Since the start of 2022, growing inflation and rising interest rates have contributed to a marked increase in market volatility. […]

The market had been pricing in a 75 basis point hike in the benchmark overnight policy rate by the Bank of Canada (the “Bank” or “BOC”) at today’s meeting and policymakers had all but explicitly confirmed that such a move was on the way in the lead-up to the fixed action date.

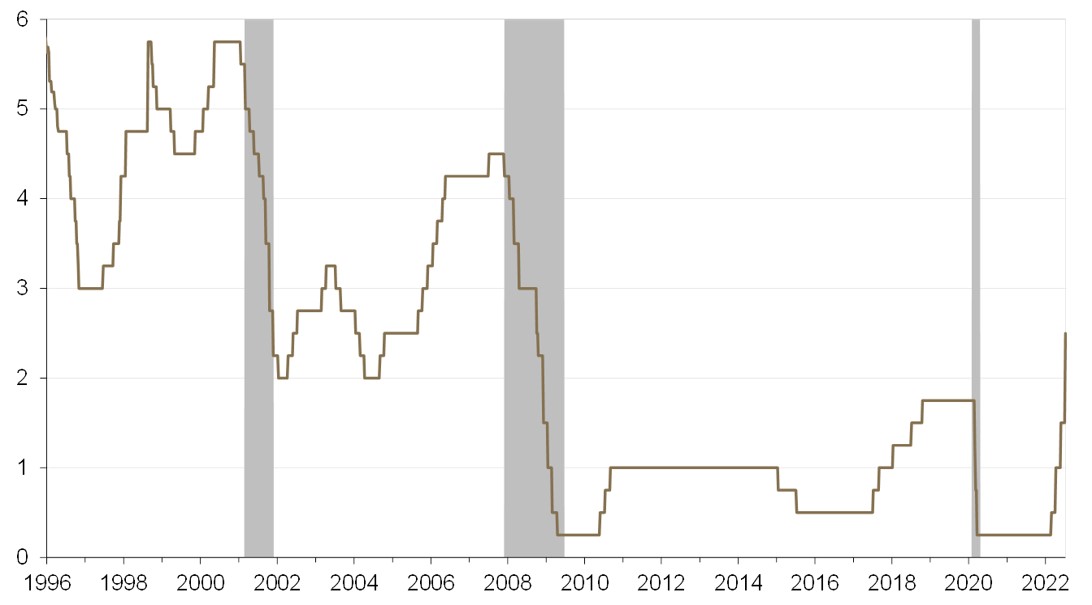

In the event, however, the Bank’s Governing Council decided¹ that with inflation proving to be “higher and more persistent” than expected, and gauges of inflation expectations among businesses and consumers moving higher, it would be prudent to “front-load the path to higher interest rates” and raise the policy rate by a larger-than-anticipated 100 basis points (to 2.50%), while also stating that it “continues to judge that interest rates will need to rise further.” Note that the Bank of Canada’s assumption for the “neutral” rate is the “midpoint of the estimated range of 2% to 3%”, so, by that definition, any further increase means that the Bank is moving into “restrictive” territory. The Bank of Canada is also continuing its quantitative tightening policy (the full statement is provided below).

Source: Guardian Capital based on data from Bloomberg, Bank of Canada to July 13, 2022

