Since the start of 2022, fears of recession, rising interest rates, high inflation, supply chain disruption and ongoing geopolitical conflict […]

By: Sri Iyer, Managing Director and Head of i³ Investments™ | Guardian Capital LP1

With 2022 behind us, Sri Iyer takes a look at the investment landscape and opportunities going forward and provides several important observations relevant to dividend paying companies: • Earnings growth predictions have fallen globally • Future dividend payouts are likely to moderate • Probability of dividend cuts is rising across all regions What this means for investors is that “In shaky economic environments and with deteriorating earnings growth, focusing on screening out companies with dividend cuts is critical, and we believe that our focus on AI model predictions for earnings growth, dividend growth and probability of dividend cuts will be even more important going forward.” |

2022 was a transitionary year. After two years of pandemic-related closures, many countries reopened. At the same time, the pandemic’s era of unprecedented policy support, coupled with disruptions in energy supply, prompted inflation to surge globally. The resulting interest rate hikes fuelled a year of market volatility and put pressure on equity valuations.

However, factors like dividend yield fared much better than the broader equity markets, as investors returned to the fundamentals in search of companies that offered the stability of earnings and visibility of cash flows. With reduced growth expectations and an increased risk of recession, we believe this trend is likely to continue. At the same time, in broad terms, we could potentially see a drop in dividend growth and a rise in credit risk (dividend cuts) for dividend paying companies in 2023.

We believe this provides an advantageous landscape for portfolio managers like ourselves, as we believe that careful stock picking and alpha will matter more than broad factor exposures and beta going forward. Alpha, in the world of dividends, is usually delivered by companies that offer cash flow visibility and growth, an attractive and sustainable dividend payout and a minimal chance of a dividend cut (low credit risk).

Below, we provided several charts and observations based on what our Artificial Intelligence (AI) model2 predicts may be a new era that will not be as kind to investors, as they may be used to. Before you review, let’s set the context.

Since starting my career in 1994, a period of low inflation and steady economic growth would see stocks and bonds flourish in a way that I feel won’t be possible moving forward. Low inflation allowed the US Federal Reserve (Fed) to maintain low and stable interest rates and provide support with quantitative easing, and the resulting period of easy money euphoria encouraged risk-taking and propped up the markets. The post-pandemic era is off to a different start as the Fed focuses on price stability, and the period of easy money is now moving in the opposite direction. The Fed Put (predicted bailouts by the central banks) that assured sustained bull markets of the past won’t likely be seen again for a while.

Put plainly, what worked in the recent past might not work going forward.

There are three major dislocations or “regime drivers” that are, in my opinion, likely to keep inflation elevated above central banks’ targets, subdue economic growth and make it more difficult for investors to turn a profit in the medium-term – this is not an attempt to forecast the future, but rather observations based on some significant dislocations in global markets:

1. Aging populations are likely to shrink workforces and cause worker shortages and reduced production. “Human Resources” could take on a new definition over the next decade and be a major cog in input costs (i.e. labour inflation).

2. Tensions between global superpowers signal that we’ve entered into a “new world order” where globalized supply chains that once helped reduce the price of goods may be broken. Also, as the past two years have made painfully clear, “globalized” supply chains can create concentrated sources of risk. We see geopolitical cooperation and globalization evolving into a fragmented world with competing blocs, which comes at the cost of economic efficiency. Furthermore, cross-sectional dispersion across global equities is likely to increase after a period of highly correlated global markets, forming clusters of economic blocks that won’t move in tandem and instead may compete against each other.

3. A more rapid transition to clean energy could ultimately be inflationary unless a new stream of investment flows into carbon-neutral solutions. It’s a simple supply-demand issue, and if high-carbon production falls faster than low-carbon alternatives are phased in, shortages could drive up prices and disrupt economic activity. This structural theme could play out over a decade and beyond news media cycles.

What is AI telling us?

