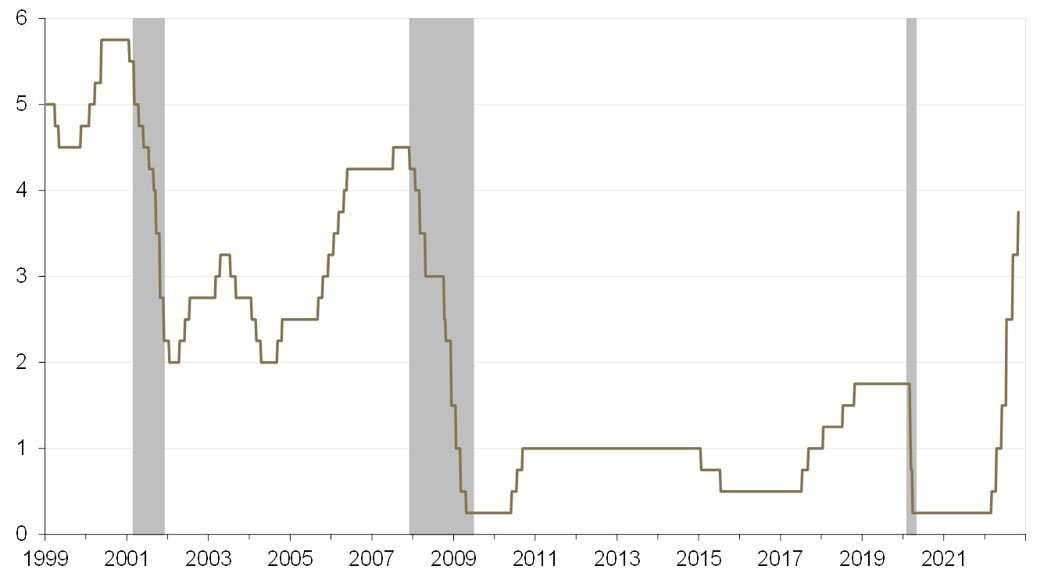

Bank of Canada overnight rate target

(percent)

Source: Guardian Capital based on data from Bloomberg and the Bank of Canada to October 26, 2022; shaded regions represent periods of US recession

While the statement accompanying today’s decision2 (provided below) states that “the Governing Council expects that the policy interest rate will need to rise further” and that they remain “resolute” in their commitment to achieving a 2% inflation target, the general tone was arguably tilted toward the more dovish side of the spectrum.

The Canadian economy operating “in excess demand,” the job market remaining “tight” as businesses continue to report “widespread labour shortages” and demand for goods and services “still running ahead of the economy’s ability to supply them,” is stoking broad domestic inflationary pressures and support for the Bank’s move toward a more restrictive policy stance. Though, there are hints that more caution over the outlook is creeping into the policymakers’ proceedings.

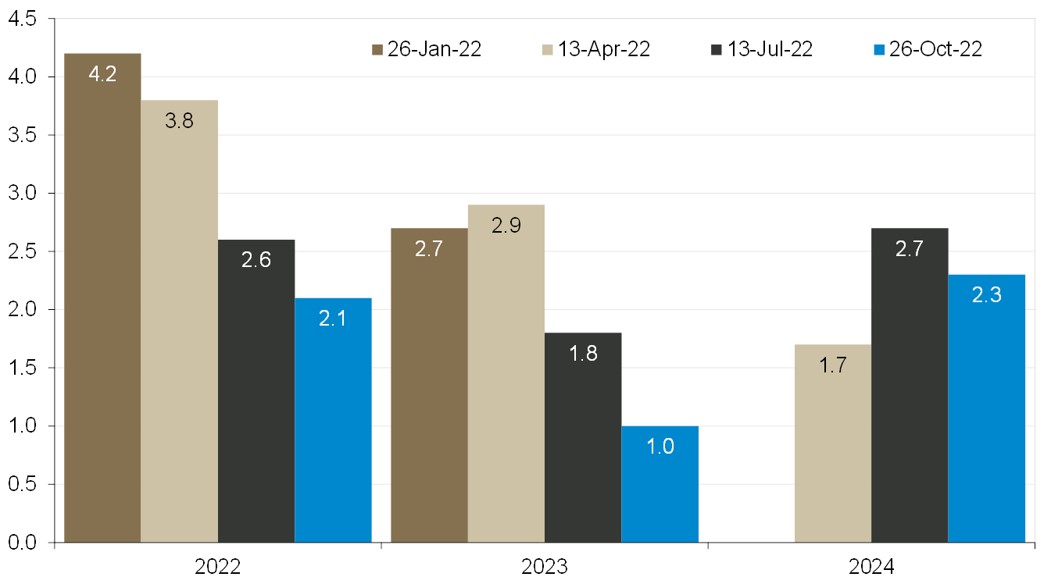

Housing market activity “has retreated sharply,” and spending by households and businesses is “softening” — signs that the hikes up to this point have impacted activity. The slowing international demand that is “beginning to weigh on exports” compounds this moderation in momentum. Taken together, and with the anticipation that tighter policy will continue to filter into the real economy, the Bank now expects growth to “stall through the end of the year and the first half of next.” The Bank’s Monetary Policy Report3, released in tandem with today’s interest rate decision, shows notable downward revisions to projected growth across the forecast horizon (particularly for 2023).

