Less than two years after the last federal election was held on October 21, 2019, Canadians will again find themselves heading to the polls on September 20, after the minority Liberal government dropped the writ on August 15 to formally dissolve Canada’s 43rd Parliament and kickoff the abbreviated campaign cycle.

At the time the decision was made to call the election, polling was strongly favouring the incumbent governing party, with the prospect of forming a majority government seemingly at hand. As the campaign has progressed, however, there has been a notable shift in voter sentiment.

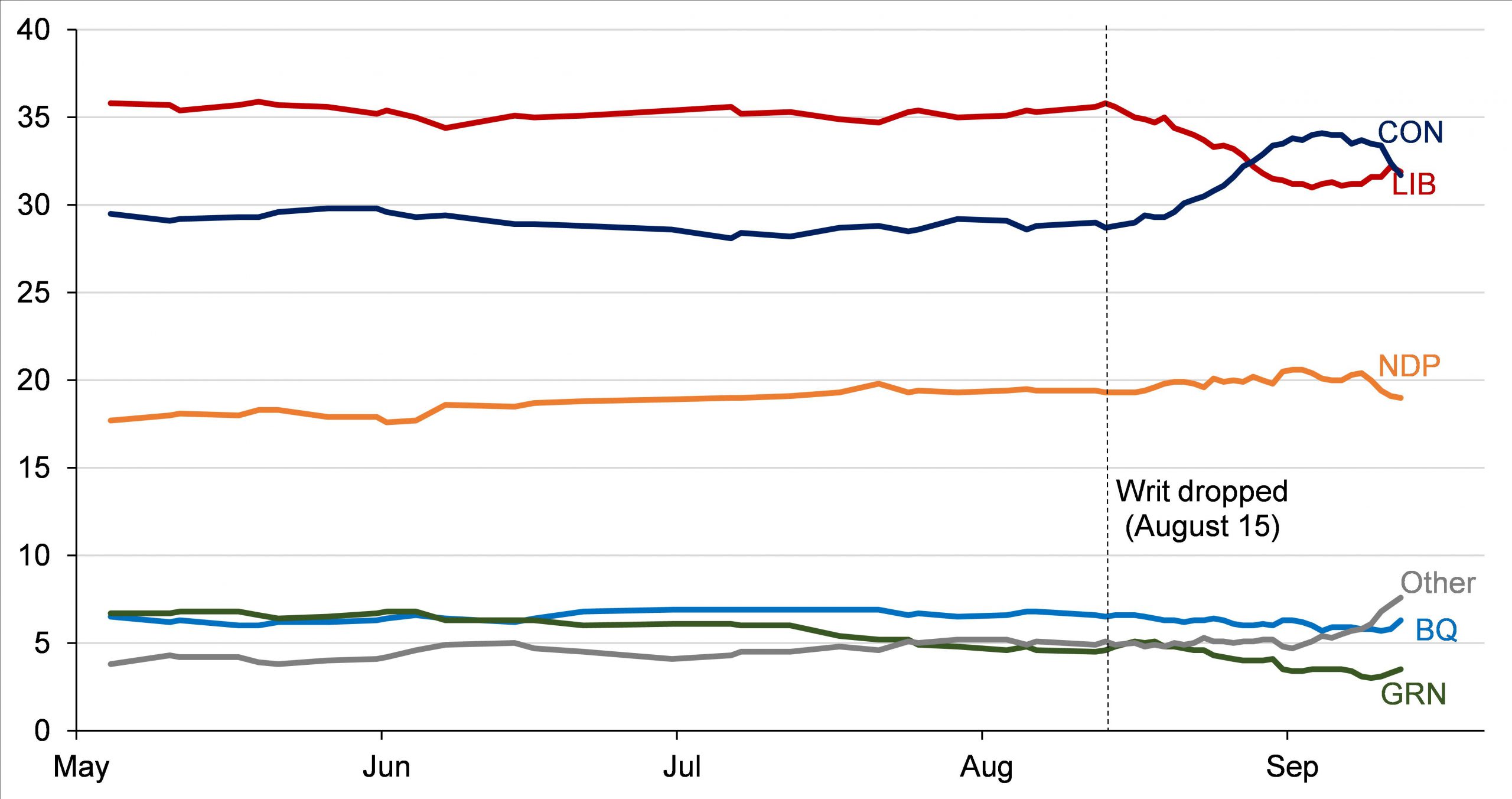

For starters, the lead in the polls (as per the CBC News Poll Tracker) has collapsed, and it is now the opposition Conservatives that have a modest advantage (though it has ebbed over the last week). This is the first time since the start of the pandemic one-and-a-half years ago that potential voters have held a more favourable view of the Conservatives than the Liberals.