The regime shift drivers are reflected in our AI model predictions shown in the charts below through companies’ earnings expectations and policy actions. The three regime shift drivers above are not specifically taught to the machines, but the features that train the model (including macroeconomic data, alternative data and fundamental data) detect their impact through predictions of forward expectations. As a result, if not the level itself (precision), the directional accuracy of the model’s AI predictions of earnings and dividend growth, as well as dividend cuts, has been on point since launching in 2020.

The i3 Investments™ team at Guardian Capital LP has developed machine learning and AI models that aim to predict which stocks are expected to see meaningful upward and downward earnings and dividend growth on an absolute and relative basis to the market over the next 12 months, as well as probability of a dividend cut. Through rigorous testing and research, the team has identified key drivers of dividend trends and relationships between factors such as historical and predicted dividend yield, dividend growth, payout ratios, news sentiment, quality and the whole spectrum of revenue and EPS revision data. These AI model insights are used as an input in our idea generation and stock selection process. Artificial Intelligence is than combined with Human Intelligence as Portfolio Managers then validate the factors

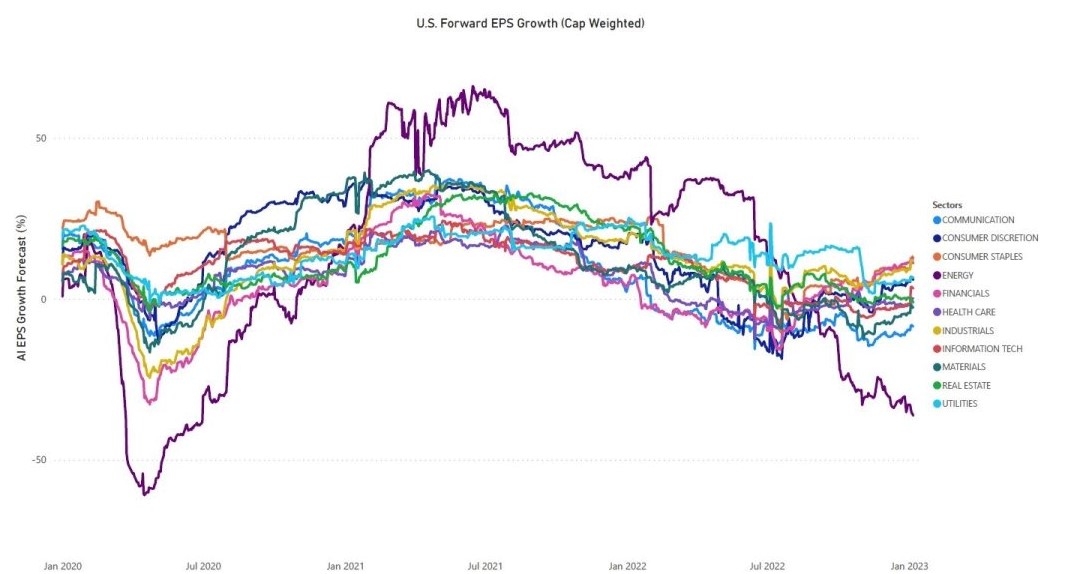

Observation: 1-year EPS growth rate predictions have fallen steeply and continue to show a negative slope.*

Market expectations plus the lack of the Fed Put, seem to keep the AI model predictions for earnings-per-share (EPS) growth estimates from bottoming in this environment, unlike the clear bottoming we saw at the outset of COVID in March 2020 (which did have a Fed Put bailout). With respect to EPS growth estimates for the next 12 months, Europe is expected to be underwater (negative growth) across most sectors, while the US is predicted to stabilize near zero EPS growth rates.