Bank of Canada projected real gross domestic product growth

(Q4-over-Q4 percent change)

Source: Guardian Capital based on data from the Bank of Canada

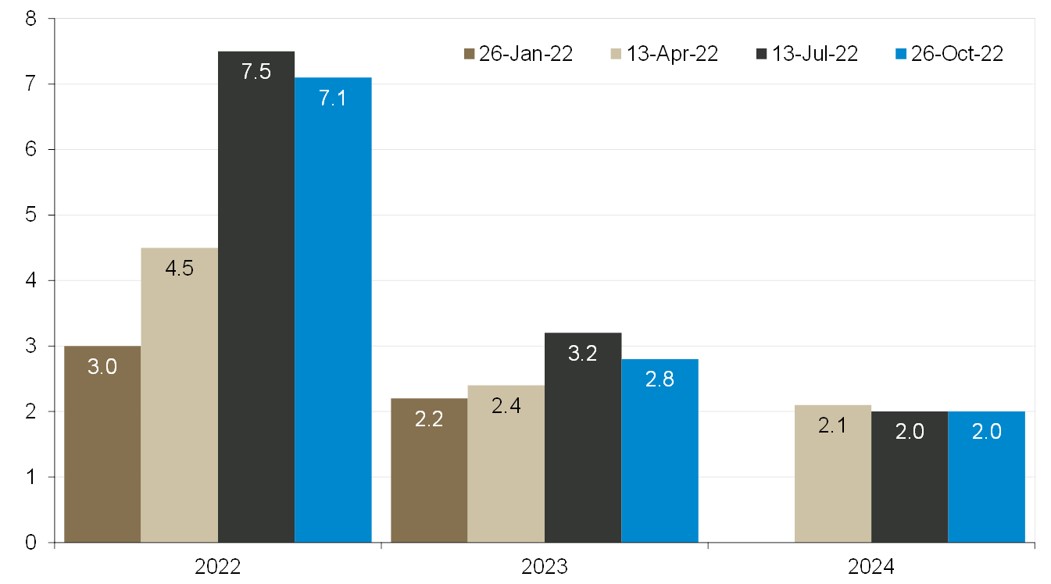

This projected slower growth momentum, combined with fading supply chain disruptions and lower commodity prices, is expected to dampen price pressures. While the Bank’s preferred measures of underlying inflation “are not yet showing meaningful evidence that underlying price pressures are easing” and “near-term inflation expectations remain high,” policymakers actually trimmed their inflation forecasts for this year and next (now projected to end 2023 within the 1% to 3% target range).

Bank of Canada projected consumer price index inflation

(Q4-over-Q4 percent change)

Source: Guardian Capital based on data from the Bank of Canada

So, the Bank of Canada is not yet done with its hiking cycle. However, the evident focus on the impact of past moves and hints of caution about the road ahead suggests that the end may be closer than previously thought. For his part, Bank Governor, Tiff Macklem, noted in the post-decision presser4 that “we are getting closer, but we are not there yet.”

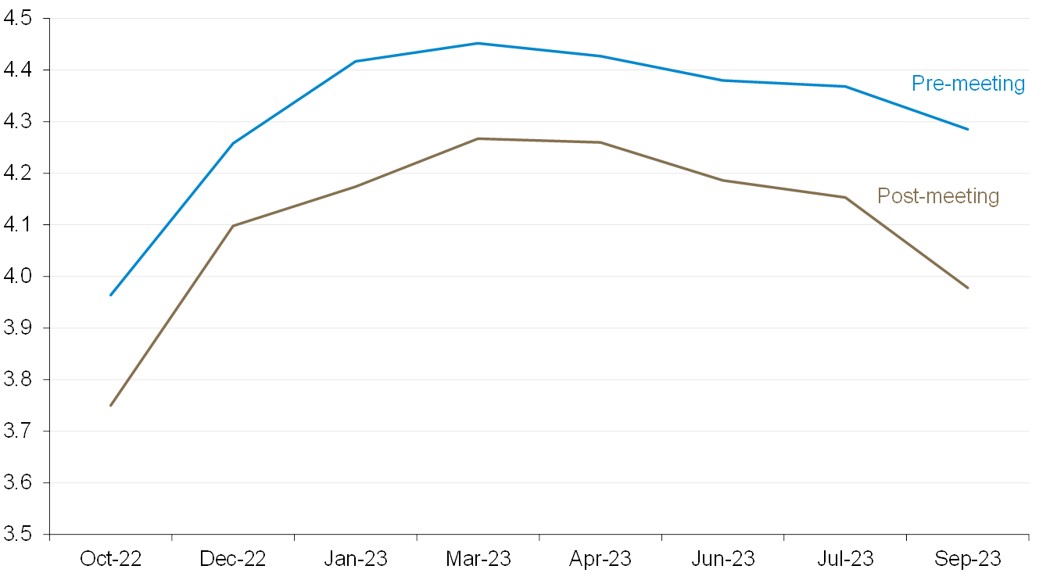

After today’s decision and comments, markets have knocked about 25 basis points from their pricing for the terminal point of the Bank’s policy rate. This has triggered a sharp rally in Canadian bonds (yields are down roughly 20 basis points out to the 10-year part of the curve) and gave a lift to Canadian equities (arguably supporting US stocks as hopes rise for the US Federal Reserve to strike a similar tone next week).

