Another upside surprise spurs further repricing of the Fed Once again, inflation data has provided an upside surprise, with the […]

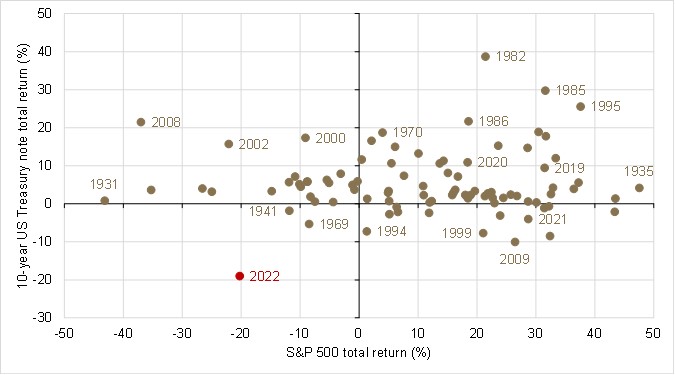

Market conditions have continued to be quite challenging since Guardian Capital LP’s Asset Mix Committee (AMC)1 last formally met in August, with both fixed income and equity assets continuing to face pressure as they experience their worst combined calendar year performance. The broad expectation is that performance across asset classes is likely to continue to face headwinds in the months ahead.

Nowhere to hide

(Calendar year total return; percent, US dollar basis)

*2022 is year-to-October 21. Source: Guardian Capital based on data from Bloomberg to October 21, 2022

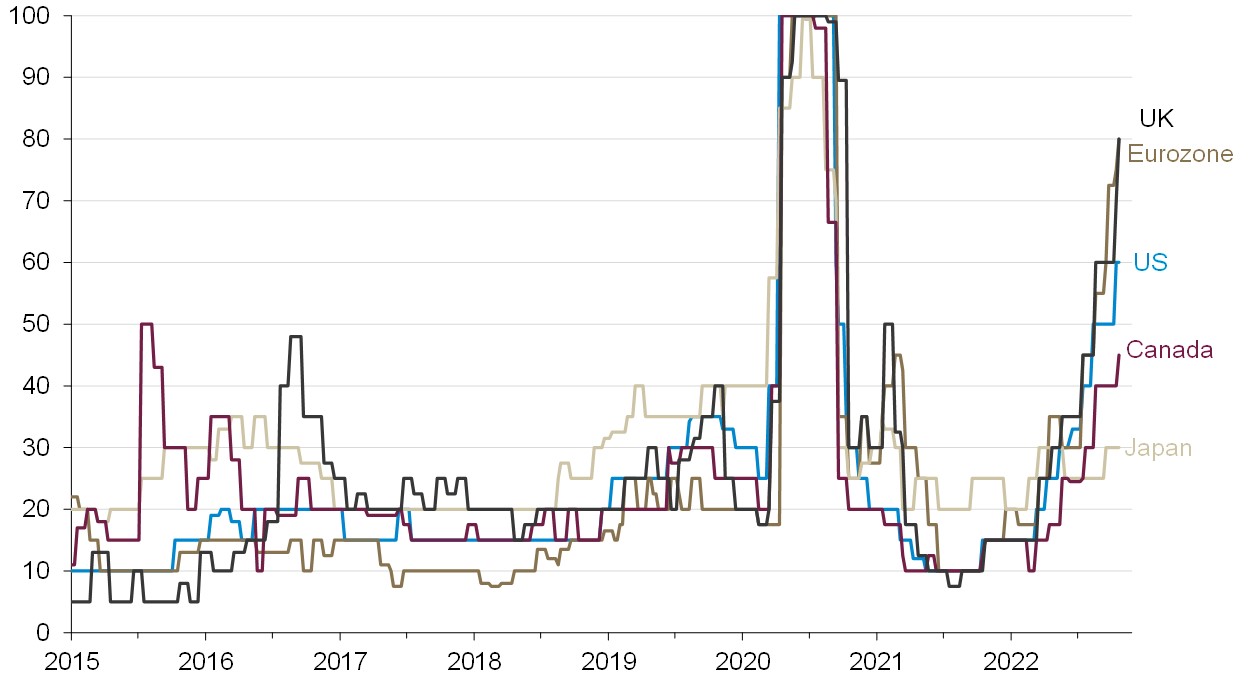

The economic outlook continues to be risk-laden. The aggressive moves by global central bankers to combat inflation pressures (and the expectation of more to come) in an environment of slowing general economic growth momentum, materially raise the risks of a material downturn in the months ahead. Indeed, consensus views are that a recession is all but assured across Europe, while the odds are considered to be little worse than a coin toss that such an outcome is avoided on this side of the Atlantic Ocean.