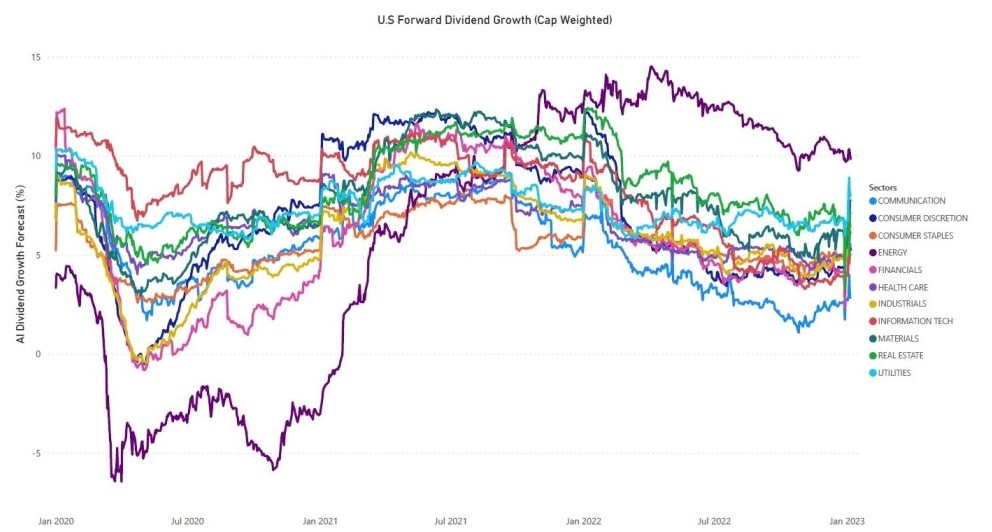

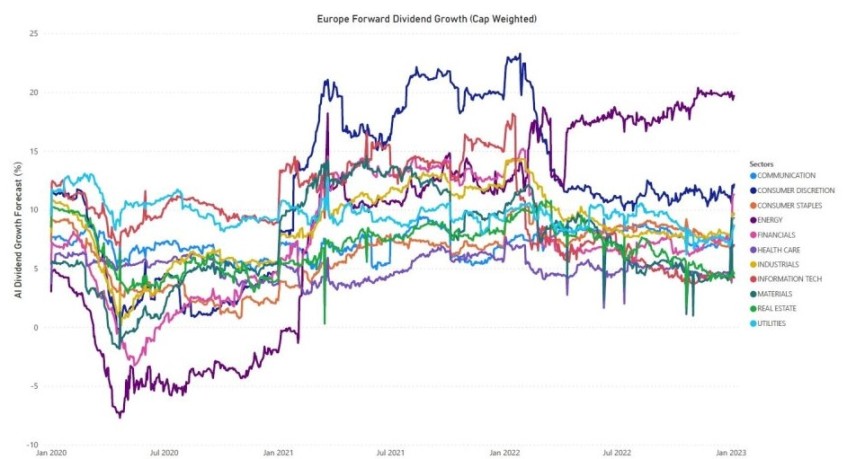

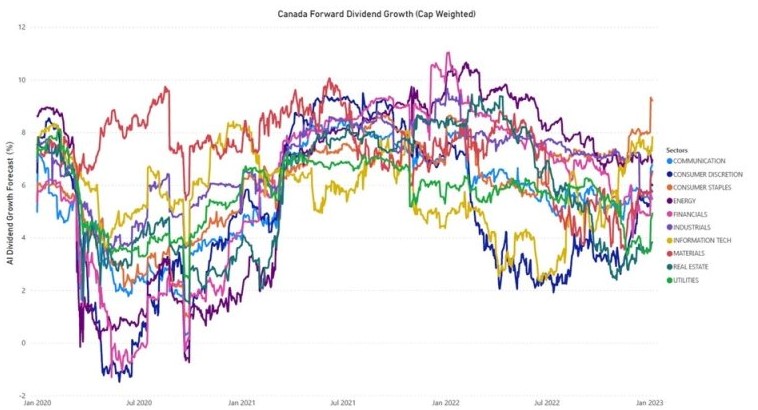

Observation: With EPS growth predictions being an input feature for dividend growth predictions (along with other features specific to dividend payout predictions) the AI models are predicting earnings impacting future payouts.*

