“The real fortunes in this country have been made by people who have been right about the business they […]

Once again, inflation data has provided an upside surprise, with the seasonally-adjusted US consumer price index (CPI) rising by 0.4% on a month-over-month basis in September, as reported earlier today1. This is the biggest increase in three months and double the 0.2% monthly pickup anticipated by market forecasters ahead of today’s release, which took the year-over-year consumer price inflation rate to 8.2% (down from 8.3% in August, 8.5% in July and the peak of 9.1% in June, but above the expected 8.1% reading).

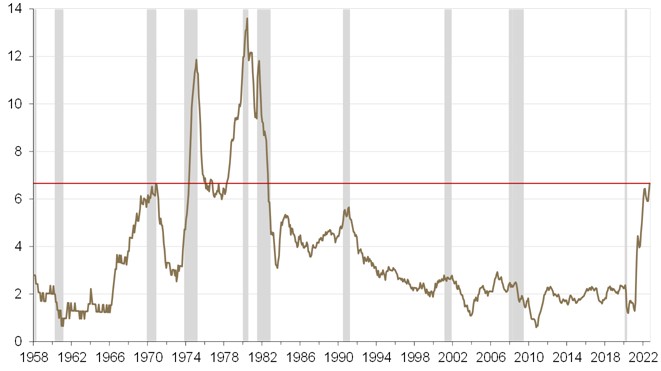

As has been the case in the last few months, the larger-than-anticipated rise reflects above-consensus increases in prices outside food & energy (+0.6% in September versus the expected +0.4%, so another sizable overshoot). Core inflation perked up to a new 40-year high of 6.6% from 6.3% in August and 5.9% in the prior two months.

US consumer price index excluding food & energy (core inflation)

(year-over-year percent change)

Source: Guardian Capital based on data from the US Bureau of Labor Statistics and Bloomberg to September 2022; shaded regions represent periods of US recession

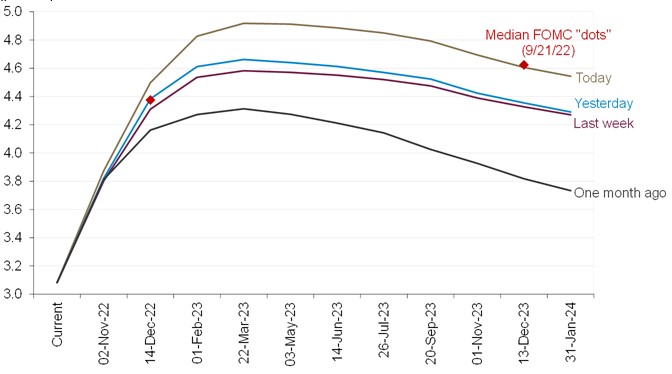

This sustained, more-intense-than-normal upward pressure in core inflation is definitely not what US Federal Reserve (Fed) policymakers want to see and, against their continued hawkish rhetoric of late, markets have thrown in additional rate hikes to the expected path for policy rates. The current fed funds futures pricing now anticipates another almost 150bps of tightening by year end (so, “jumbo” 75bps hikes at each of the remaining two meetings this year) and nearly 50bps in Q1/23 before reversing course; this compares to the latest “dot plot” from the US Federal Open Market Committee (FOMC) pointing to 125bps by year-end and 25bps next year). Bond and equity markets are selling off sharply as a result — the US Treasury curve is bear-flattening (2-year yields +16bps, 10-year’s +9bps), while North American equities are sharply lower than before the report.

Fed funds futures implied policy rate

(percent)

Source: Guardian Capital based on data from Bloomberg to October 13, 2022

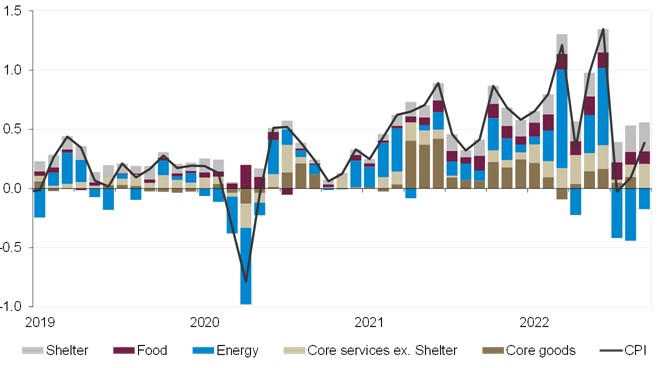

In terms of the details of the report, the firmness in core prices in September was focused on services (with services excluding energy +0.8% month-over-month, the biggest one-month increase since 1982), rather than goods (commodities excluding food & energy flat in September), particularly shelter costs (+0.7%; these lag the dynamics in housing markets) and medical services (+1.0%), which alone account for 40% of the CPI basket.