Rising recession risks

(consensus expected probability of a recession in next 12 months; percent)

Source: Guardian Capital based on data from Bloomberg to October 21, 2022

With that said, outside of more interest-sensitive areas of the economy (such as real estate) that are already feeling the impact of higher rates, general demand (underpinned by relatively healthy consumer finances and strong labour markets) has proven fairly resilient to this point. Against this, and with businesses able to pass through costs and maintain high margins, corporate profits have also proven to be more resilient than expected.

Looking forward, however, it is anticipated that the impact of slower economic growth, tighter monetary policy and margin pressures will become more prominent, resulting in downward pressure on earnings — profit forecasts, which had been holding up, have been scaled back of late and there is scope for further cuts to come.

Managing expectations

(consensus MSCI All Country World Index2 earnings per share forecasts; US dollars)

Source: Guardian Capital based on data from Bloomberg to October 21, 2022

Add in the potential for further price-to-earnings multiple compression on equities arising from higher interest rates and the view is that it may prove difficult for any sustained rallies over the longer term.

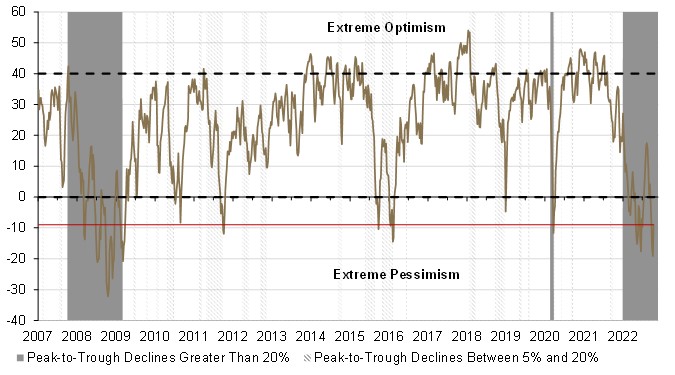

With that said, however, short-run “bear market rallies” are definitely possible — and the combination of extreme pessimism/bearishness in terms of investor sentiment and elevated cash balances right now, plus the positive seasonal factors, following the considerable weakness at the end of the summer, would appear to set the table for such a bounce in the near term.

Nattering nabobs or negativity

(Investors Intelligence’s bull-bear differential; percentage points)

Source: Guardian Capital based on data from Ned Davis Research, Wall Street Journal & Investors Intelligence to October 20, 2022

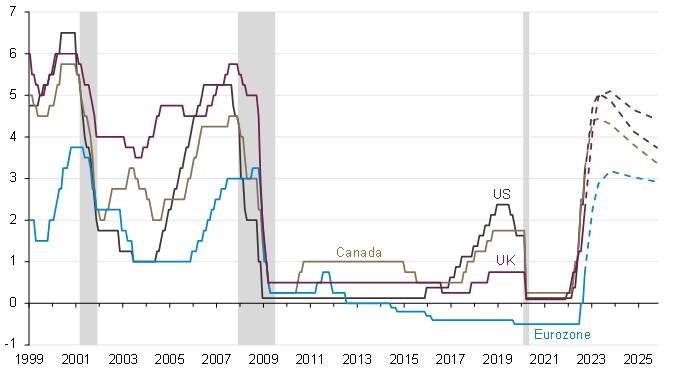

With respect to fixed income, market expectations for global central banks have continued to shift higher, with more hikes being priced in and rates now anticipated to hold at elevated levels for longer — this has seen yields move higher across the curve and weigh on the performance of all segments of the bond market.

Higher and higher for longer

(overnight index swap (OIS)-implied policy rates; percent)

Source: Guardian Capital based on data from Bloomberg to October 21, 2022; dashed lines represent OIS-implied policy rates as at October 21, 2022; shaded regions represent periods of US recession

The adjustment in yields, while historically painful for fixed income investors this year, has made the asset class risk/reward profile more compelling, particularly for high-quality corporate bonds and shorter-duration securities.

