Since the start of 2022, growing inflation and rising interest rates have contributed to a marked increase in market volatility. […]

The last two years have been tumultuous, to say the least, with a seemingly unending onslaught of challenges (COVID-19 chief among them) impacting economic activity and general daily life.

Interestingly, however, forward-looking financial markets have largely been able to take the events in stride and, after a brief detour in early 2020, remained on the path of strong performance laid in the aftermath of the financial crisis more than a decade ago as investors focused on the better days ahead.

The start of 2022, however, has seen the mood in the markets change notably, with the combination of rising inflationary pressures, the aggressive turn by global central banks, the Russian invasion of Ukraine and the ongoing negative impacts of the ongoing pandemic seemingly becoming too much, ratcheting up the risks to the outlook and souring investor sentiment.

While macroeconomic data has remained resilient to this point, risk asset prices have come under significant pressure — and the current equity market sell-off stands in stark contrast to the last major one two years ago. That event occurred against a seismic shift in the outlook, with the segments that fared best amid the onset of the public health crisis (and over the subsequent two years) significantly underperforming.

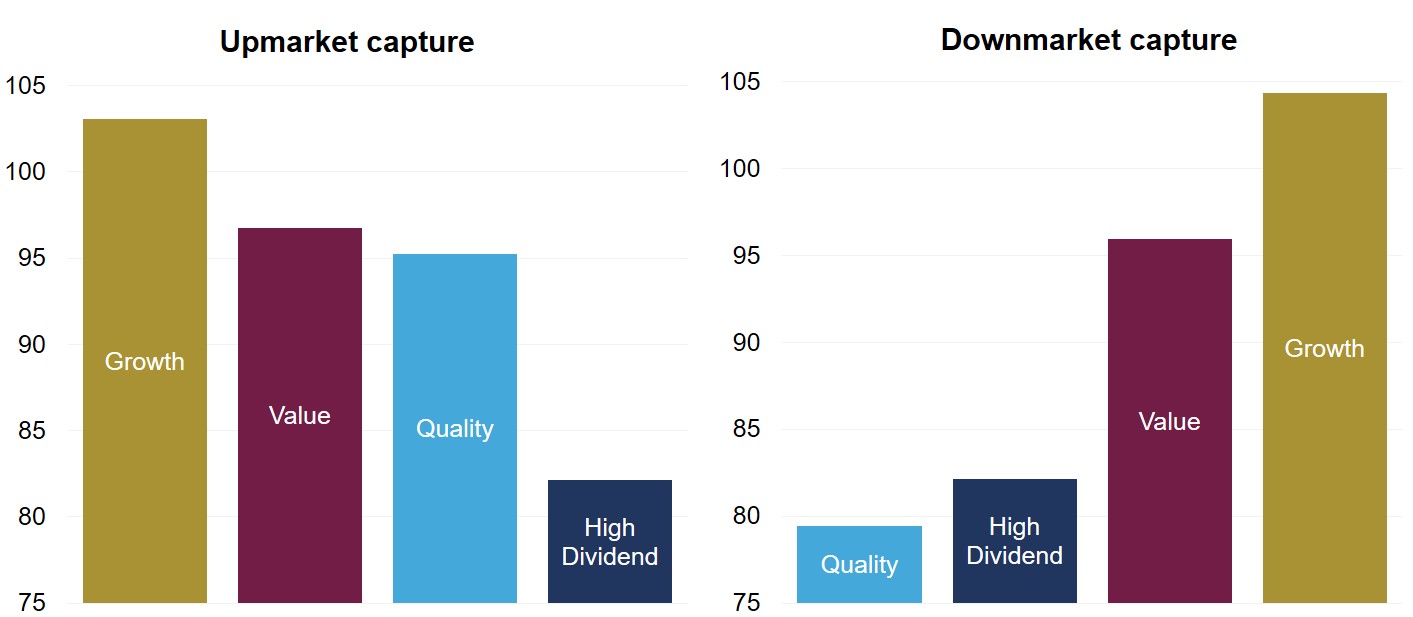

(MSCI World Style Index performance; percent change since January 1)

Data to May 13, 2022; source: Bloomberg, Guardian Capital

Moreover, the fact that “quality” strategies — those that focus on equity of companies that have high profitability, low volatility in earnings growth and low leverage — have been among the worst performers represents a pretty notable difference during this period.