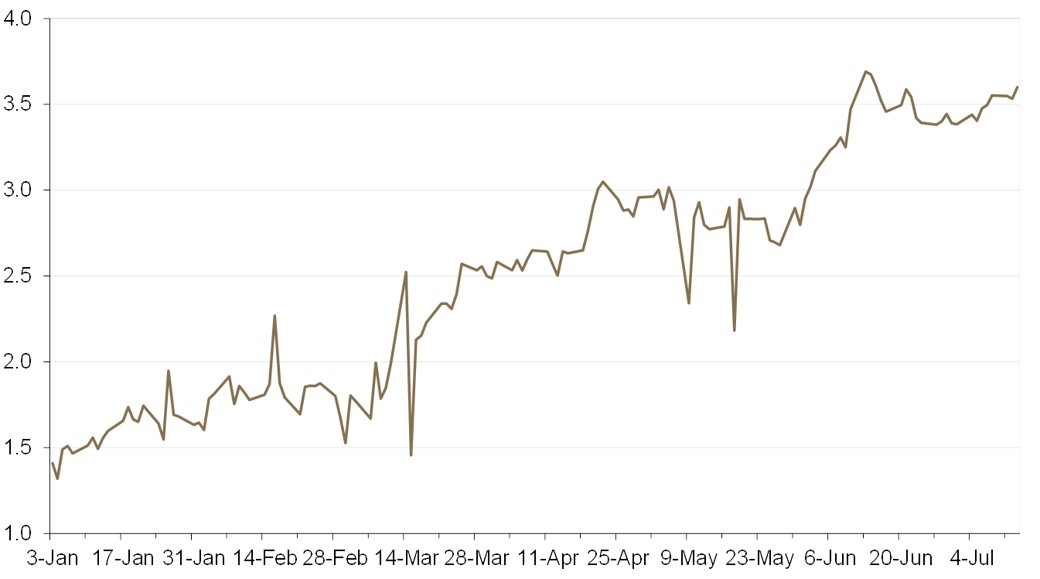

While the magnitude of the move comes as a surprise relative to consensus forecasts (it is the biggest increase since August 1998 and took the overnight rate to its highest level since 2008), it was not entirely unexpected — after all, markets had been looking for the Bank of Canada to keep raising rates through the end of the year and, as it stands even after today, there has not been a material shift in market pricing for year-end policy rates from where they have been recently (an indication that the BOC has adequately convinced markets of the “front-loading” argument). The destination is assumed to be the same, we are just going to get there a little faster.

Source: Guardian Capital based on data from Bloomberg to July 13, 2022

Of course, accelerating the policy tightening (combined with the tightening by central banks abroad, ongoing supply constraints, and higher inflation) is expected to put more of a dampening impact on economic growth sooner. The Monetary Policy Report² (MPR), released with today’s policy decision, showed that the Bank is downgrading its outlook for the domestic economy, with real gross domestic product now expected to expand by 3.5% for this year as a whole and 1.8% next year (versus 4.2% and 3.2%, respectively, in April’s³ forecast; 2024 was revised up to 2.4% from 2.2%). Note that these are now lower than the current Bloomberg consensus calls of 3.8% and 2.3% for 2022 and 2023, respectively, but still projecting that a “soft landing” is achieved.

