Another upside surprise spurs further repricing of the Fed Once again, inflation data has provided an upside surprise, with the […]

Canadian inflation is continuing to prove to be more persistent than hoped. Today’s (October 19, 2022), upside surprise1, drove markets to add another 25bps worth of hikes to expectations for next week’s Bank of Canada (Bank) fixed action date and pushed yields on Government of Canada securities higher across the curve (the Canadian dollar has firmed from earlier lows against the US dollar as well).

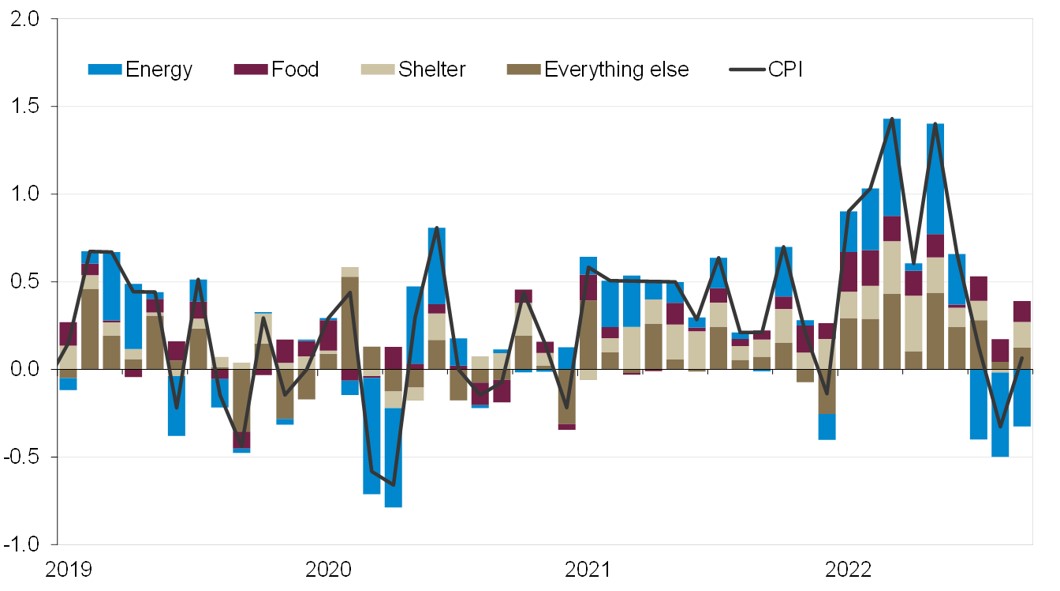

The unadjusted consumer price index rose 0.1% on a month-over-month basis last month, an overshoot to expectations for a 0.1% decline. Continued softening in energy (gas) prices (-4.4% month-over-month, though they have increased so far through October, suggesting some upward pressure on headline inflation to come) was offset by gains elsewhere, particularly food (+0.8%) and the heavily-weighted shelter (+0.5%) component; the latter seeing upward pressure from rising mortgage costs, somewhat ironically, driven by the central bank trying to tamp down on inflation.

Canadian consumer price index

(contribution to month-over-month percent change)

Source: Guardian Capital based on data from Statistics Canada and Bloomberg to September 2022