The outlook and market pricing suggest that there is a limited likelihood of a material rally in fixed income markets, as a “pivot” in the approach to monetary policy does not seem in the offing soon. That said, markets have readily priced in an aggressive path for policy rates, which suggests that the likelihood of a significant further shift higher is fairly low as well — though, higher does appear to be the path of least resistance for now.

Putting this all together, the Asset Mix Committee at Guardian Capital LP has a limited desire to further pare equity exposure at the moment, but should a rally materialize it will be viewed as an opportunity to reduce exposure and raise cash.

Within equity allocations, the view is that strategies that focus more on active investment in quality equities (the stocks of companies that are well positioned to sustain margins and profitability amid a more challenging environment) have greater upside given the outlook than core or income-biased mandates.

As such, the decision was made by the AMC to add to positions in quality growth equity strategies and reduce exposures to core and income-biased ones. Within fixed income, the views continue to support a bias toward high-quality corporate credit and shorter-duration securities. Overall, however, the potential for rates to continue to grind higher suggests little appetite to add to exposures at the current moment. As such, we plan to leave the fixed income positions unchanged.

The AMC will monitor economic and market developments closely in the coming weeks and stands ready to tactically exploit opportunities that may present themselves.

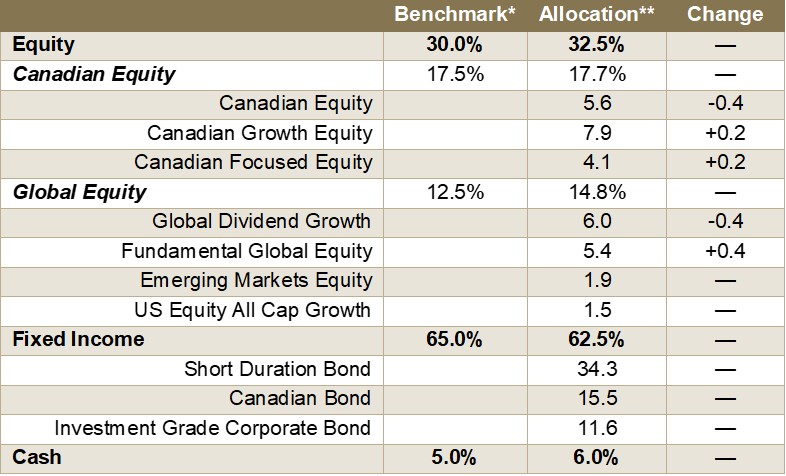

Conservative Asset Allocation

*Benchmark: **Figures may not add up due to rounding

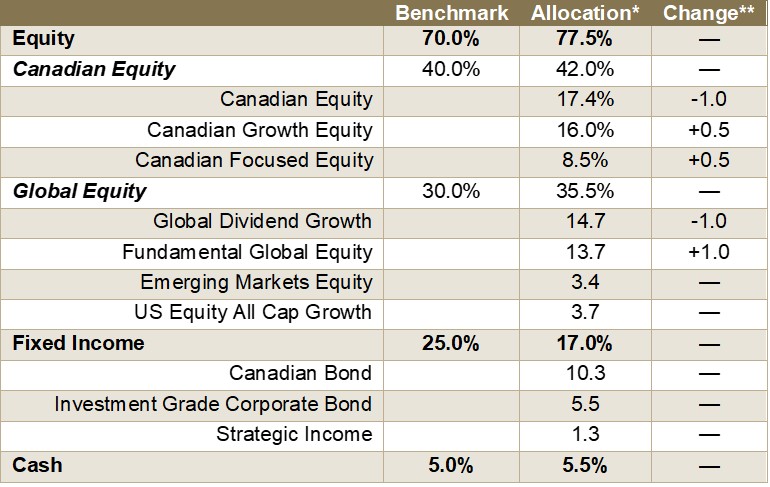

Growth Asset Allocation

*Benchmark: **Figures may not add up due to rounding

1. Guardian’s Asset Mix Committee (AMC) consists of investment professionals and asset class specialists and is charged with overseeing the development and management of multi-asset investment portfolios, specifically addressing asset mix composition/allocation and areas for advice or communication to such clients as it relates to the makeup of their portfolio.

2. The MSCI ACWI Index is a market capitalization weighted index of equities in both Developed and Emerging Markets

3. These Asset Allocations represent the Asset Mix Committee’s tactical views given their s assessment of market conditions and performance expectations.

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. Guardian, Guardian Capital and the Guardian gryphin design are trademarks of Guardian Capital Group Limited, registered in Canada.