Dividend growth rates in the US are moderating, and an article by Wall Street Horizon corroborates with real data what our models have been predicting over the past six to nine months. Wall Street Horizon found that the number of companies announcing lower dividends increased in the back half of 2022.3

While not a stunning inflection, the net number of dividend increases has declined as equities endured a tough year. Simply put, companies are not growing their dividends as much as before but do not appear to be cutting them broadly either. In the US, dividend growth rates seem to be normalizing at around 5%, and Europe is also in that range. The Energy sector in Europe continues to buck the trend, so one should not paint all dividends with the same brush. The strength in Energy is evident in Canada as well, but Canada has also shown resilience in a few other sectors, such as (Industrials and Consumer staples).

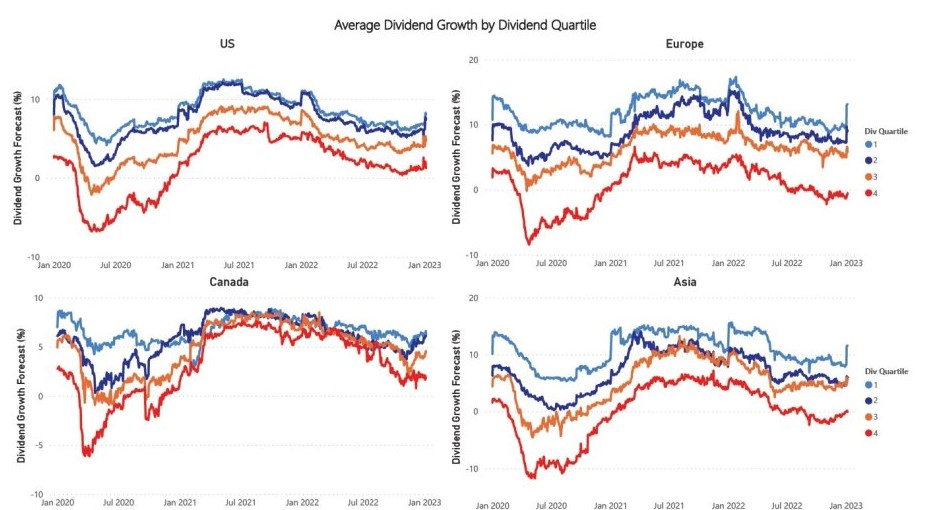

Observation: If one classifies the universe into quartiles by dividend yield, dividend growth in all four quartiles is moving down.*

What is not noticeable to the average investor though is that the euphoric dividend payouts after the COVID quantitative easing have evaporated, and stocks with the lowest yielding are deteriorating in quality. Low dividend payout stocks also appear to be the stocks that are predicting a larger slowdown in earnings and have a greater sensitivity to discount rates and terminal assumptions. As much as high dividend-yielding stocks present risks in terms of potential credit risk and dividend cuts, it seems low-yielding stocks have their own problems to contend with.

This leaves us with the final and most important aspect of dividend risk premia – credit risk or what is to us the probability of a dividend cut.