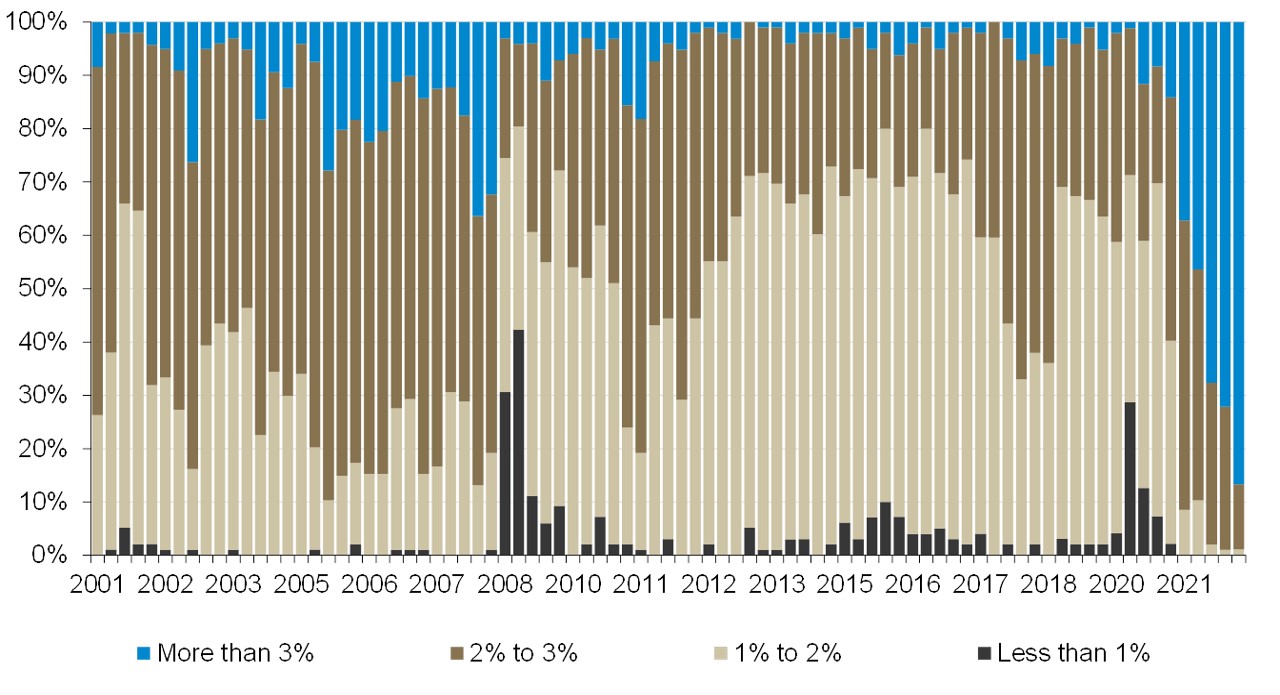

On inflation, expectations were increased materially, with consumer price inflation now only forecast to moderate to 7.5% by the end of this year (revised from +4.5%) and 3.2% by the end of 2023 (versus +2.4% in April’s forecasts) before returning to the midpoint of the Bank’s 1% to 3% target range by the end of 2024 (the latest consensus forecasts are for year-over-year CPI to be 6.2% in Q4/22 and 2.1% by Q4/23).

The bottom line is that persistently high inflation has shown signs of filtering into inflation expectations (this received far more attention than it has previously, including specific discussion within the MPR; not uncoincidentally, last week’s BOC-published Business Outlook Survey⁴ indicated that a record 78% of respondents expected inflation to be above the BOC’s target range over the next two years) and the Bank of Canada is looking to nip this in the bud — the MPR specifically highlights the risk that unanchored inflation expectations could trigger a “wage-price spiral” that would require a “greater degree of monetary policy tightening and a more pronounced slowdown of the economy” to bring inflation back to target.

(percent of total respondents)

Source: Guardian Capital based on data from Bank of Canada to July 5, 2022

As such, the likelihood is that the Bank of Canada continues to move aggressively in the coming meetings as it looks to get to its end-point sooner rather than later. BOC Governor Tiff Macklem stated in the post-meeting presser that they were headed to the “top end or slightly above the neutral range”, so a terminal rate around 3½% (consistent with what is currently priced into the market) seems entirely reasonable to me, and I expect we are likely to get to this level before the Bank’s final fixed action date of the year scheduled for December 7 (the other remaining dates are September 9 and October 26).

Written by: David Onyett-Jeffries

David Onyett-Jeffries is Vice President, Economics & Multi Asset Solutions, at Guardian Capital LP (GCLP) and provides macro-economic guidance to GCLP and its affiliates—Alta Capital Management LLC and GuardCap Asset Management Limited.

1. Bank of Canada, Bank of Canada increases policy interest rate by 100 basis points, continues quantitative tightening, July 13, 2022, https://www.bankofcanada.ca/2022/07/fad-press-release-2022-07-13/

2.Bank of Canada, Monetary Policy Report July 2022, July 13, 2022, https://static.bankofcanada.ca/uploads/pdf/mpr-2022-07-13.pdf

3.Bank of Canada, Monetary Policy Report April 2022, April 13, 2022,https://www.bankofcanada.ca/2022/07/mpr-2022-07-13/

4.Bank of Canada, Business Outlook Survey—Second Quarter of 2022, Results of the second-quarter 2022 survey | Vol. 19.2 | July 4, 2022, July 4, 2022, https://www.bankofcanada.ca/2022/07/business-outlook-survey-second-quarter-of-2022/

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. Guardian, Guardian Capital and the Guardian gryphin design are trademarks of Guardian Capital Group Limited, registered in Canada.

