Recap The narrative that the central banks are done with hiking has fueled one of the strongest months for bond […]

Source: Guardian Capital based on data for the FTSE Canada Universe Bond Index from PC Bond, Bloomberg as at November 30, 2023.

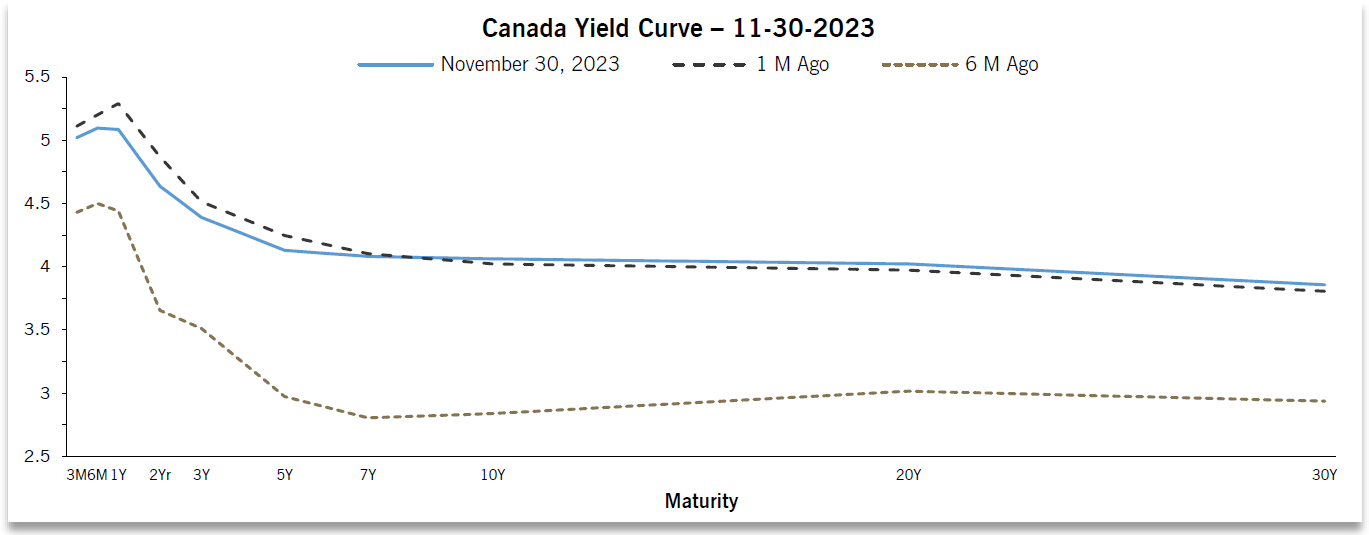

Despite bond yields falling in the short- and middle-end of the curve over the past month, the yield curve remains in deep inversion territory. In these conditions, investors are not being compensated in the belly of the curve. However, with a regime of rate rises coming closer to an end, there are likely decent capital appreciation opportunities in the 5-10-year segment of the curve. There could still be volatility here, but investors are now being compensated with higher yields to wait for a normalization of the curve which would benefit this segment of bonds.