US consumer price index

(contribution to month-over-month percent change)

Source: Guardian Capital based on data from the US Bureau of Labor Statistics and Bloomberg to September 2022

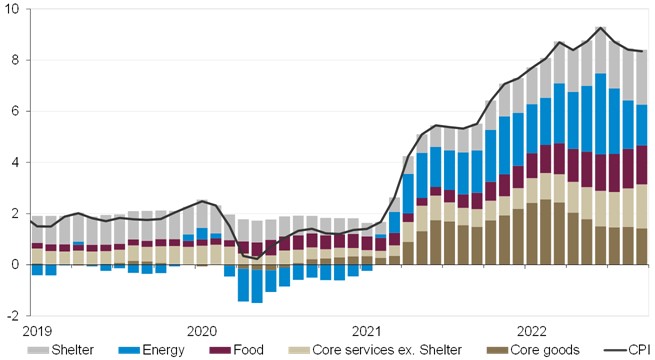

Indeed, core services (and particularly the heavily-weighted shelter) are the only areas where 12-month inflation rates are accelerating — costs for energy, other goods and, to a lesser extent, food, have moderated from recent highs (though all still remain elevated).

US consumer price index

(contribution to year-over-year percent change)

Source: Guardian Capital based on data from the Bureau of Labor Statistics and Bloomberg to September 2022

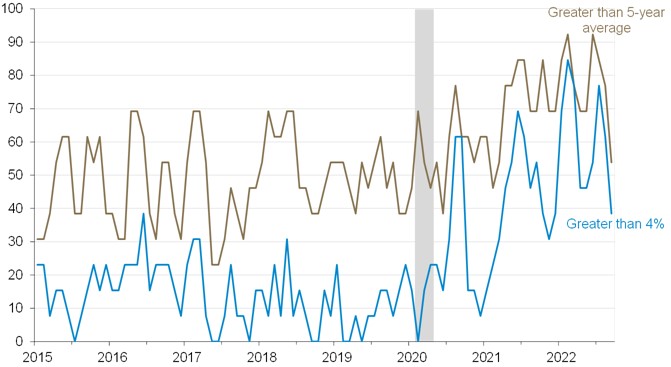

Getting a little more wonk-ish, this divergence in pricing trends was also highlighted by the fact that the share of broad components in the CPI basket with three-month trend rates running above their five-year average fell further in September, to 54% from 77% in August, from 85% in July and a recent peak of 92% in June (for perspective, September represents the lowest since March 2021). The share of CPI components with three-month annualized inflation above 4% fell to 38%, the lowest this year and down from a recent peak of 77% two months ago. The breadth is narrowing, with a few (albeit, important) components in the driver’s seat.

Share of US consumer price index components running hot on a three-month annualized basis

(percent of components)

Source: Guardian Capital based on data from the Bureau of Labor Statistics and Bloomberg to September 2022

With that said, underlying inflationary pressures clearly continue to run hotter than desired and the elevated monthly readings, over the last few months, indicate that the annual rates will likely show a little more persistence than previously anticipated in the months ahead, even as the year-ago comparables get increasingly favourable (prices really started increasing in earnest last winter, so even more moderately-above-average gains going forward should see downward pressure on year-over-year rates).

The bottom line is that the inflation data do not yet offer what can be considered “compelling evidence” of broadly easing price pressures, which means that Fed policymakers will likely continue to raise interest rates (another 75bps on November 2 would appear to be a near guarantee given recent dataflow, with the odds rising of a similar move to close the year). A pivot to a more market-friendly policy stance does not appear to be in the offing any time soon.

Written by: David Onyett-Jeffries

David Onyett-Jeffries is Vice President, Economics & Multi Asset Solutions, at Guardian Capital LP (GCLP) and provides macro-economic guidance to GCLP and its affiliates—Alta Capital Management LLC and GuardCap Asset Management Limited.

1. U.S. Department of Labor, Consumer Price Index – September 2022, Bureau of Labor Statistics, Press Release issued October 13, 2022. https://www.bls.gov/news.release/pdf/cpi.pdf

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. Guardian, Guardian Capital and the Guardian gryphin design are trademarks of Guardian Capital Group Limited, registered in Canada.