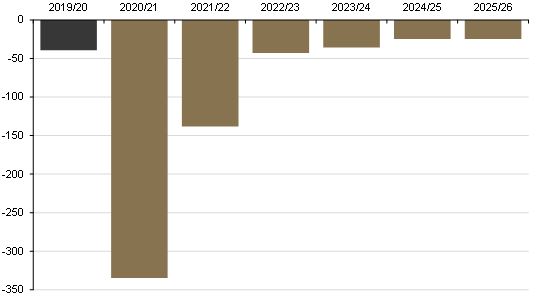

National federal election voter intention polling averages

(per cent)

Data to September 12, 2021

Source: CBC News Poll Tracker, Guardian Capital

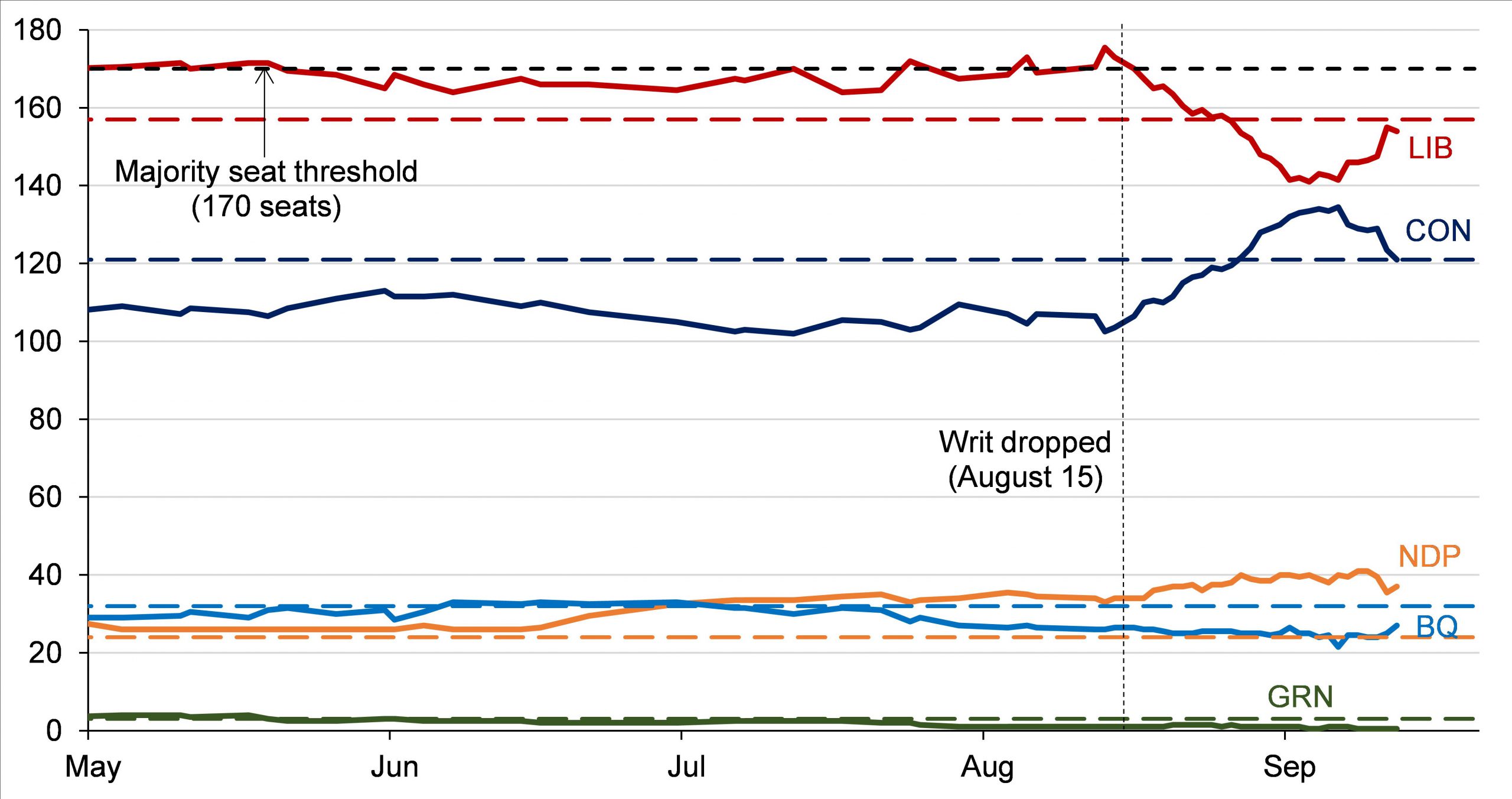

The winners of elections in Canadian politics, however, are not determined by overall vote share, but instead on how the regional ridings play out. As such, pollsters are still indicating that the Liberals will come out on top of the seat count thanks to their support in Ontario and Quebec, the most populous Parliamentary-seat-heavy provinces. Yet the lead has diminished in the month since the election was called and these estimates from poll aggregators suggest that any hopes of establishing a majority are effectively gone.