Looking at the available history back to 1982 (so, spanning the last four decades and all of the economic cycles therein), what has differentiated the performance of quality global equity strategies (and why they have consistently outperformed over long horizons) has been their ability to keep their head above water among more turbulent tides. Quality strategies typically are not necessarily the best performing when markets are buoyant, however they register materially more muted declines when broad markets weaken versus other strategies; by their nature, stocks of quality companies are designed to weather the storms in financial markets and the economy as a whole since their ability to generate consistently solid earnings growth with low leverage means they can survive systematic financial crises and recessionary conditions.

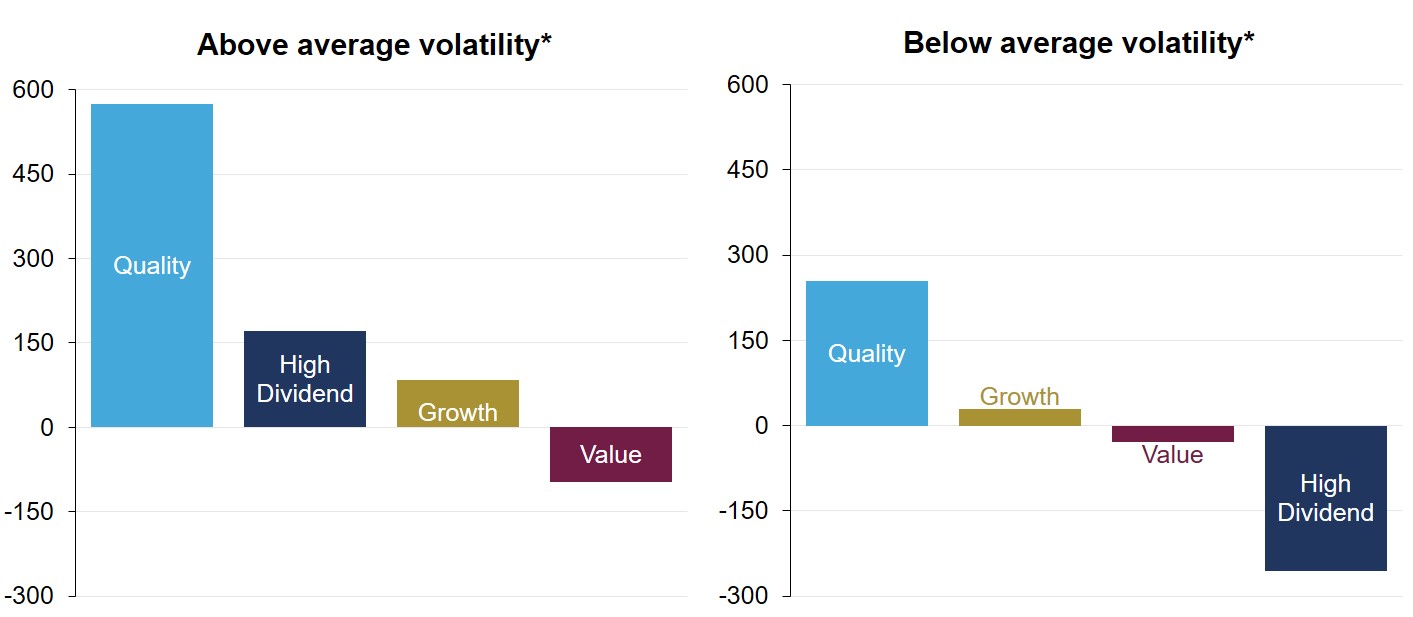

(percent, relative to MSCI World Index)

Based on monthly data from January 1982 to April 2022; source: Bloomberg, Guardian Capital

More to this point, quality stocks typically serve as a safe haven amid periods of crisis, outperforming the global benchmark over the last four decades in above-average volatility, and by a significant degree.

(MSCI World Style Index performance by volatility regime; basis points relative to MSCI World Index, annualized)

*Average in the CBOE US Equity Volatility Index (VIX) from January 1990 to April 2022; source: Bloomberg, Guardian Capital

This raises an obvious question: what has been driving the current underperformance in quality and is it likely to be sustained, or is there good reason to anticipate a reversal of fortune?