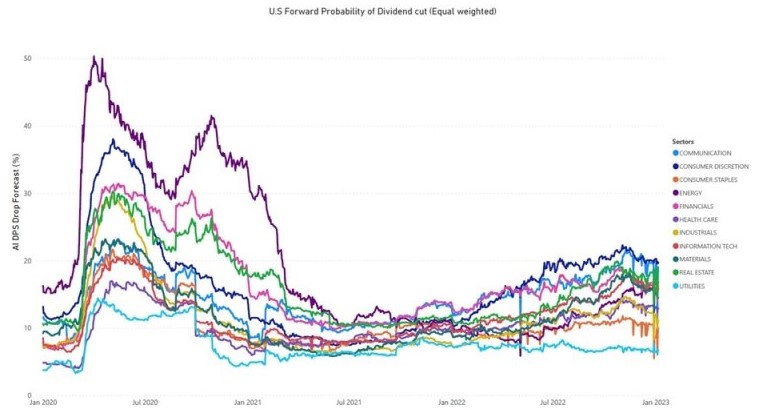

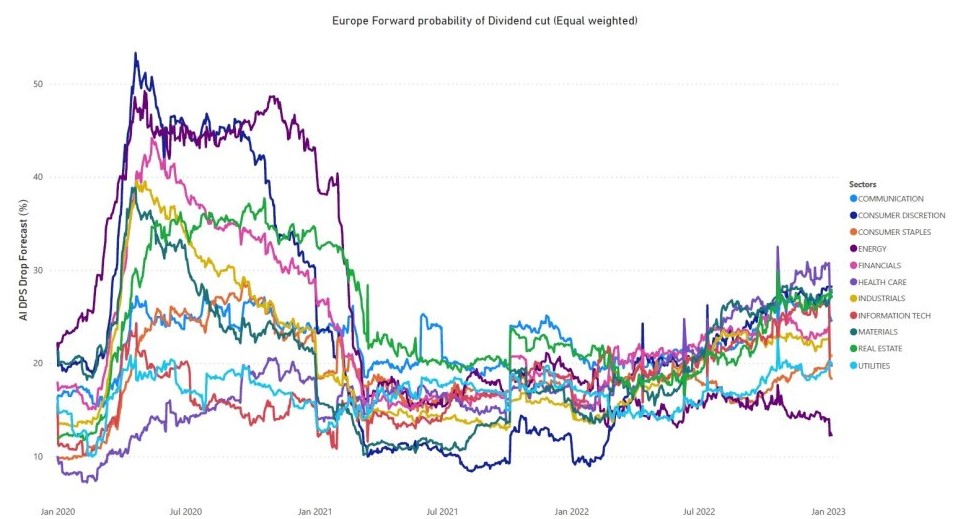

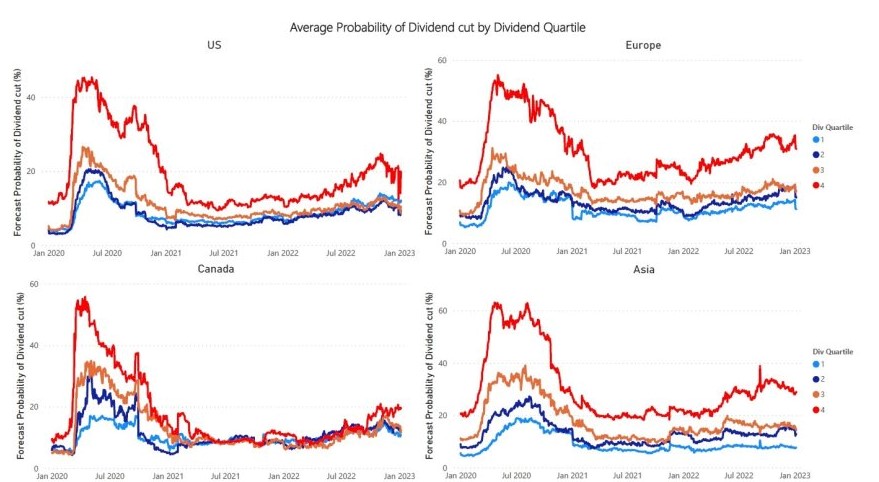

Observation: The probability of dividend cuts appears to be rising across all regions and quartiles of dividend yields.*

There is no doubt there, but it is nowhere near the levels we saw at the peak of COVID in March 2020. However, that does not mean we should disregard them. The fact that the probability of dividend cuts appears to be rising steeply in some sectors shows that many stocks within these sectors have a higher probability of dividend cuts.

Regarding our investment decisions, we generally only act once we see the probability of cuts reach a 40% to 50% level, as we try to eliminate as many false positives as possible. Consumer Staples, Utilities and Energy seem of no concern in Europe. Consumer Discretionary and Real Estate are still big areas of concern in the US. We take a hands-on approach to every stock in our portfolio with regard to credit risk and do our due diligence on any names where we see rising or high probability of dividend cuts.

