Press Release Guardian Capital Announces December 2021 Distributions for Guardian Capital ETFs TORONTO, December 16, 2021 – Guardian Capital LP […]

Published August 25, 2023.

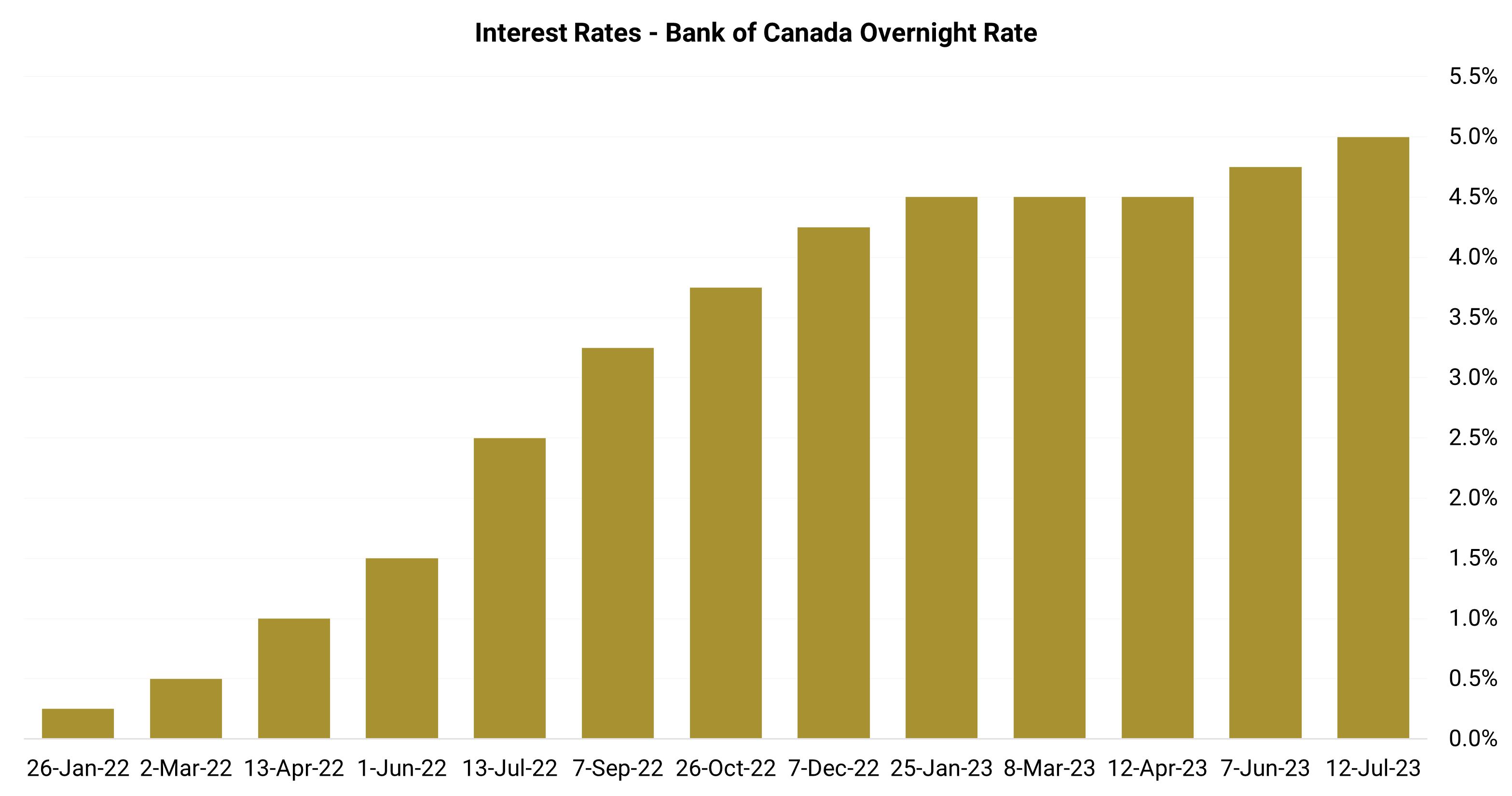

After having been overlooked as an asset class for much of the last decade, while interest rates were at historically low levels, cash appears to be king once again. This is, of course, on the heels of fast and furious interest rate hikes over the past 18 months that have moved interest rates to 5% here in Canada – hard to believe after rates were just 0.25% at the start of 2022.