As mentioned, economic momentum has continued to prove resilient, and despite the growing list of headwinds that are weighing on the macro outlook, earnings have come in better than anticipated (especially for the “value” strategies and their relatively heavy exposure to commodity markets). Consensus earnings expectations for the coming 12 months have moved higher — deconstructing market performance year-to-date shows that a downgrade in valuations has been the driver of declines.

(MSCI World style index year-to-date* performance decomposition; percent)

*January 1, 2022 to May 13, 2022; source: Bloomberg, Guardian Capital

The compression of valuation multiples is consistent with rising pessimism over the current outlook — the increased uncertainty and downgraded views imply expected lower earnings growth over the medium term. Additionally, valuations have come under pressure due to the impact of higher market interest rates, which serve to reduce the present value of future earnings — and given that stocks that carry higher relative valuations are typically those that derive their value from their expected ability to generate above-average earnings growth in the years ahead, these areas of the market have underperformed.

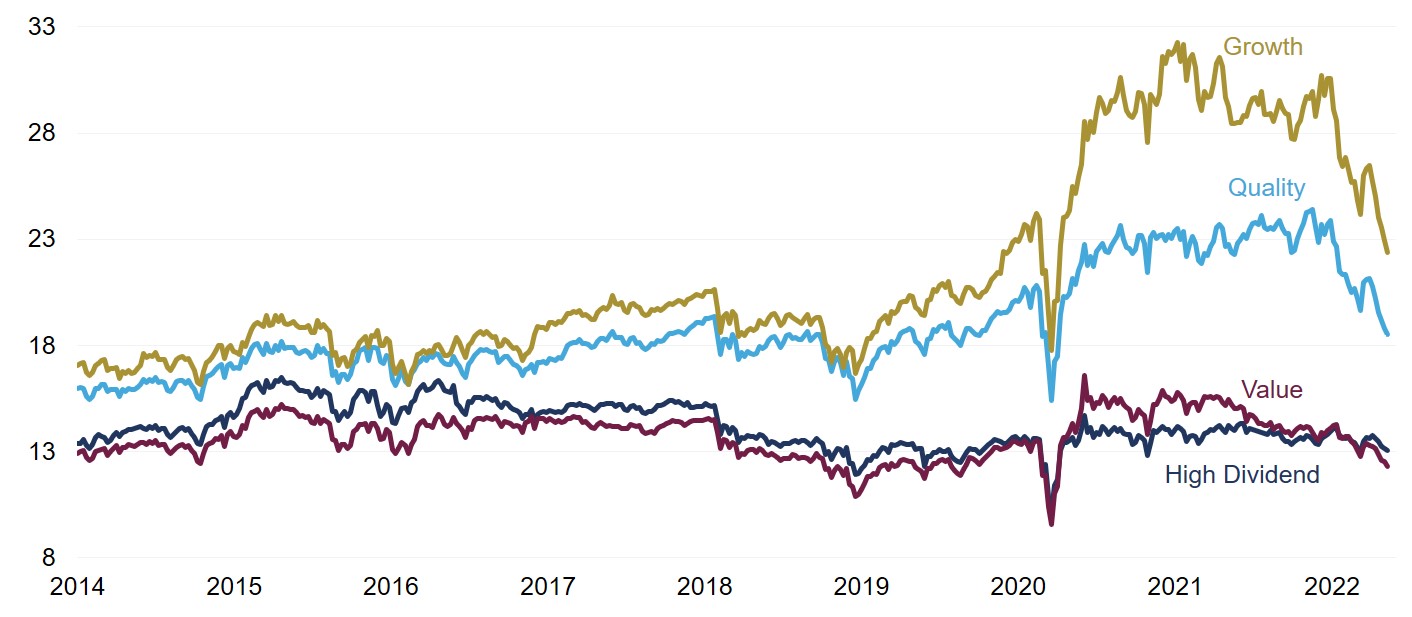

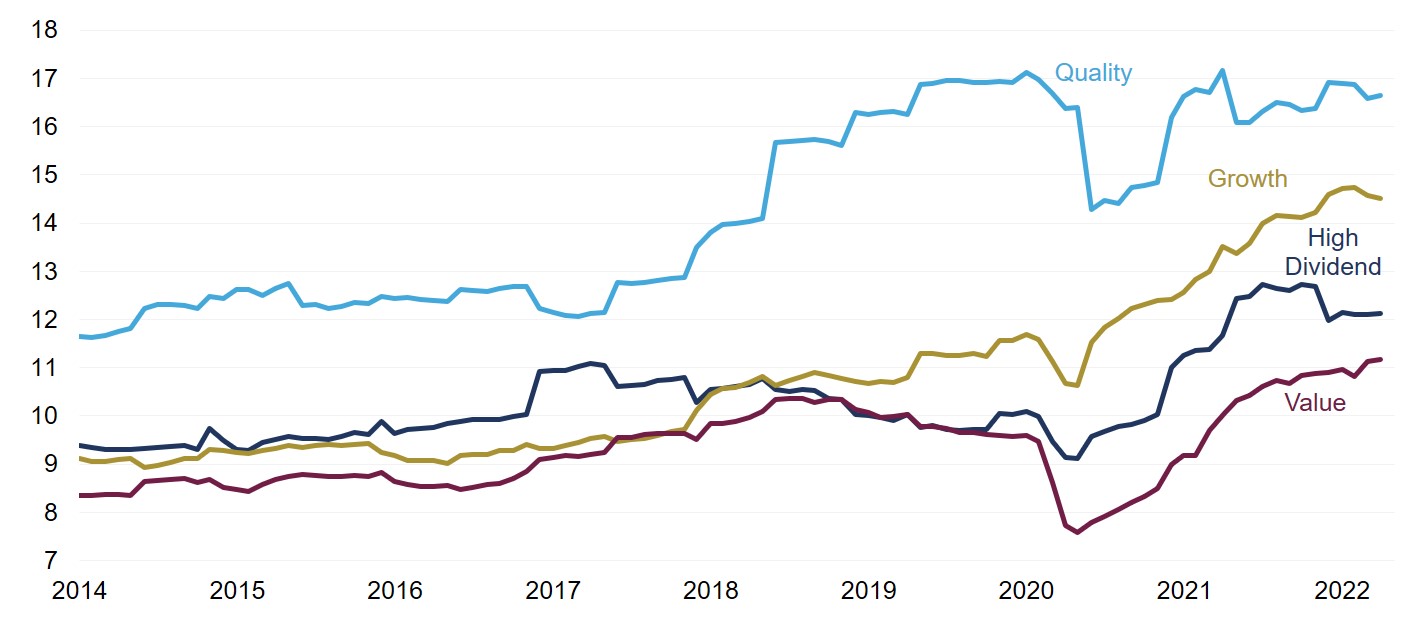

(MSCI World Style Index forward price-to-earnings ratio)

Data to May 13, 2022; source: Bloomberg, Guardian Capital

The extent of the selling pressure among quality stocks, however, provides some indication that the baby is maybe being dumped with the bathwater right now — not everything with an above-average valuation multiple is created equally and warrants being sold.

For starters, while both “growth” and “value” companies tend to be highly susceptible to changes in the economic environment, quality companies, which typically are more mature (and as such have strong management), tend to be sheltered from the ebbs and flows of the business cycle. The same is true for dominant players in their industries with sustainable advantages over competitors and that focus on secular trends rather than cyclical ones.