So, where do we go from here?

We believe that using unbiased4 AI predictors in investment decision making has become all the more critical as we go forward. Our AI model predictions of earnings and dividend growth currently do not show sustenance to stability across any regions, apart from a few sectors, namely Consumer Staples, Utilities and Energy.

Perhaps our AI systems are wrong, but they are indeed objective in their assessment that when the Fed Put no longer applies, and global cross currents keep affecting macro environments, something has got to give. Central bankers will likely not ride to the rescue when growth slows in this new regime, contrary to what investors have come to expect. We think the old playbook of simply ‘buying the dip’ won’t be an effective approach in this oncoming regime. Simply put, the economic impact of rising rates has to be constantly mapped across multiple asset classes to evaluate its impact on equity valuations and, in our case, AI earnings and dividend growth predictions.

Sure, year-over-year inflation likely peaked last summer, and many money managers argue that it’s set to come down fast. However, I think that, even with a recession, we could see inflation persisting above policy targets in the coming years. So, what kind of investments can you own that are likely to help you weather the challenges of the prevailing market environment? You can own companies that will pay out cash and reward shareholders through dividends, buybacks and debt reduction.

A rethinking of dividends is necessary. After years of muted performance compared to other equity styles during periods of easy money, it may be time to look at the duration and credit cycles within the dividend-paying equities. While 2022 was a challenging environment for the markets, it highlighted many of the strengths of dividend-paying equities that outperformed non-dividend paying equities and bonds. We believe, that many of the forces that brought back to light companies with growing dividends in 2022 remain intact for 2023.

There are always opportunities in the markets, but strong credit analysis, experience across cycles and active portfolio management may be necessary to avoid pitfalls, as the Fed Put moves into the rear-view mirror. In our view, focusing on screening out companies with dividend cuts is critical in these shaky economic environments with deteriorating earnings growth. We also believe that our focus on AI model predictions for earnings growth, dividend growth and probability of dividend cuts will be even more important as we move forward.

We continue to focus on dividend-paying equities supported by strong fundamentals, sustainable growth potential, healthy balance sheets, ample free cash flow, stable margins and company management teams committed to returning capital to their shareholders. These types of companies tend to be more resilient and may help mitigate risk during periods of heightened volatility. In our view, these characteristics position them as an ideal equity allocation to navigate current market headwinds.

1. i3 Investments™ Team is a portfolio management team with Guardian Capital LP, a registered portfolio manager.

2. Based on a multi-factor algorithm incorporated into a proprietary analytics model. The application of a model is hypothetical and the simulated results are subject to inherent limitations.

3. Source: Factset, Does a Spike in Dividend Decrease Announcements Portend 2023 Volatility?, Article written by Christine Short, VP, of Research at Wall Street Horizon, December 13, 2022. https://insight.factset.com/does-a-spike-in-dividend-decrease-announcements-portend-2023-volatility

4. We believe that using machine learning and AI model predictors that are unbiased by human investor behaviour can deliver a more disciplined and objective approach to investing.

*All charts in this commentary are as at December 31, 2022 and are sourced from Guardian Capital LP’s proprietary AI analytics model, as created and maintained by the i3 Investments™ team. These charts show forward-looking predictions of a model only and do not guarantee future results will correspond with those presently anticipated.

This communication is intended as a general source of information about Guardian Capital LP’s i³ Investments™ team and their approach to investing. Investment strategies which rely on predictive artificial intelligence and quantitative models may perform differently than expected as a result of, among other things, the factors used in the models, the weight placed on each factor, changes from the factors’ historical trends and technical issues in the construction and implementation of the models. Please consider these and other factors carefully and not place undue reliance on modeled information. There is no guarantee that the use of the quantitative model will result in effective investment decisions, as the simulated results are subject to inherent limitations.

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. Guardian, Guardian Capital and the Guardian gryphin design are trademarks of Guardian Capital Group Limited, registered in Canada.