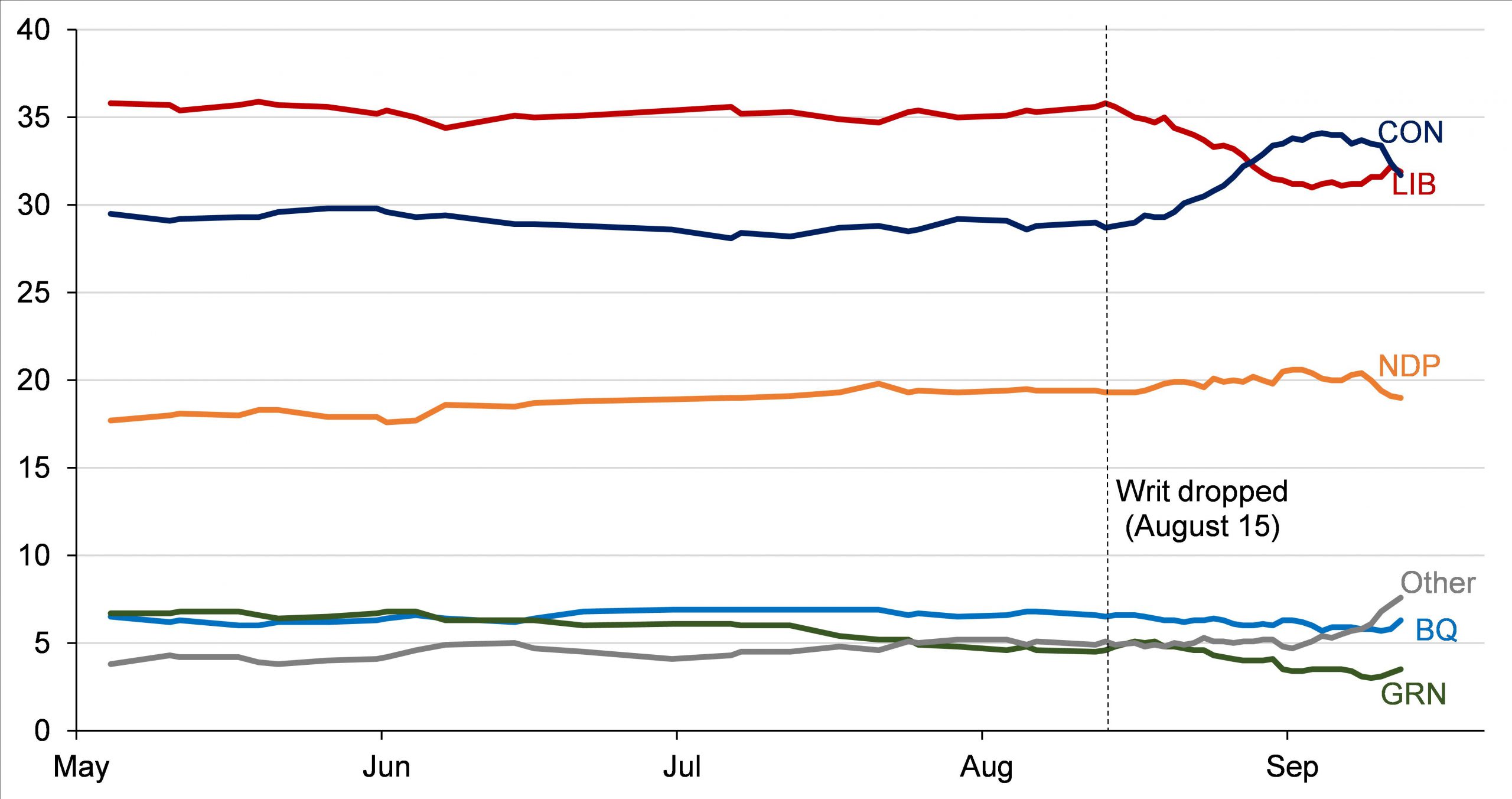

Federal election seat projections

(number of seats; median of estimated range of outcomes)

Data to September 12, 2021; coloured dashed line represents seats won in 2019 federal election