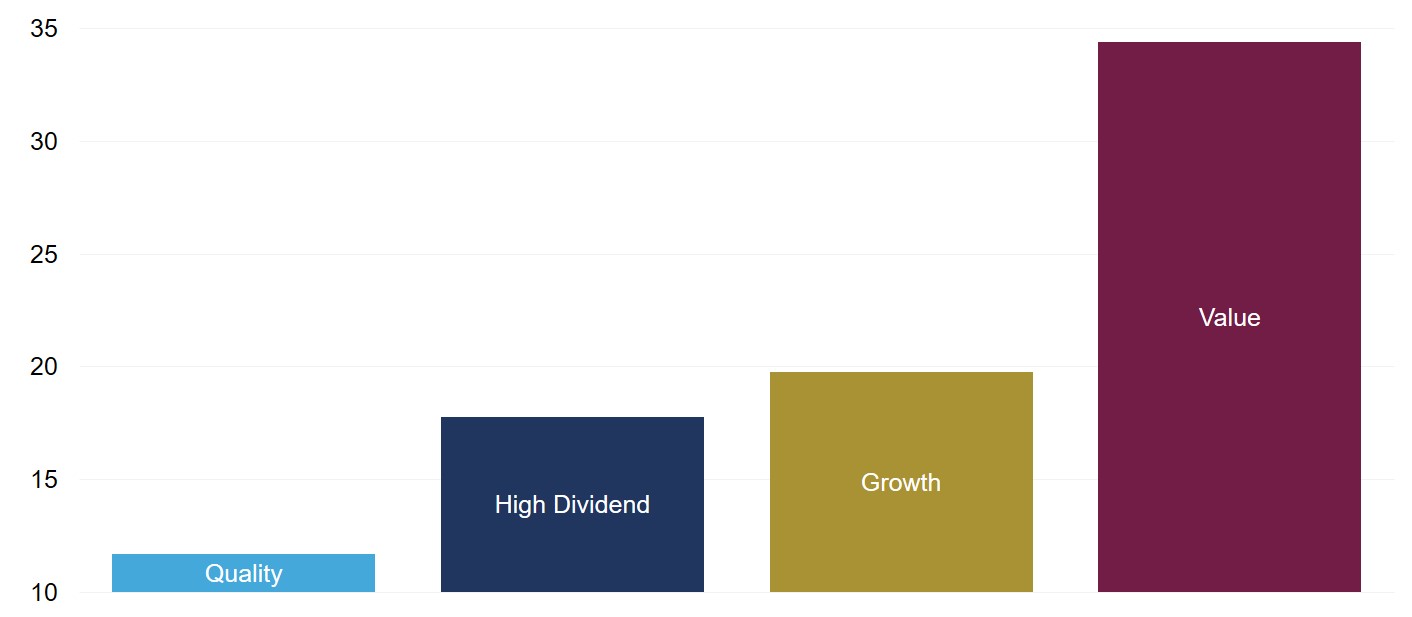

The volatility of “quality” companies’ earnings growth has been lower than peers — a factor underpinning quality strategies’ outperformance amid higher volatility environments, where a premium is put on certainty.

(MSCI World Style Index standard deviation of trailing 12-month earnings growth*)

*Based on data from January 2014 to April 2022; source: Bloomberg, Guardian Capital

Furthermore, it has historically been the case that stocks of quality companies have been able to outperform the broad market no matter the global economic growth backdrop. In fact, the best relative performance over the last four decades has actually come when growth across developed market economies has been below average as investors placed an added premium on companies that can consistently expand their profits in these environments.

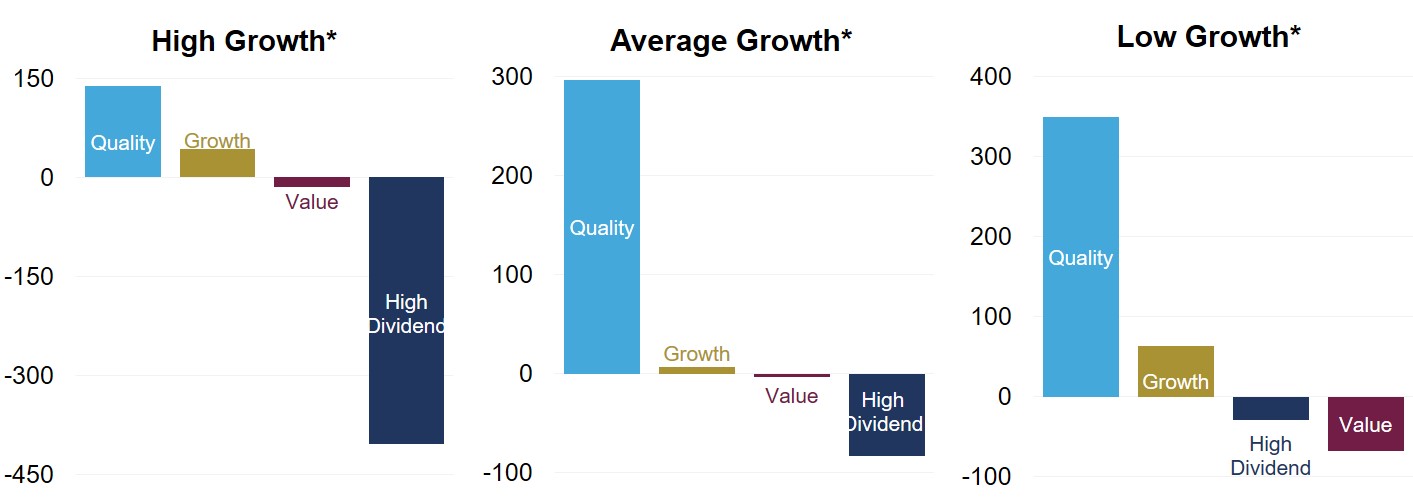

(MSCI World Style Index performance by economic growth regime*; basis points relative to MSCI World Index, annualized)

