Decision by Committee (October 24, 2022): Managing against a challenging backdrop Market conditions have continued to be quite challenging since […]

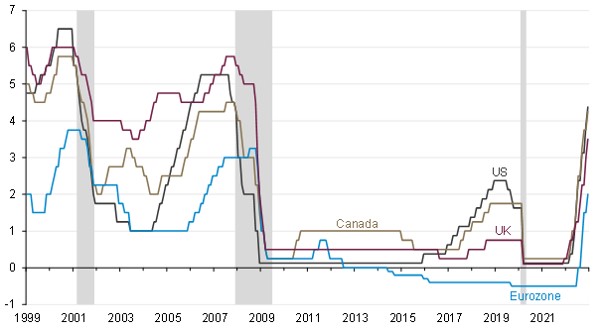

Interest rates have moved markedly higher over the last 12 months as financial markets adjusted to the aggressive shift among central bankers worldwide towards tightening financial conditions to try and get ahead of the curve with respect to inflation and preventing price pressures from spiraling ever-higher at significant, long-run costs to the global economy.

Rate reset

(central bank policy interest rates; percent)

Source: Guardian Capital based on data from Bloomberg to January 12, 2023

Against this backdrop, Guardian Capital LP’s Asset Mix Committee (AMC) has maintained a consistent bias in its asset allocation decisions toward shorter-duration securities and corporate credit. While all segments of the bond market faced significant selling pressure in response to the increase in yields, these less rate-sensitive areas fared comparatively better than the broader market and recorded relatively better returns throughout the year.

As we move into the New Year, it is increasingly looking like the reset in market interest rates is complete. There appears to be limited further upside in yields as tightening cycles have arguably been fully priced in, and expectations are growing for central banks to move to the sidelines in the coming months.

As such, rates are anticipated to remain rangebound around current levels, meaning that the coupons on offer will likely drive bond performance. The persistent inversion of the yield curve implies that those coupons are larger for shorter maturity bonds, while credit spreads offer an adequate premium for credit risk in the current environment. This supports a continued bias toward shorter-duration securities and corporate credit.

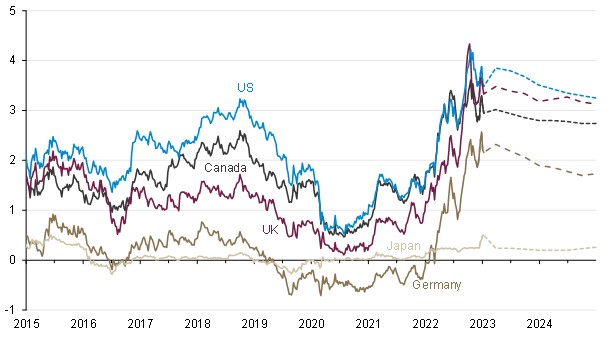

Steady as she goes?

(10-year sovereign bond yields; percent)

Dashed lines represent Bloomberg consensus forecasts as at January 12, 2023; source: Guardian Capital based on data from Bloomberg to January 12, 2023

But with that said, the current outlook would suggest that the balance of risks with respect to interest rates is tilted to the downside — there is more scope for rates to move lower than higher from current levels.

Any sort of upside surprise from inflation would be met with an upward shift in expectations for policy rates. Still, the magnitude of the increase is likely fairly small, and the probability of repeating the surge seen in 2022 is low.

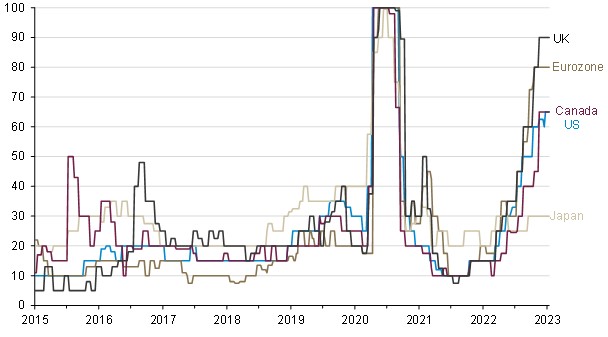

In contrast, should inflation come down faster than anticipated (high-frequency indicators are pointing in this direction) or should economic activity slow markedly (the current consensus is that a recession is all but a certainty in the next 12 months), then not only would expectations of further central bank rate hikes be pared, but the prospect of moves away from the now-restrictive policy stances would increasingly be priced.

Expecting the worst

(consensus probability of a recession in the next 12 months; percent)

Source: Guardian Capital based on data from Bloomberg to January 12, 2023

In the declining rate scenario, the added yield available on shorter-term fixed-income securities would unlikely match the capital gains recorded on longer-term, more rate-sensitive bonds.

Considering this, valuations appear attractive per the ongoing preference to maintain an overweight in equity in balanced fund asset mixes. The current rally appears to have further room to run as the near-term balance of risks appears tilted to the upside. A boost to multiples from an attendant decline in rates could potentially offset any headwinds from downside surprise with respect to the growth outlook. The AMC has decided to adjust its risk exposures within Fixed Income allocations and bring portfolio durations closer to the benchmark. Accordingly, allocations to core bond strategies were increased, with the weight coming from shorter duration and investment-grade corporate bond strategies.

