Decision by Committee (October 24, 2022): Managing against a challenging backdrop Market conditions have continued to be quite challenging since […]

This commentary is authored by the Guardian Capital LP Asset Mix Committee (AMC)1

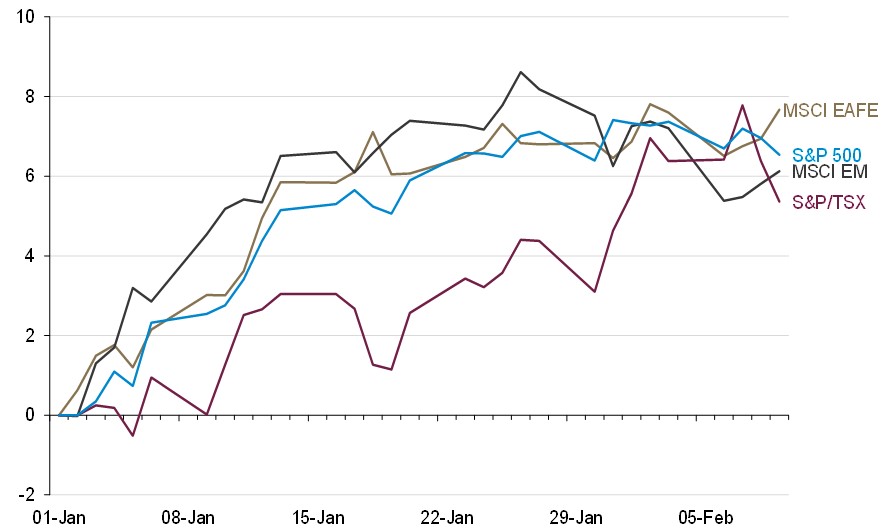

After a dismal end to a historically poor year for global financial markets, 2023 has started on the right foot as materially better than expected outturns in economic data (particularly in Europe and China) and cooperative inflation figures have supported broad rallies across equity markets.

Starting out strong

(year-to-date total return; percent, Canadian dollar basis)

Source: Guardian Capital LP based on data from Bloomberg to February 9, 2023

The gains are a welcome development from a performance perspective and valuations do not yet appear particularly stretched. Still, despite the cloudy and risk-laden outlook, the speed and magnitude of the gains in risk assets year-to-date give the AMC cause for pause.

While economic momentum has continued to be more resilient than anticipated, and looks to continue in the near term, the outlook remains highly uncertain. Growth is expected to slow materially in the coming year and, while viewed as having lower odds than even a few months ago, a recession and the potential for a “hard landing” outcome cannot be dismissed.

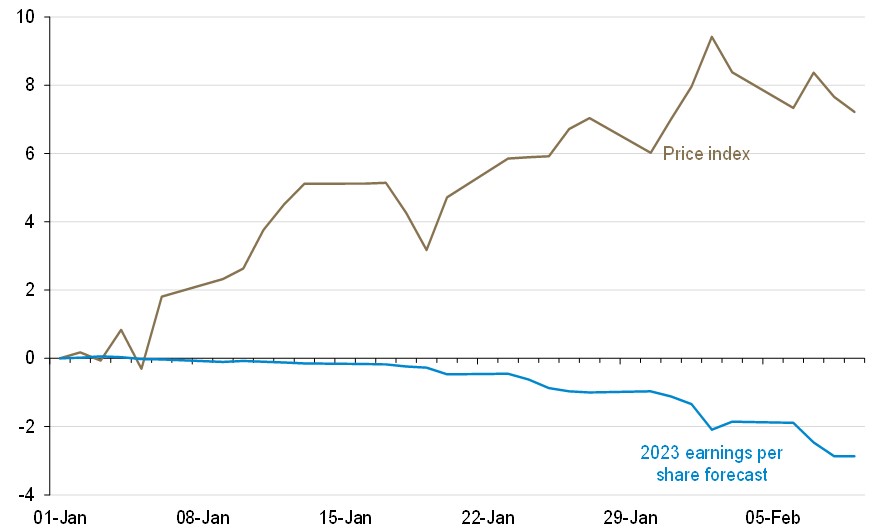

Similarly, while corporate profits have held up well and the “earnings recession” anticipated by many has not yet happened, earnings expectations are consistently being revised lower as profitability is anticipated to face increased pressure in the months ahead as margins compress from elevated levels. There is scope for further downgrades, which could trigger a renewed bout of investor pessimism and valuation multiple compression.