Source: CBC News Poll Tracker, Guardian Capital

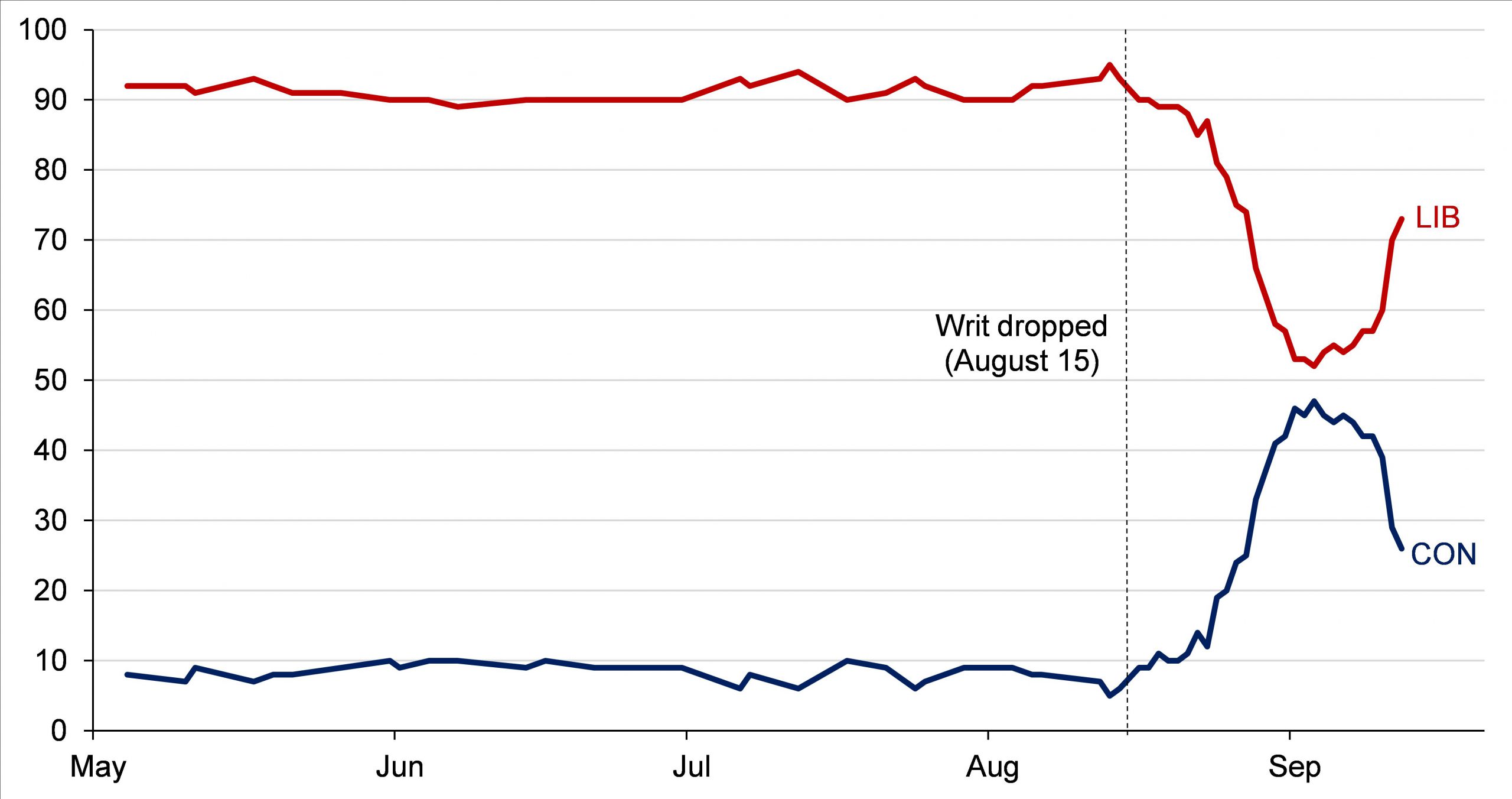

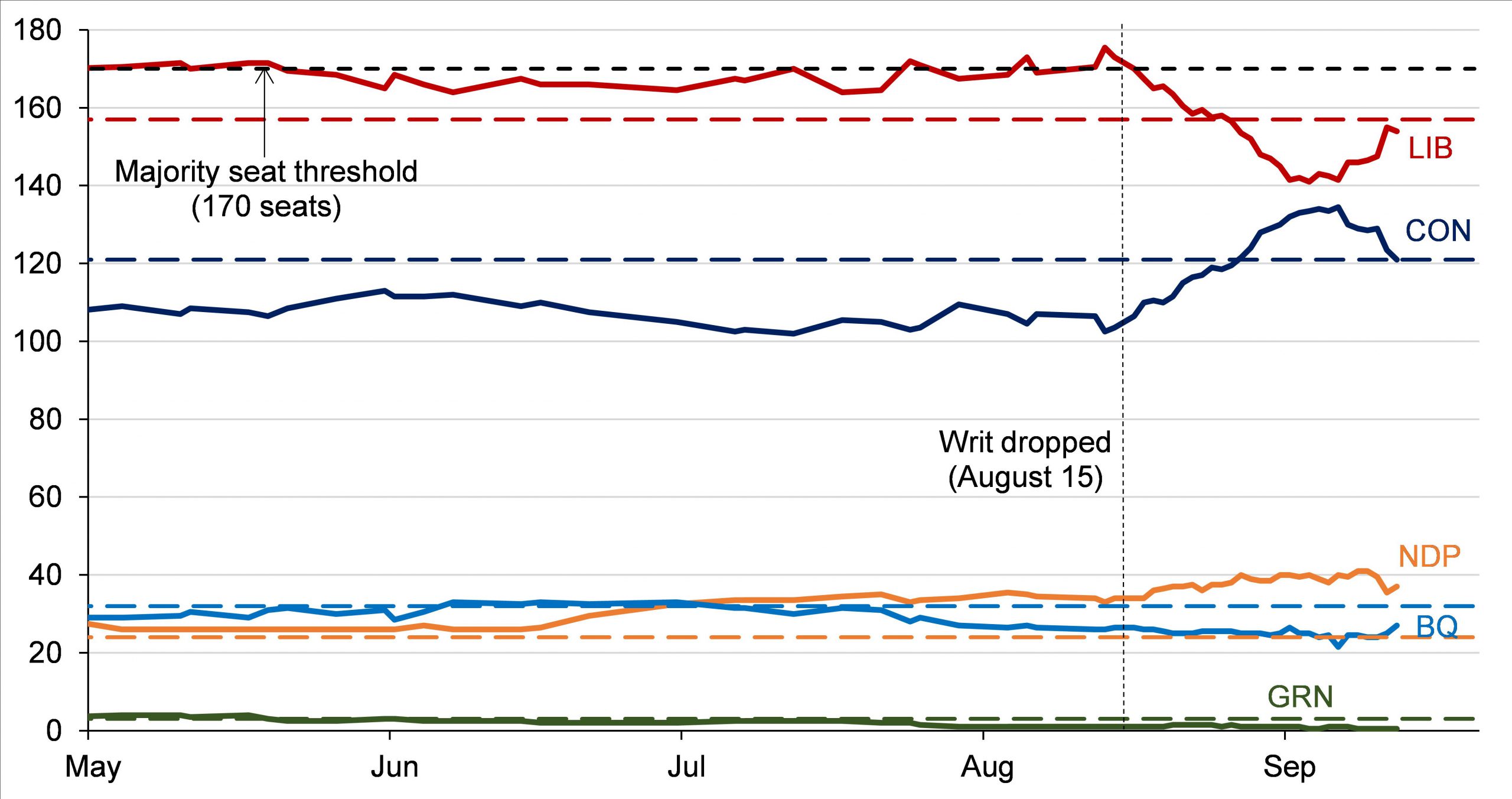

Accordingly, a Liberal victory on election night remains the current highest estimated probability, though it has moved from a sure thing to a little more than a coin flip back to somewhere in between — of course, the potential for a coalition among the left-leaning parties could well leave the incumbents at the helm regardless.

Estimated probability of winning the federal election

(per cent)

Data to September 12, 2021

Source: CBC News Poll Tracker, Guardian Capital

In the election cycle in the US last year, such dramatic shifts in prospective outcomes carried significant reverberations throughout global financial markets. The Canadian election, in contrast, carries far less weight on the international scale but also tends to make only minor ripples at home as well. The average total return on the S&P/TSX Composite Index from the day before to the day after the election since 1993 (excluding the October 2008 election in the heat of the financial crisis) is -0.04%, while the ICE Bank of America Merrill Lynch Canada Broad Market Bond Index is up by an average of 0.03% on those dates. The Canadian dollar is up 0.03% versus a basket of other major currencies on this timeline.

Moreover, the ongoing pandemic and the resultant fragile economic backdrop have resulted in prospective policymakers being largely unwilling to introduce any significant austerity over what is likely to be the term of the new parliament. Indeed, while some revenue measures have been presented, the bulk of the platforms across the parties are focused on net new spending to support the economy as it attempts to exit this COVID-19 crater and letting assumed fiscal multipliers and embedded automatic stabilizers do the heavy lifting in terms of fiscal balance. Nobody is seeking to actively rein in fiscal shortfalls in the near-term and only the Conservatives are even committing to eliminating the deficit at all — yet even here, the Conservatives state it will only be done “within the next decade in a responsible way” and the bias over the coming months will be to keep fiscal purse strings loose.