Source: Bank of Canada as of July 13, 2023. Available on their website at: https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate

To get a better understanding of the opportunity in T-Bills today, let’s start by explaining what these securities are. Treasury bills, also called T-Bills, are short-term debt instruments (like bonds) that mature in one year or less, and are issued and fully backed by the government, which makes them perhaps the safest investments available.

Benefits

The phenomenon we’ve seen take shape in fixed income markets since the rise in interest rates is the inversion of the yield curve, meaning yields on short-dated bonds (those maturing sooner) are considerably higher than yields on long-dated bonds (those maturing later). As a result, the risk-return prospects for T-Bills, which are short-dated debt instruments, are currently very attractive. In fact, more attractive than they’ve been in over 20 years.

Why? Because investors are essentially able to earn approximately 5% with low risk. T-Bills are, after all, often referred to as the “risk-free rate”2. And so, while a very select few other segments of the fixed income market (i.e. high yield bonds) may offer higher yields, they carry much higher credit and interest rate risk, making the T-Bill proposition today very compelling.

This, of course, will evolve over time, but investors are being very well compensated for parking cash in the current yield environment.

With the launch of Guardian Capital’s Ultra-Short T-Bill Funds, available as mutual fund and ETF investments, we’re providing investors with two new solutions, among very few, in the Canadian market directly and exclusively exposed to T-Bills, and offering options to invest either in Canadian or U.S. dollars.

As of inception, the yield to maturity (YTM) of the Funds’ underlying portfolio of T-Bill securities was 4.95% and 5.19% on the Canadian and U.S. versions, respectively, offered at management fees of just 0.12% (ETF and Series F).

Key reasons to invest

|

Monthly Income:

Cash-alternative with attractive yield3 |

|

Stability & Security:

Government-backed, ultra-short-term T-Bills with very little interest rate risk |

|

Actively Managed:

Experienced fixed-income team tactically positions Fund amongst 0- to 6-month T-Bills, depending on their views of the best opportunities |

Although there are a few different products in the market that are considered cash-alternatives, there are some key differences that are worth highlighting. GICs and High Interest Savings Accounts/Funds have been beneficiaries of investor inflows, but we believe T-Bills provide a more compelling proposition for a few different reasons, namely based on liquidity (ease of access to capital without lock-ups), government backing of the T-Bills offering low credit risk, and a considerably more attractive yield relative to cashable GICs. High Interest Savings Funds are also under review by the Office of the Superintendent of Financial Institutions (OFSI) which could potentially see their associated yields come under pressure.