Diverging paths…

(MSCI World Index; year-to-date percent change, US dollar basis)

Source: Guardian Capital based on data from Bloomberg to February 9, 2023

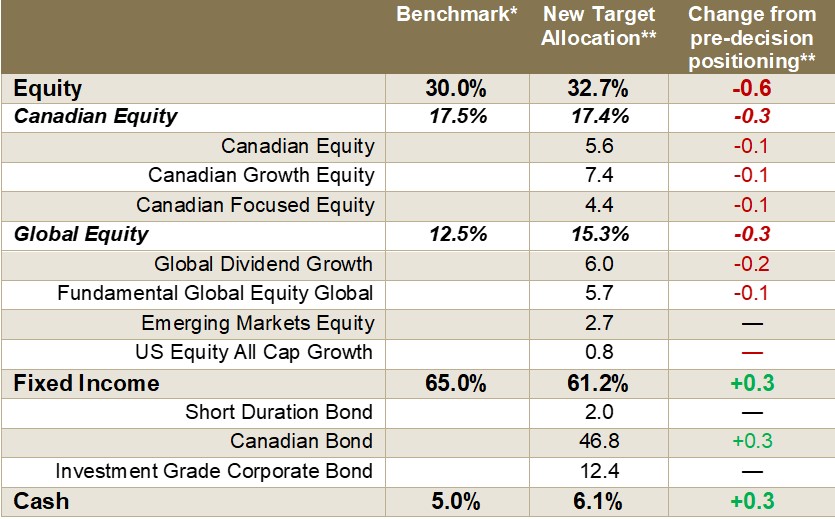

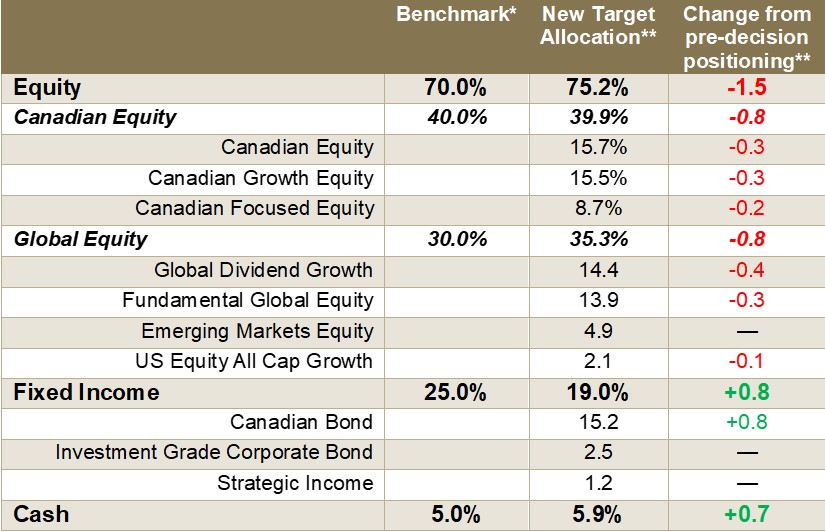

Accordingly, and combined with the constructive outlook for Fixed Income as global policy tightening cycles appear to be approaching their endpoint and market interest rates viewed as at or near their peak, the AMC decided to pare its risk exposures by reducing its Equity overweight and re-allocating some of the proceeds toward core Fixed Income strategies and positions in cash.

Within Equity, allocations were reduced proportionally based on current market weights across underlying holdings, except for Emerging Markets (EM), which was left unchanged. The outlook for EM is viewed as relatively more positive than for Domestic Markets (DM), particularly in the near term, due to the benefits from China’s broader economic reopening as it moves away from its “zero COVID” policy. More generally, the EM central bank tightening cycle is more mature, and the grouping is expected to re-establish its growth premium over DM, which the AMC believes should support positive relative performance. An anticipated continued weakening of the US dollar is also seen as constructive for the asset class.

For Fixed Income, the AMC’s preference was toward extending the duration in the asset mix given the continued assessment that the balance of risks for rates is tilted to the downside (i.e. there is more scope for rates to move lower than higher from current levels over the coming year), resulting in an increased allocation to the core Canadian Bond strategy.

A portion of the proceeds from the reduction in Equity was allocated to cash as a buffer to any potential near-term reversal of recent momentum and as a dry powder that can be tactically redeployed as market conditions warrant.

Overall, the asset mix remains overweight Equity, with a bias toward Global Equity and a focus on Quality Growth strategies that stand to benefit from a market environment in which general growth moderates to lower rates and profitability faces greater constraints. In Fixed Income, there remains a skew in favour of high-quality corporate credit, for which carry and spreads are attractive and duration remains below that of the broad bond market index. Cash is currently above the strategic weight.

The AMC will continue to monitor economic and market developments closely in the coming weeks and stands ready to tactically exploit opportunities that may present themselves.

Conservative Asset Allocation

*Benchmark3 =portfolio strategic asset allocation **Figures may not add up due to rounding

Growth Asset Allocation

*Benchmark4 =portfolio strategic asset allocation **Figures may not add up due to rounding

1. Guardian’s Asset Mix Committee (AMC) consists of investment professionals and asset class specialists and is charged with overseeing the development and management of multi-asset investment portfolios, specifically addressing asset mix composition/allocation and areas for advice or communication to such clients as it relates to the makeup of their portfolio.

2. These Asset Allocations represent the Asset Mix Committee’s tactical views given their assessment of market conditions and performance expectations. They do not represent any particular client account or portfolio, and are subject to change without notice.

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. Guardian, Guardian Capital and the Guardian gryphin design are trademarks of Guardian Capital Group Limited, registered in Canada.