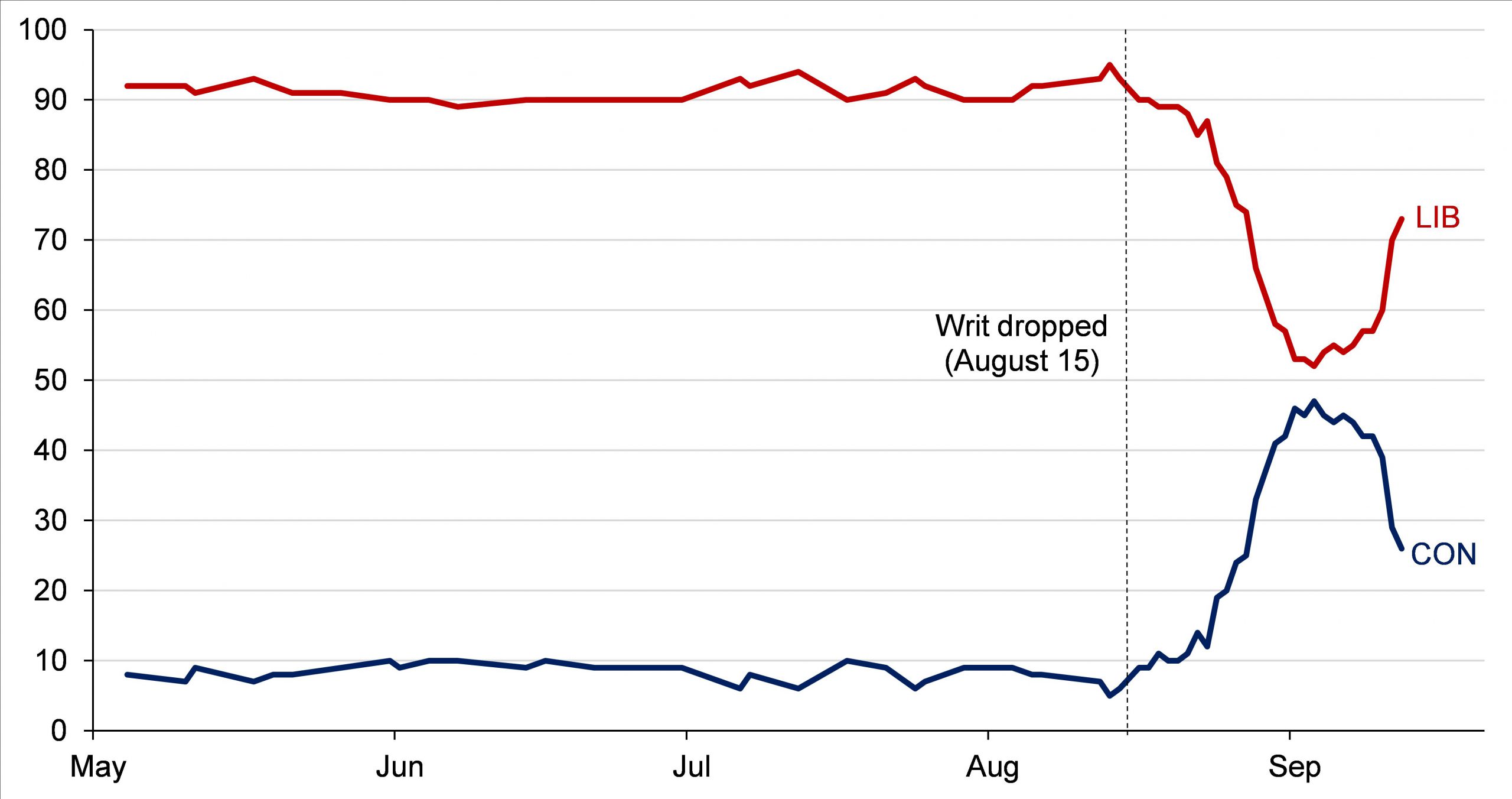

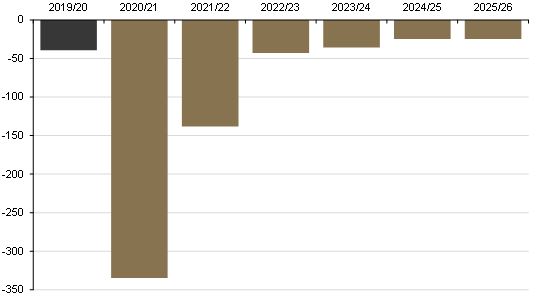

Parliamentary Budget Office’s 2021 election proposal costing baseline federal deficit

(billions of Canadian dollars)

Data as per PBO’s economic and fiscal baseline projection for 2021 election proposal costing period published August 16, 2021

Source: Parliamentary Budget Office, Guardian Capital

This general consensus is in favour of a continued elevated degree of government expenditure-induced deficits, combined with the growing possibility that the election could result in a nearly identical makeup of the legislature as the one that sat just a month ago. Polls point to the only real change being the New Democratic Party adding seats at the expense of the Bloc Québécois, which could help the Liberals push through pieces of their agenda — which provides no reason to anticipate much by way of a particularly noteworthy market reaction.

The bottom line is that, while the Canadian Federal election clearly matters, the campaign is being drowned out by a myriad of important developments on other fronts outside of the federal government’s control; for example, pandemic management and economic reopening plans are being dealt with at the provincial levels, while climate change policies will be likely guided by international decisions and agreements.

This communication is for educational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation or solicitation to buy, sell or hold a security and should not be considered an offer or solicitation to deal in any investment product. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com

Published: September 16, 2021