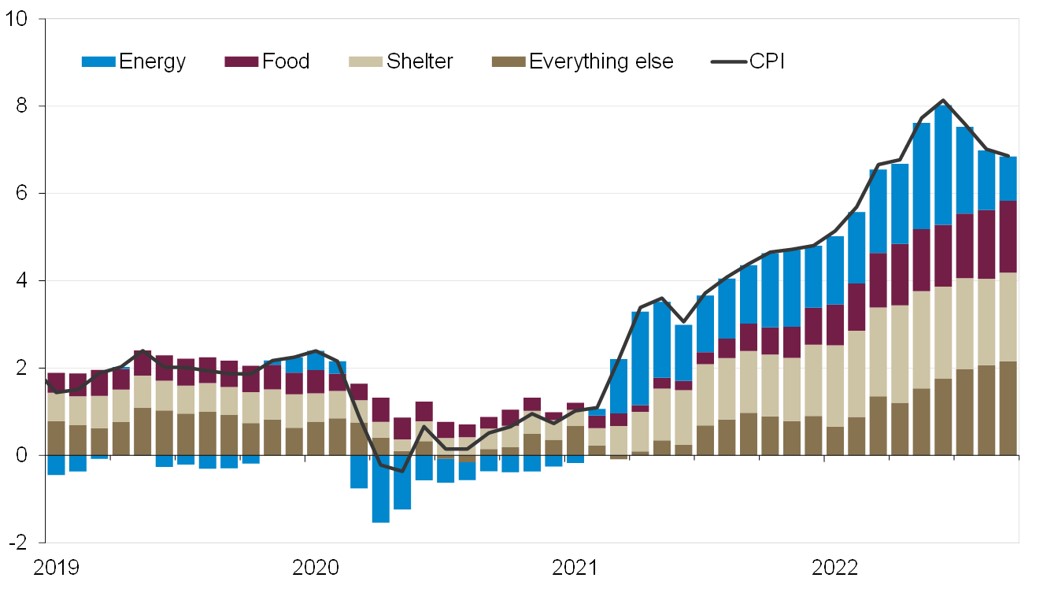

The upside surprise in the monthly figures resulted in a firmer-than-anticipated 12-month inflation rate. The headline consumer price index was up 6.9% versus its level a year ago, which does represent a five-month low and the third consecutive moderation in the inflation gauge since it hit a peak of 8.1% in June; however, it was higher than market expectations, for a 6.7% read. The continued moderation in energy prices (+14% year-over-year, down sharply from +39% in June) was the biggest factor behind the slowing. However, firmness among food (+10.3%, the biggest such increase since summer 1981), shelter (+6.8%, the first acceleration since May) and, particularly, the “catch-all” everything else (+4.6%, my math shows this is the highest since December 2002) shows general resilience and persistence of underlying pricing that will undoubtedly be the focus on policymakers at next week’s meeting.

Canadian consumer price index

(contribution to year-over-year percent change)

Source: Guardian Capital based on data from Statistics Canada and Bloomberg to September 2022

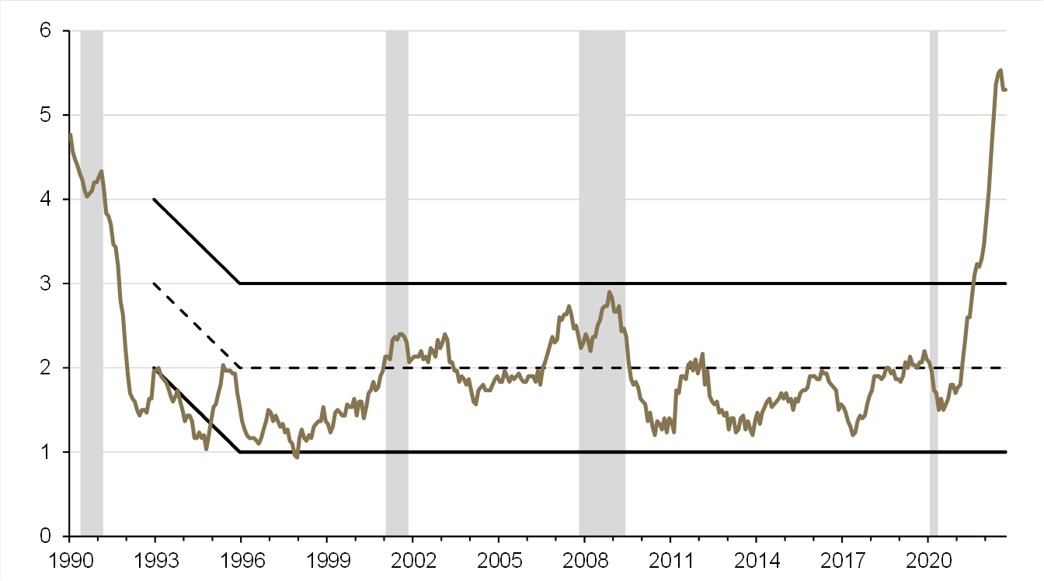

Echoing this, all three of the Bank’s gauges of core inflation unexpectedly held steady at rates well above the Bank’s 1% to 3% target range in September; instead, seeing an anticipated continued moderation from July’s peak. Not ideal.

Average of the three Bank of Canada measures of core consumer price inflation

(year-over-year percent change)

Source: Guardian Capital based on data from Statistics Canada and Bloomberg to September 2022; shaded regions represent periods of US recession; black lines represent Bank of Canada’s inflation target range