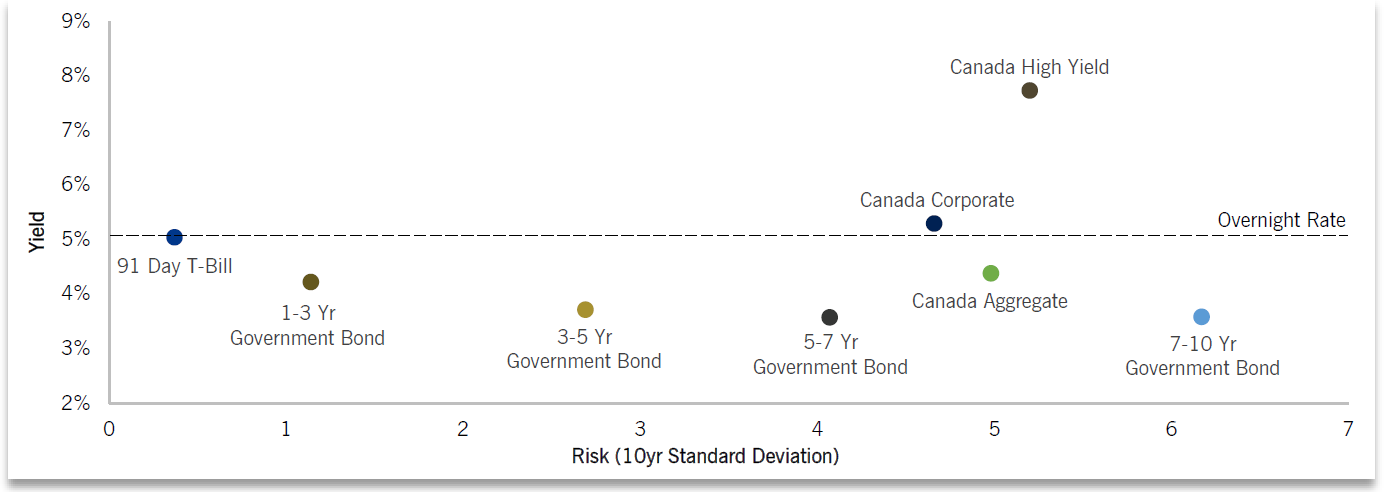

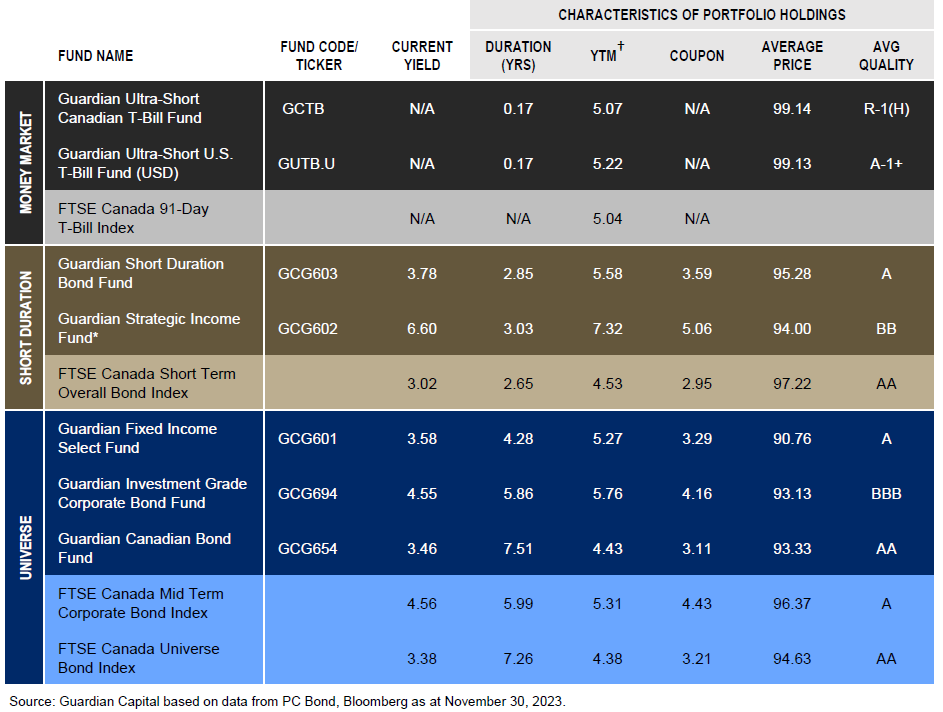

For investors who want a conservative risk return profile, the proposition in ultra-short-term bonds is still very attractive. For example, currently, investors can earn yields on the short-end of the curve in excess of 5%, whereas the Canada five-year bond rate is less than 4%. Investors seeking to dampen fixed income volatility may consider a tactical allocation to T-Bills, such as those held in the Guardian Ultra-Short Canadian T-Bill Fund and Guardian Ultra-Short U.S. T-Bill Fund (USD). Those seeking to add risk to an ultra-short or high-interest savings accounts (HISA) allocation may consider a tactical allocation to corporate credit, such as the holdings in the Guardian Investment Grade Corporate Bond Fund. Likewise, investors may consider an alternative fixed income solution that looks to provide monthly distributions and the opportunity for capital gains, while seeking low correlation to other asset classes, such as offered by the Guardian Strategic Income Fund*.

Source: Guardian Capital based on data for the FTSE Canada Universe Bond Index from PC Bond, Bloomberg as at October 31, 2023.

