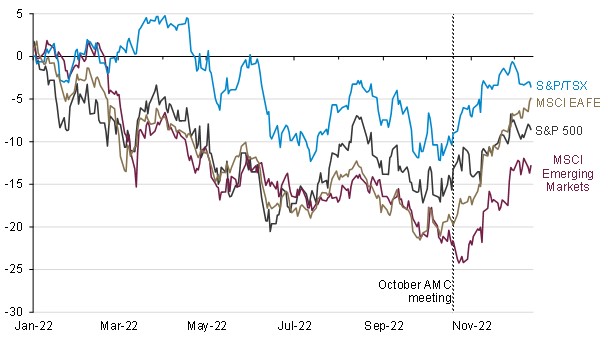

Decision by Committee (October 24, 2022): Managing against a challenging backdrop Market conditions have continued to be quite challenging since […]

When Guardian Capital LP’s Asset Mix Committee (AMC)1 last formally met in October, the consensus view among members was that while the elevated uncertainty surrounding the outlook and continued hawkishness among central bankers created a challenging backdrop for financial markets, the abundant pessimism in the marketplace shifted the balance of risks to the upside. Combined with an apparent abundance of cash on the sidelines, this appeared to set the table for a near-term rebound in equities.

Equity markets have rallied from their lows in the period since, indicating that inflationary pressures are starting to ebb and underlying economic momentum remains somewhat more resilient than anticipated. This has driven an improvement in investor sentiment.

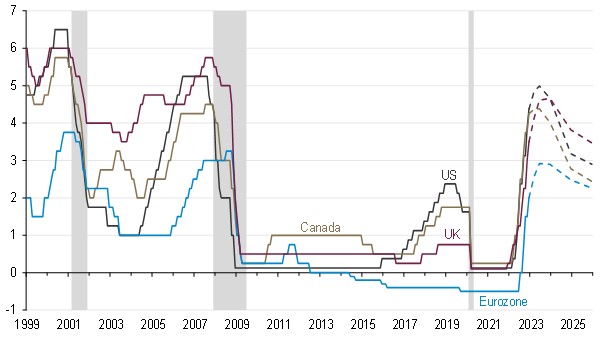

On the rebound

(year-to-date equity market performance; percent, Canadian dollar basis)

Source: Guardian Capital based on data from Bloomberg to December 14, 2022

While there is still plenty of lost ground to be recovered concerning previous market peaks, the magnitude of the rally over the last two months in the face of concerns over the recovery’s durability due to the risks to the outlook provides the AMC with cause to reconsider its positioning.

Indeed, recent macroeconomic developments are positive and suggest that policymakers may have a broader runway to navigate a soft landing; however, the outlook remains risk-laden and highly uncertain.

The impact of the ongoing tightening campaign undertaken by a historically broad number of global central banks is likely to become increasingly apparent in the months ahead, with the more rate-sensitive areas of the economy likely to feel more significant pressure.

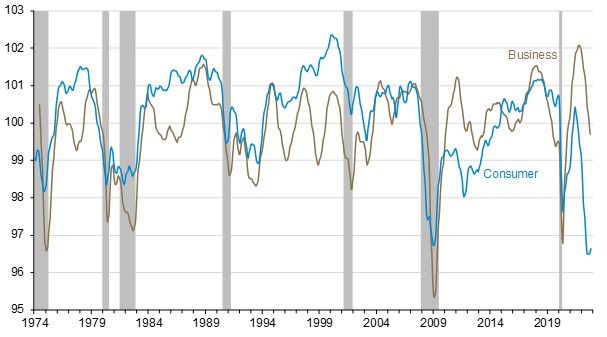

Broader concerns about the outlook and perceived elevated recession risks are expected to weigh on spending, investment and hiring plans and constrain growth momentum. Consumer and business sentiment gauges have already deteriorated significantly in recent months.

Down in the dumps

(OECD consumer & business confidence; index, long-term average = 100)

Source: Guardian Capital based on data from the Organisation for Economic Co-operation and Development to November 2022; shaded regions represent periods of US recession

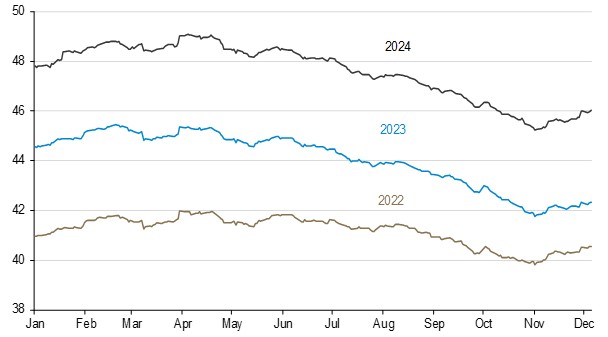

Concerning price pressures, while the recent moderation in inflation is welcome and provides scope for central banks to ease off the throttle, it is a headwind for earnings that have so far been propped up by the ability of firms to pass through costs to end consumers.