** Bank of Canada increases policy interest rate by 100 basis points, continues quantitative tightening

FOR IMMEDIATE RELEASE

July 13, 2022

The Bank of Canada today increased its target for the overnight rate to 2½%, with the Bank Rate at 2¾% and the deposit rate at 2½%. The Bank is also continuing its policy of quantitative tightening (QT).

Inflation in Canada is higher and more persistent than the Bank expected in its April Monetary Policy Report (MPR), and will likely remain around 8% in the next few months. While global factors such as the war in Ukraine and ongoing supply disruptions have been the biggest drivers, domestic price pressures from excess demand are becoming more prominent. More than half of the components that make up the CPI are now rising by more than 5%. With this broadening of price pressures, the Bank’s core measures of inflation have moved up to between 3.9% and 5.4%. Also, surveys indicate more consumers and businesses are expecting inflation to be higher for longer, raising the risk that elevated inflation becomes entrenched in price- and wage-setting. If that occurs, the economic cost of restoring price stability will be higher.

Global inflation is higher, reflecting the impact of the Russian invasion of Ukraine, ongoing supply constraints, and strong demand. Many central banks are tightening monetary policy to combat inflation, and the resulting tighter financial conditions are moderating economic growth. In the United States, high inflation and rising interest rates are contributing to a slowdown in domestic demand. China’s economy is being held back by waves of restrictive measures to contain COVID-19 outbreaks. Oil prices remain high and volatile. The Bank now expects global economic growth to slow to about 3½% this year and 2% in 2023 before strengthening to 3% in 2024.

Further excess demand has built up in the Canadian economy. Labour markets are tight with a record low unemployment rate, widespread labour shortages, and increasing wage pressures. With strong demand, businesses are passing on higher input and labour costs by raising prices. Consumption is robust, led by a rebound in spending on hard-to-distance services. Business investment is solid and exports are being boosted by elevated commodity prices. The Bank estimates that GDP grew by about 4% in the second quarter. Growth is expected to slow to about 2% in the third quarter as consumption growth moderates and housing market activity pulls back following unsustainable strength during the pandemic.

The Bank expects Canada’s economy to grow by 3½% in 2022, 1¾% in 2023, and 2½% in 2024. Economic activity will slow as global growth moderates and tighter monetary policy works its way through the economy. This, combined with the resolution of supply disruptions, will bring demand and supply back into balance and alleviate inflationary pressures. Global energy prices are also projected to decline. The July outlook has inflation starting to come back down later this year, easing to about 3% by the end of next year and returning to the 2% target by the end of 2024.

With the economy clearly in excess demand, inflation high and broadening, and more businesses and consumers expecting high inflation to persist for longer, the Governing Council decided to front-load the path to higher interest rates by raising the policy rate by 100 basis points today. The Governing Council continues to judge that interest rates will need to rise further, and the pace of increases will be guided by the Bank’s ongoing assessment of the economy and inflation. Quantitative tightening continues and is complementing increases in the policy interest rate. The Governing Council is resolute in its commitment to price stability and will continue to take action as required to achieve the 2% inflation target.

Please note that for certain documents provided on this webpage, accessible formats can be made available, free upon request, from Guardian’s Human Resources department.

You may contact us via telephone, e-mail or in writing at:

Human Resources

Guardian Capital Group Limited

Commerce Court West

199 Bay Street, Suite 2700, P.O. Box 201

Toronto, ON M5L 1E8

Phone: 416-364-8341 | 1-800-253-9181

Email: hr@guardiancapital.com