**Details of the Indexes used in the chart can be found on page 3.

| Guardian Ultra-Short Canadian T-Bill Fund | Guardian Canadian Bond Fund | Guardian Strategic Income Fund* |

|---|---|---|

|

|

|

The Duration, Yield to Maturity (YTM), Coupon, Average Price and Average Quality shown are based on the weighted average of the securities held in the respective Funds’ portfolio, and for the comparative benchmarks they are based on the weighted average of the Index constituents.

YTM: The YTM shown is the current yield-to-maturity, gross of fees, based on underlying portfolio holdings as at the date indicated. These yields will fluctuate regularly. YTM represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity.

†Note: For the T-Bill Funds, the YTM shown is the Yield to Maturity at Cost or YTM (at Cost), which is the weighted average YTM (at Cost) of each of the underlying T-Bill securities in the portfolio, net of cash. YTM (at Cost) means the percentage rate of return paid if the security is held to its maturity date from the original time of purchase. The calculation is based on the coupon rate, length of time to maturity, and original price of the underlying T-Bill securities. This is not the yield, distribution rate, or performance return of the Fund and is not intended to represent the distribution or return experience of any unitholder. It is only intended to give investors an idea a particular portfolio characteristic of the underlying securities held in the Fund’s portfolio.

Current Yield: The Current Yield is an annualized historical yield based on net income for the seven-day period ended on the date specified and does not represent an actual one-year return.

For more information on the financial terms used in this document, please refer to the Glossary of Financial Terms on our website at: https://www.guardiancapital.com/investmentsolutions/glossary-of-terms.

*The Guardian Strategic Income Fund is an alternative mutual fund. It is permitted to invest in asset classes or use investment strategies that are not permitted for other types of mutual funds. The specific strategies that differentiate this Fund from other types of mutual funds include borrowing cash, engaging in short selling and investing in specified derivatives. While these strategies will be used in accordance with the Fund’s objectives and strategies, during certain market conditions they may accelerate the pace at which your investment changes in value. This Fund also pays the Manager a Performance Fee equal to 15% of the amount by which the Investment Performance of the applicable series of Units exceeds the aggregate of the High Water Mark and the cumulative Hurdle Amount during the Performance Period. Please refer to the Fund’s prospectus for additional details.

**Fixed Income Risk-for-Yield Spectrum chart

91 Day T-Bill: FTSE Canada 91 Day T-Bill Index, which tracks Canadian Treasury Bills with maturities of 91 days.

1-3yr Government Bond: FTSE Canada 1-3 Government Bond Index, which tracks Government of Canada Bonds with maturities of 1-3 years.

3-5yr Government Bond: FTSE Canada 3-5 Government Bond Index, which tracks Government of Canada Bonds with maturities of 3-5 years.

5-7yr Government Bond: FTSE Canada 5-7 Government Bond Index, which tracks Government of Canada Bonds with maturities of 5-7 years.

7-10yr Government Bond: FTSE Canada 7-10 Government Bond Index, tracks Government of Canada Bonds with maturities of 7-10 years.

Canada Aggregate: FTSE Canada Universe Bond Index:, which tracks all Canadian Bonds.

Canada Corporate: FTSE Canada All Corporate Bond Index, which tracks corporate bonds within Canada.

Canada High Yield: FTSE Canada High Yield Overall Index, which tracks high-yield bonds within Canada.

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

Please read the prospectus, Fund Facts or ETF Facts before investing. Important information, including a summary of the risks, about each Fund is contained in its respective offering documents. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund and exchange traded fund (ETF) investments. You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on the Toronto Stock Exchange (“TSX”). If the units are purchased or sold on the TSX, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. For ETF Units and mutual funds other than money market funds, unit values change frequently. For money market mutual fund Units, there can be no assurances that these mutual fund Units will be able to maintain their net asset value per unit at a constant amount or that the full amount of your investment in the fund will be returned to you. Mutual fund and ETF securities, including money market funds, are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. Mutual funds and ETFs are not guaranteed, and past performance may not be repeated.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP is the Manager of the Guardian Capital mutual funds and ETFs. Guardian Capital LP is a wholly-owned subsidiary of Guardian Capital Group Limited, a publicly traded firm, the shares of which are listed on the Toronto Stock Exchange. For further information on Guardian Capital LP or its affiliates, please visit www.guardiancapital.com. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.