*Based on OECD quarterly real GDP growth data since Q1/1982; “high”=top third; “low”=bottom third; “average”=middle third; source: Bloomberg, Organization for Economic Co-operation and Development, Guardian Capital

A key contributor to the consistency and stability in earnings of quality companies is the fact that they typically have the ability to exert pricing power on their end customers thanks to their dominance in their industry and differentiated product offerings that result in lower elasticity of demand (demand does not change much with changes in prices). Quality companies tend to be “price makers” rather than “price takers,” with companies that operate in commodity-related sectors generally sparse among their ranks. These characteristics allow quality companies to operate at higher profit margins.

(MSCI World style index profit margins; percent)

Data to April 29, 2022; source: Bloomberg, Guardian Capital

High margins and the ability to influence pricing also mean that quality companies tend to be well-insulated from the impact of rising prices — these companies are able to pass through increases in input costs and sustain margins and earnings. As such, quality stocks have managed to outperform the broad market over the last 40 years during periods of elevated inflation — another notable contrast from more recent events.

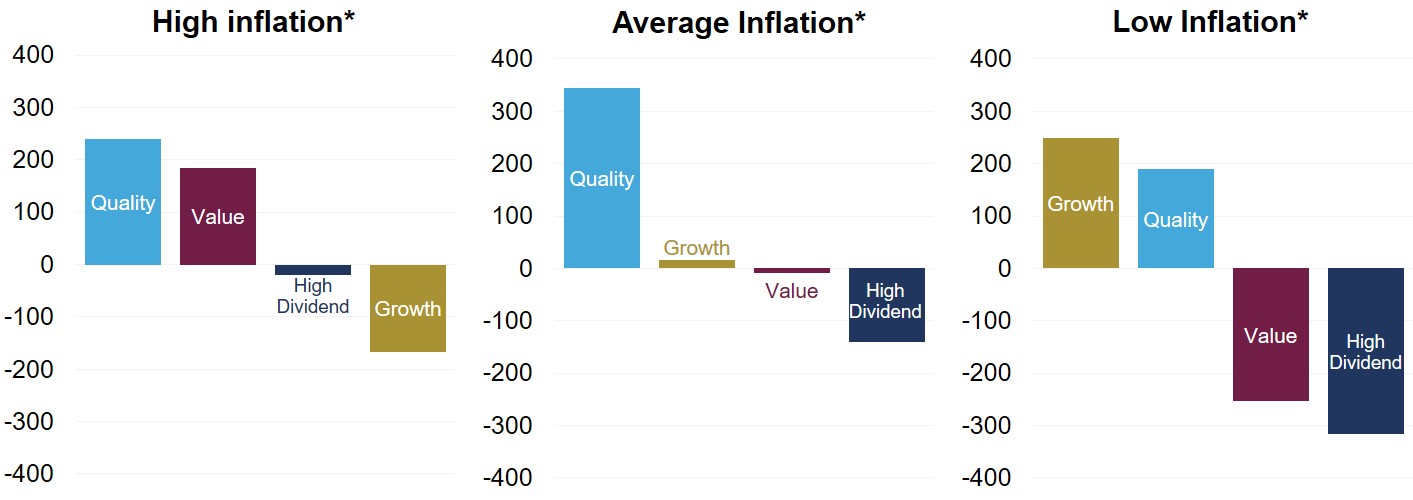

(MSCI World Style Index performance by inflation regime*; basis points relative to MSCI World Index, annualized)

*Based on US consumer price inflation; “high”=top third; “low”=bottom third; “average”=middle third; based on data since January 1982April 2022; source: Bloomberg, Guardian Capital

On a related note given global central banks’ focus on maintaining price stability, it is also worth highlighting that the fundamental nature of quality stocks leaves them relatively insulated from changes in market interest rates as well. Low leverage leaves these companies in better shape than others when interest rates (and costs of capital) rise and historically has led to outperformance in such regimes. Additionally, their stability and strength permit them to be able to manage in weaker economic conditions that are associated with generally declining interest rates.