A tilt toward shorter duration corporate credit remains as these securities appear to offer very compelling risk/reward trade-offs; however, the magnitude of this bias has been pared.

The AMC will monitor economic and market developments closely in the coming weeks and stands ready to tactically exploit opportunities that may present themselves.

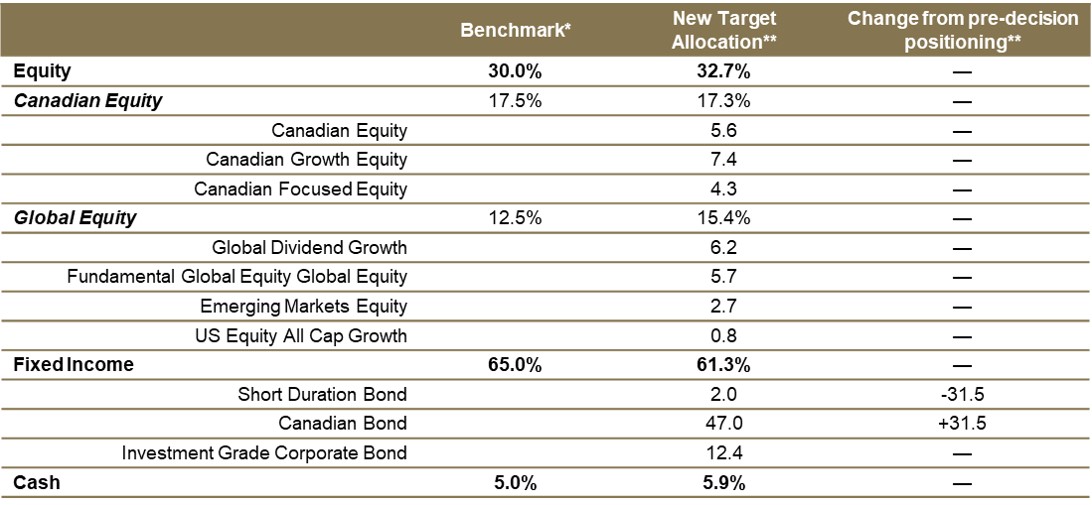

Conservative Asset Allocation

*Benchmark3 =portfolio strategic asset allocation **Figures may not add up due to rounding

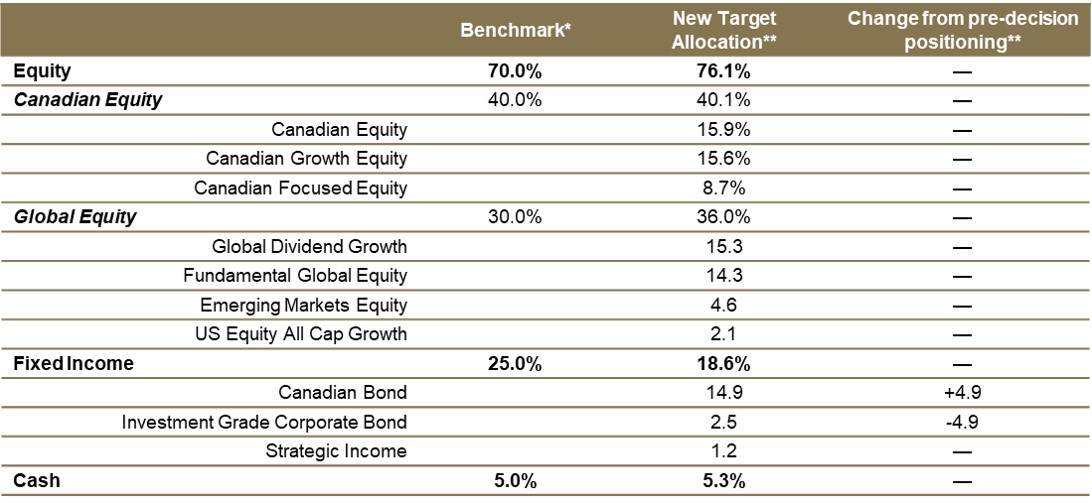

Growth Asset Allocation

*Benchmark4 =portfolio strategic asset allocation **Figures may not add up due to rounding

1. Guardian’s Asset Mix Committee (AMC) consists of investment professionals and asset class specialists and is charged with overseeing the development and management of multi-asset investment portfolios, specifically addressing asset mix composition/allocation and areas for advice or communication to such clients as it relates to the makeup of their portfolio.

2. These Asset Allocations represent the Asset Mix Committee’s tactical views given their assessment of market conditions and performance expectations. They do not represent any particular client account or portfolio, and are subject to change without notice.

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. Guardian, Guardian Capital and the Guardian gryphin design are trademarks of Guardian Capital Group Limited, registered in Canada.