Combined with the prospect of moderating demand, there is a growing risk that the outlook for profits will deteriorate more materially than currently assumed in the months ahead.

Knives out

(MSCI All Country World Index consensus earnings per share forecasts; US dollars)

Source: Guardian Capital based on data from Bloomberg to December 14, 2022

Add to that, the persistently higher market interest rates that will continue to exert downward pressure on equity valuations. The view is that the road ahead for equities will likely prove challenging, making it difficult to sustain rallies over the longer term.

Under pressure

(S&P 500 forward price-to-earnings ratio & 10-year US Treasury note yield; LHS: ratio; RHS: percent, inverted scale)

Source: Guardian Capital based on data from Bloomberg to December 14, 2022

At the same time, the outlook for fixed-income performance has improved. This year’s material increase in interest rates has been undeniably painful for bond investors. Still, it has created a far better risk/reward trade-off for the asset class going forward.

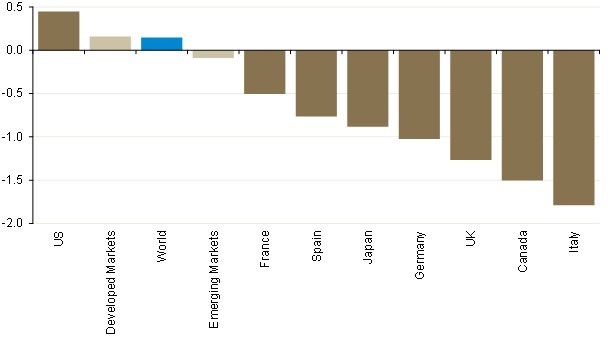

There appears to be limited further upside in yields as tightening cycles have largely been priced in, with the current consensus expectation being that central banks will pause early in 2023. The balance of risks for yields is now arguably tilted to the downside should central banks decide to pivot sooner toward a less stringent policy stance.

Reaching an apex

(central bank policy rates; percent)

Source: Guardian Capital based on data from Bloomberg to December 14, 2022; dashed lines represent overnight index swap (OIS) implied future policy rates; shaded regions represent periods of US recession

Rates are anticipated to remain rangebound around current levels, meaning that bond performance will likely be driven by the coupons on offer, which now stand at their highest levels in over a decade.