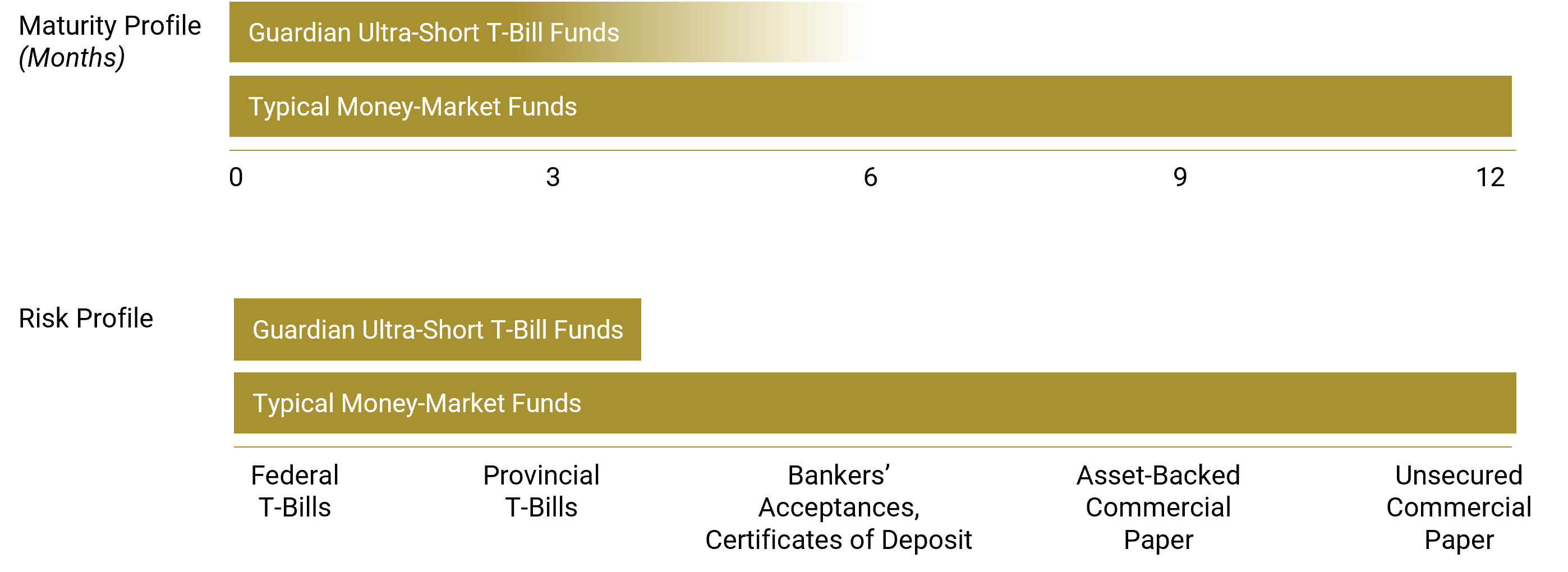

Furthermore, there are certainly no shortage of money-market funds available to Canadian investors. A lot of them, however, invest in bonds maturing in up to 1 year, adding relatively higher volatility stemming from changes in interest rates. They may also invest in money-market securities that carry some higher incremental credit risk relative to T-Bills – investments like certificates of deposit, asset-backed- and unsecured commercial paper. With the Guardian Ultra-Short T-Bill Funds, the Funds’ portfolios were intentionally designed to be as close to cash as possible to help mitigate credit- and interest rate risks. The bulk of the Guardian Ultra-Short T-Bill Funds’ portfolio exposure will be in government debt securities with maturities under 3 months, with some smaller positions in maturities under 6 months, and they will exclusively hold T-Bills to help mitigate credit risk.

With current high yields, no lock-up periods and very little interest rate or credit risk, the Guardian Ultra-Short T-Bill Funds warrant consideration by investors with a variety of investment needs. Get paid to park your cash!

1 As at August 25, 2023, Yield to Maturity (YTM) at Cost: The YTM (at Cost) shown is the weighted average Yield to Maturity at Cost of each of the underlying T-Bill securities in the portfolio, net of cash. Yield to Maturity at Cost means the percentage rate of return paid if the T-Bill security is held to its maturity date from the original time of purchase. The calculation is based on the coupon rate, length of time to maturity, and original price of the underlying T-Bill securities. This is not the yield, distribution rate or performance return of the Fund and is not intended to represent the distribution or return experience of any unitholder. It is only intended to give investors an idea a particular portfolio characteristic of the underlying securities held in the Fund’s portfolio.

2 T-Bills are deemed to be very low risk investments based on government backing, very little interest rate risk and very low historical volatility of returns.

3 Expected to be in excess of other short-term instruments, like bank deposits and cashable GICs, under current interest rate conditions.

4 Based on average fixed-rate yields of the current 1-year cashable GICs offered by BMO, CIBC, Scotiabank, RBC and TD, as published on August 25, 2023.

5 Based on the average of the latest yield figures posted for the largest five HISA ETFs in Canada (by AUM), as of August 25, 2023.

6 As at August 25, 2023. Yield to Maturity (YTM) at Cost: The YTM (at Cost) shown is the weighted average Yield to Maturity at Cost of each of the underlying T-Bill securities in the portfolio, net of cash. Yield to Maturity at Cost means the percentage rate of return paid if the security is held to its maturity date from the original time of purchase. The calculation is based on the coupon rate, length of time to maturity, and original price.

For more information on the financial terms used in this document, please refer to the Glossary of Financial Terms on our website at: https://www.guardiancapital.com/investmentsolutions/glossary-of-terms.

Please read the prospectus, Fund Facts or ETF Facts before investing. Important information, including a summary of the risks, about each Fund is contained in its respective offering documents. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund and exchange traded fund (ETF) investments. You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on the Toronto Stock Exchange (“TSX”). If the units are purchased or sold on the TSX, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them.

Mutual fund and ETFs securities, including money market funds, are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For ETF Units and funds other than money market funds, unit values change frequently. For money market mutual fund Units, there can be no assurances that the mutual fund Units will be able to maintain their net asset value per unit at a constant amount or that the full amount of your investment in the fund will be returned to you. Mutual funds and ETFs are not guaranteed, and past performance may not be repeated.

Guardian Capital LP is the Manager of the Guardian Capital mutual funds and ETFs, and also manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP and its affiliates, please visit www.guardiancapital.com. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.