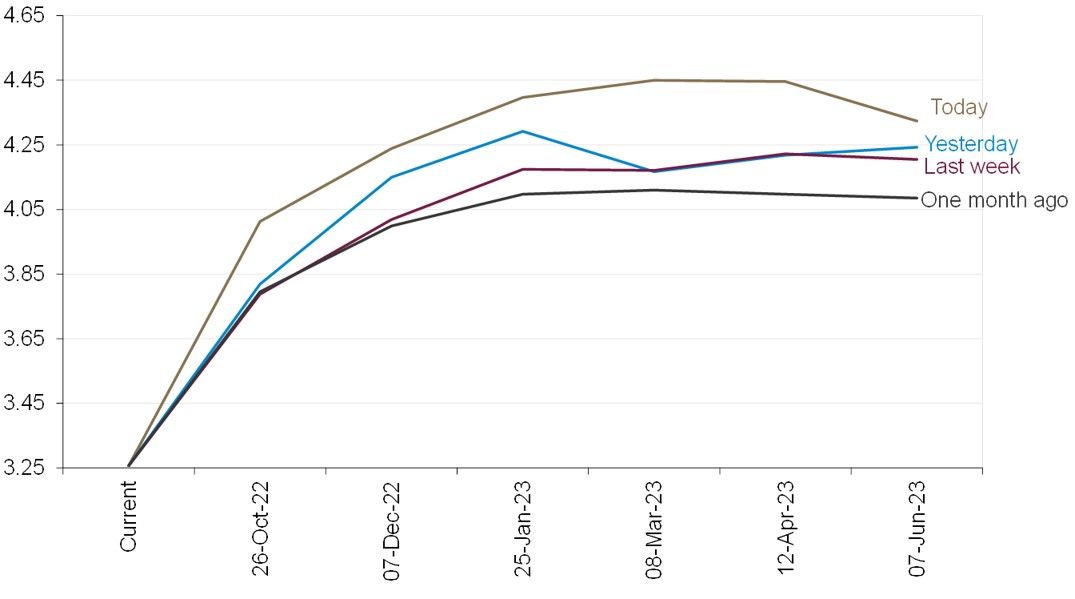

So, the elevated readings, combined with expectations for above-target inflation for the foreseeable future (the Bank of Canada’s Business Outlook Survey indicated that 90% of survey respondents anticipate inflation to hold above 2% over the next two years, with 86% of those expecting it to remain above 3%; chart provided below), results in the pressure remaining on the Bank to continue to tighten its policy stance in an effort to rein in excess demand and cap price pressures that can destroy demand. Following the data, market expectations are for the Bank to raise its overnight rate target by another 75bps next week (they were leaning toward 50bps as of yesterday) to take the key policy rate to 4.00%.

Overnight index swap implied Bank of Canada policy rate

(percent)

Source: Guardian Capital based on data from Bloomberg as at October 19, 2022

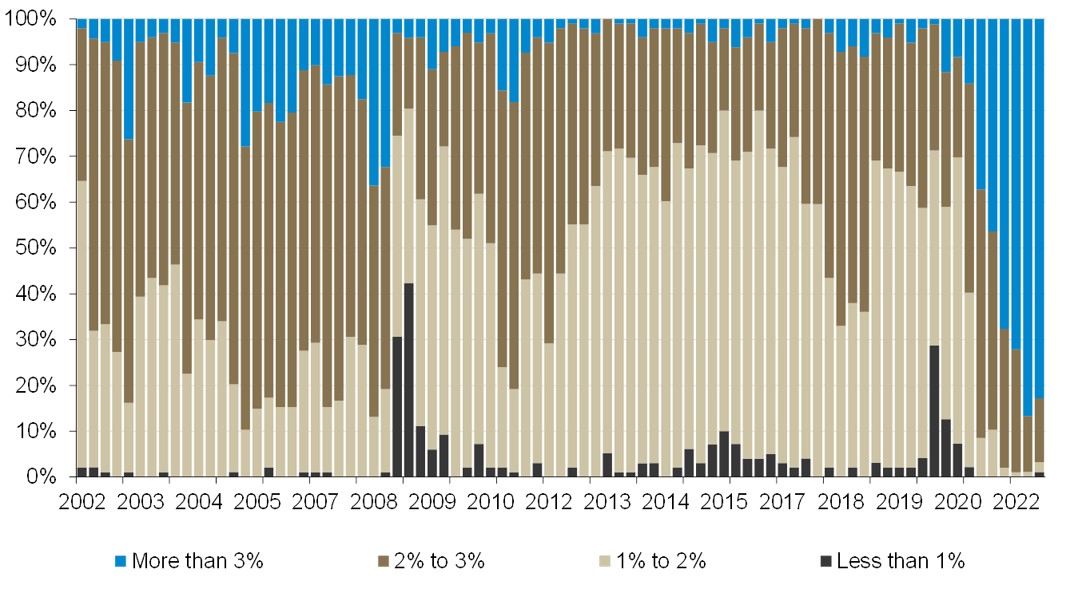

Bank of Canada Business Outlook Survey respondent inflation expectations over the next two years

(percent of total)

Source: Guardian Capital based on data from the Bank of Canada to Q3 2022

Written by: David Onyett-Jeffries

David Onyett-Jeffries is Vice President, Economics & Multi Asset Solutions, at Guardian Capital LP (GCLP) and provides macro-economic guidance to GCLP and its affiliates—Alta Capital Management LLC and GuardCap Asset Management Limited.

1. Statistics Canada, The Daily, Consumer Price Index, September 2022, October 19, 2022, https://www150.statcan.gc.ca/n1/daily-quotidien/221019/dq221019a-eng.htm?HPA=1

2. Bank of Canada, Business Outlook Survey —Third Quarter of 2022, October 17, 2022, https://www.bankofcanada.ca/2022/10/business-outlook-survey-third-quarter-of-2022/

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. Guardian, Guardian Capital and the Guardian gryphin design are trademarks of Guardian Capital Group Limited, registered in Canada.