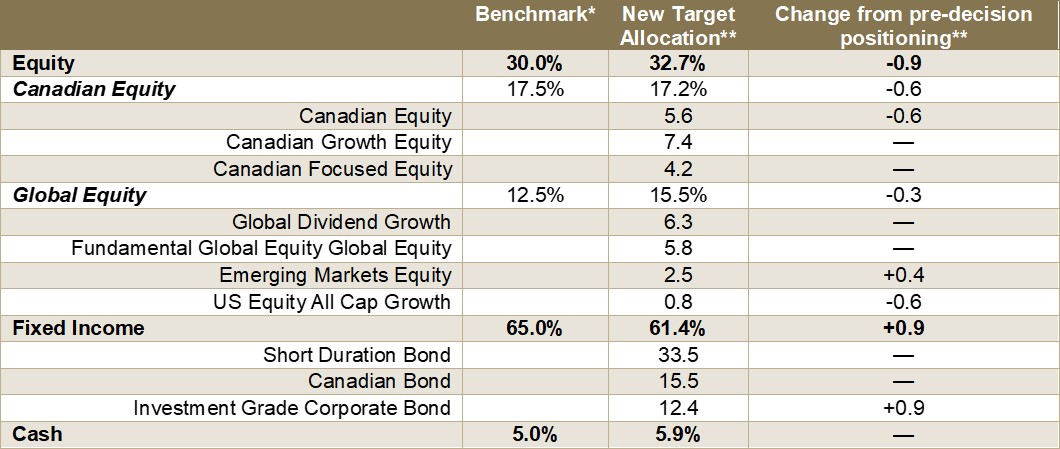

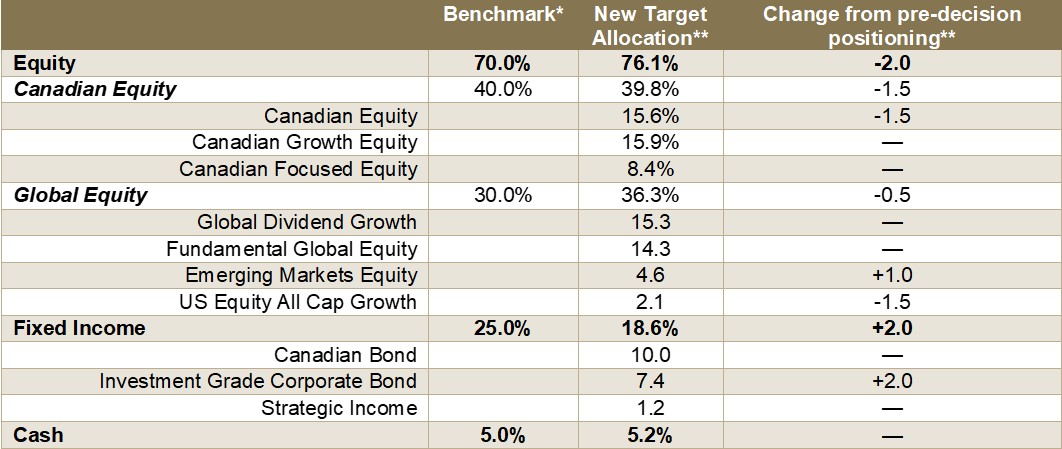

Taking this into consideration, while the AMC generally believes that there is further upside for risk assets as the “bear market rally” continues, the decision was made to reduce its risk exposures by paring back the tactical overweight position in Equity and reallocating the proceeds into Fixed Income.

Within Equity allocations, the view remains that strategies that focus on active and selective investment in quality equities (stocks of companies well positioned to sustain profit margins and earnings growth amid a challenging economic backdrop) will outperform broad-market core and income-biased mandates.

Regionally, the view is that the commodity-driven tailwind that underpinned the strong relative performance of Canadian equities this year has likely run its course. The comparatively higher relative valuations in the US combined would also appear to make it more vulnerable to a sustained high-interest rate lower growth environment. In contrast, Emerging Markets (EM) appear to present an opportunity. EM are further along in their tightening cycle than Developed Markets, and the prospect of an easing in public health restrictions in China could support a recovery in the grouping that has been subject to an extreme degree of investor pessimism. A softening in the US dollar would also serve as a tailwind for these assets.

Relative values

(MSCI country index forward price-to-earnings ratios relative to longer-term averages; standard deviations from average)

Source: Guardian Capital based on data from Bloomberg to December 14, 2022

Against these views, the decision was made to reduce exposure to core Canadian Equity and US-specific strategies in the asset mix while making a small allocation to the EM Equities.

In Fixed Income, the AMC views that shorter duration securities appear to offer the best opportunities at the moment, with the elevated yield and low rate sensitivity providing a cushion against any potential further increase in yields. The prospect of the yield curve unwinding its current extreme inversion also would mean better potential capital appreciation than the longer-dated securities.

Furthermore, the added yield available on high-quality corporate bonds is also attractive. Spreads have widened, which creates potential performance benefits in the event of improvements in the economic outlook or a decline in rates. Accordingly, the AMC decided to increase its exposure to investment grade corporate credit.

The AMC will closely monitor economic and market developments in the coming weeks and stands ready to tactically exploit potential opportunities.

Conservative Asset Allocation

*Benchmark3 =portfolio strategic asset allocation **Figures may not add up due to rounding

Growth Asset Allocation

*Benchmark4 =portfolio strategic asset allocation **Figures may not add up due to rounding

1. Guardian’s Asset Mix Committee (AMC) consists of investment professionals and asset class specialists and is charged with overseeing the development and management of multi-asset investment portfolios, specifically addressing asset mix composition/allocation and areas for advice or communication to such clients as it relates to the makeup of their portfolio.

2. These Asset Allocations represent the Asset Mix Committee’s tactical views given their assessment of market conditions and performance expectations. They do not represent any particular client account or portfolio, and are subject to change without notice.

3. Conservative benchmark: 17.5% S&P/TSX Total Return Index/12.5% MSCI World Index (Net, CAD)/65% FTSE Canada Universe Bond Index/5% FTSE Canada 91 Day Treasury Bill Index.

4. Growth benchmark: 40% S&P/TSX Total Return Index/30% MSCI World Index (Net, CAD)/25% FTSE Canada Universe Bond Index/5% FTSE Canada 91 Day Treasury Bill Index.

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. Guardian, Guardian Capital and the Guardian gryphin design are trademarks of Guardian Capital Group Limited, registered in Canada.