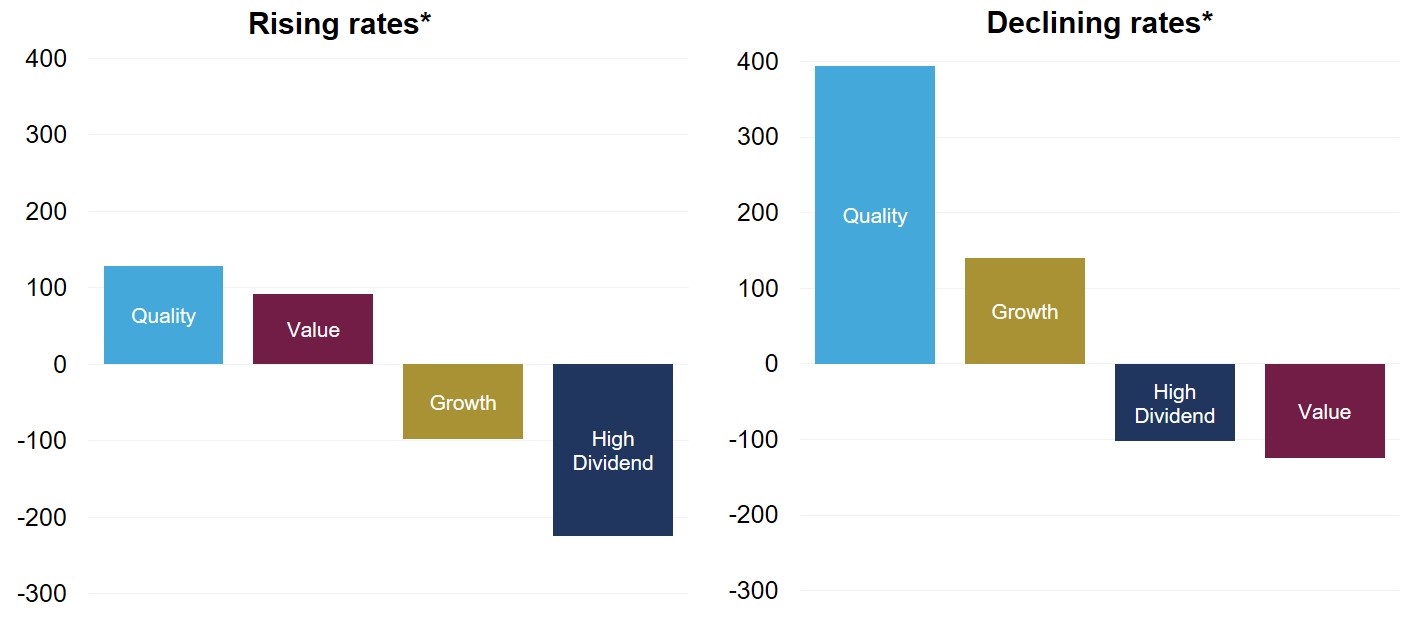

(MSCI World style index performance by interest rate regime*; basis points relative to MSCI World Index, annualized)

*Based on two-month change in 10-year US Treasury Yield from January 1982 to April 2022; source: Bloomberg, Guardian Capital

In other words, the material underperformance of quality stocks so far this year seems inconsistent with both history and the fundamental characteristics that differentiate the companies included in the group from other style factors.

A more challenging outlook for growth, with higher interest rates, heightened volatility and the potential for persistently elevated inflation are definitely less than favourable for growth-oriented investment strategies that have flourished over the last decade. However, such environments have traditionally supported the relative performance of strategies that focus on the quality companies that score highly with respect to profitability, earnings growth stability and leverage.

The seeming lack of discrimination in the selling of anything that trades with an above-average valuation multiple and limited exposure to commodities would therefore appear to provide opportunities for more active investors with a longer-term focus. Stocks in many high-quality companies are nowhere near “worthless,” just “worth less” at the moment, and history suggests that mispricings do not tend to last long once volatility subsides.

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. Guardian, Guardian Capital and the Guardian gryphin design are trademarks of Guardian Capital Group Limited, registered in Canada.