Overnight index swap (OIS) implied Bank of Canada overnight rate target

(percent)

Source: Guardian Capital based on data from the Bank of Canada

Written by: David Onyett-Jeffries

David Onyett-Jeffries is Vice President, Economics & Multi Asset Solutions, at Guardian Capital LP (GCLP) and provides macro-economic guidance to GCLP and its affiliates—Alta Capital Management LLC and GuardCap Asset Management Limited.

Bank of Canada increases policy interest rate by 50 basis points, continues quantitative tightening

FOR IMMEDIATE RELEASE

Media Relations

Ottawa, Ontario

October 26, 2022

The Bank of Canada today increased its target for the overnight rate to 3¾%, with the Bank Rate at 4% and the deposit rate at 3¾%. The Bank is also continuing its policy of quantitative tightening.

Inflation around the world remains high and broadly based. This reflects the strength of the global recovery from the pandemic, a series of global supply disruptions, and elevated commodity prices, particularly for energy, which have been pushed up by Russia’s attack on Ukraine. The strength of the US dollar is adding to inflationary pressures in many countries. Tighter monetary policies aimed at controlling inflation are weighing on economic activity around the world. As economies slow and supply disruptions ease, global inflation is expected to come down.

In the United States, labour markets remain very tight even as restrictive financial conditions are slowing economic activity. The Bank projects no growth in the US economy through most of next year. In the euro area, the economy is forecast to contract in the quarters ahead, largely due to acute energy shortages. China’s economy appears to have picked up after the recent round of pandemic lockdowns, although ongoing challenges related to its property market will continue to weigh on growth. Overall, the Bank projects that global growth will slow from 3% in 2022 to about 1½% in 2023, and then pick back up to roughly 2½% in 2024. This is a slower pace of growth than was projected in the Bank’s July Monetary Policy Report (MPR).

In Canada, the economy continues to operate in excess demand and labour markets remain tight. The demand for goods and services is still running ahead of the economy’s ability to supply them, putting upward pressure on domestic inflation. Businesses continue to report widespread labour shortages and, with the full reopening of the economy, strong demand has led to a sharp rise in the price of services.

The effects of recent policy rate increases by the Bank are becoming evident in interest-sensitive areas of the economy: housing activity has retreated sharply, and spending by households and businesses is softening. Also, the slowdown in international demand is beginning to weigh on exports. Economic growth is expected to stall through the end of this year and the first half of next year as the effects of higher interest rates spread through the economy. The Bank projects GDP growth will slow from 3¼% this year to just under 1% next year and 2% in 2024.

In the last three months, CPI inflation has declined from 8.1% to 6.9%, primarily due to a fall in gasoline prices. However, price pressures remain broadly based, with two-thirds of CPI components increasing more than 5% over the past year. The Bank’s preferred measures of core inflation are not yet showing meaningful evidence that underlying price pressures are easing. Near-term inflation expectations remain high, increasing the risk that elevated inflation becomes entrenched.

The Bank expects CPI inflation to ease as higher interest rates help rebalance demand and supply, price pressures from global supply disruptions fade, and the past effects of higher commodity prices dissipate. CPI inflation is projected to move down to about 3% by the end of 2023, and then return to the 2% target by the end of 2024.

Given elevated inflation and inflation expectations, as well as ongoing demand pressures in the economy, the Governing Council expects that the policy interest rate will need to rise further. Future rate increases will be influenced by our assessments of how tighter monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding. Quantitative tightening is complementing increases in the policy rate. We are resolute in our commitment to restore price stability for Canadians and will continue to take action as required to achieve the 2% inflation target.

1. Statistics Canada, The Daily, Consumer Price Index, September 2022, October 19, 2022, https://www150.statcan.gc.ca/n1/daily-quotidien/221019/dq221019a-eng.htm?HPA=1,

2. Bank of Canada, Bank of Canada increases policy interest rate by 50 basis points, continues quantitative tightening, Press Release issued on October 26, 2022, https://www.bankofcanada.ca/2022/10/fad-press-release-2022-10-26/

3. Bank of Canada, Monetary Policy Report, October 2022, Report of the Governing Council, October 26, 2022, https://static.bankofcanada.ca/uploads/pdf/mpr-2022-10-26.pdf

4. Bank of Canada, Monetary Policy Report Press Conference Opening Statement, October 26, 2022, https://www.bankofcanada.ca/2022/10/fad-press-release-2022-10-26/

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. Guardian, Guardian Capital and the Guardian gryphin design are trademarks of Guardian Capital Group Limited, registered in Canada.