Bank of Canada’s policy decision – hawkish hold As was widely anticipated, the Bank of Canada (BoC) opted to make […]

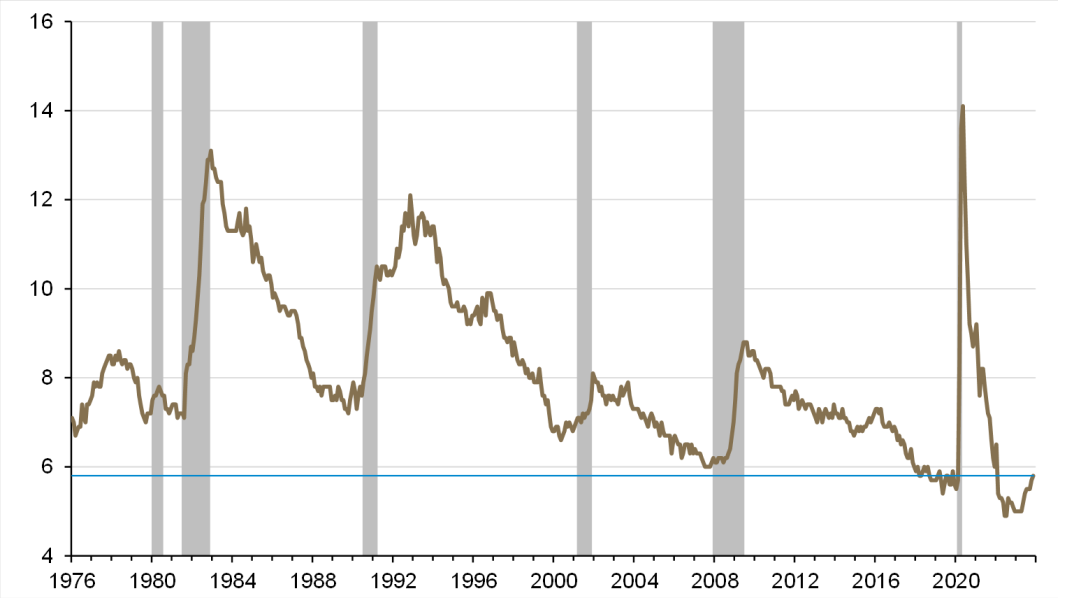

In July of last year, the Canadian unemployment rate was sitting at an all-time low of just 4.9% (data since 1976), and that, combined with other indications of “excess demand” within the domestic economy, prompted the Bank of Canada to accelerate their pace of rate hikes (they raised the overnight rate target by 100bps to 2.50% on July 13, 20221).

Fast forward 16 months and the policy interest rate has doubled (another 250bps worth of hikes to 5.0%) while the unemployment rate has coincidentally increased to its highest level since January 2022 at 5.8% in November.

For sure, the unemployment rate started at a historically low level and remains notably below “normal” levels (the average in non-recessionary periods since 1976 is 7.5%), but previously, when the unemployment rate has increased by this magnitude over a 16-month time span, it has been a fairly clear indicator of recessionary conditions. Not a positive indicator for the year ahead.

Unemployment rate, Canada

(percent)

Shaded regions represent periods of US recession; source: Guardian Capital based on data from Statistics Canada to November 2023

With that said, however, historically the rise in the unemployment rate has come as the result of a shift of Canadians from the ranks of the employed to the unemployed (i.e., people lost their jobs) — in previous periods where the unemployment rate has increased by 0.9 percentage points or more over a 16-month span (excluding the outlier pandemic shock), the average change in total employment is -106,300 (i.e., overall employment has declined).

In stark contrast, the Canadian economy has added 581,400 jobs on net over the last 16 months (including the stronger-than-expected 24,900 increase in November reported today2, which was concentrated in full-time and private sector jobs).

How can the unemployment rate rise when employment is increasing robustly (that’s an average of 36,000 per month since July 2022, which is roughly double the typical pace of job gain over the pre-pandemic decade), you may ask?

The answer is the number of people looking for jobs has been growing even faster than the number of people actually finding jobs — the supply of workers in Canada has boomed with the labour force (the sum of those classified as employed and unemployed) expanding by a record 810,400 over the last 16-months.

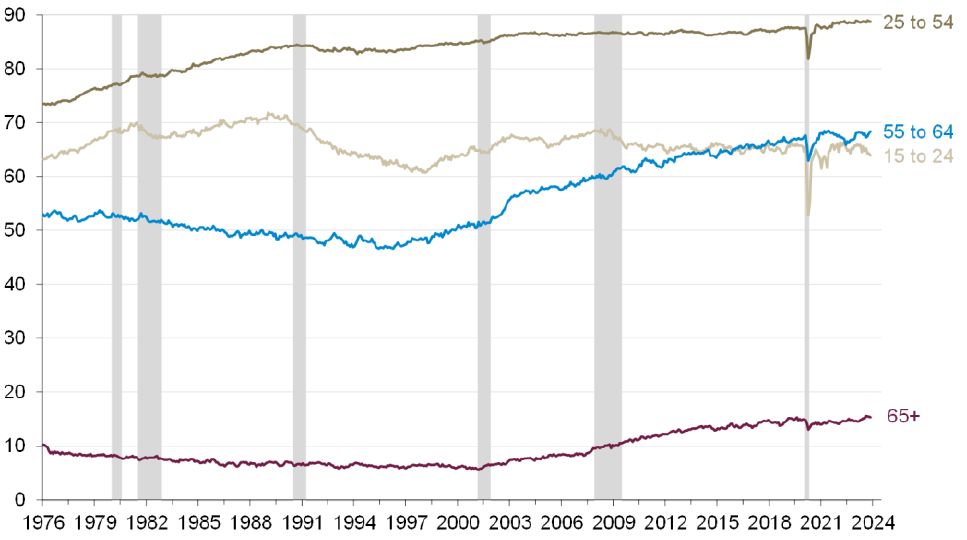

Part of this reflects the continued recovery of labour force participation from pandemic lows — the overall participation rate (share of the population that is either employed or looking for work) is back within an arm’s reach of pre-COVID levels, while the rates for those aged 25 to 54 and 55 to 64 are sitting at or near all-time highs (same goes for the 65+ crowd, while the youngest cohort has been trending lower; the greater share of the population among the low-participation 65+ crowd should be taking the overall rate lower anyway).

Labour force participation rate by age cohort, Canada

(percent)

Shaded regions represent periods of US recession; source: Guardian Capital based on data from Statistics Canada to November 2023

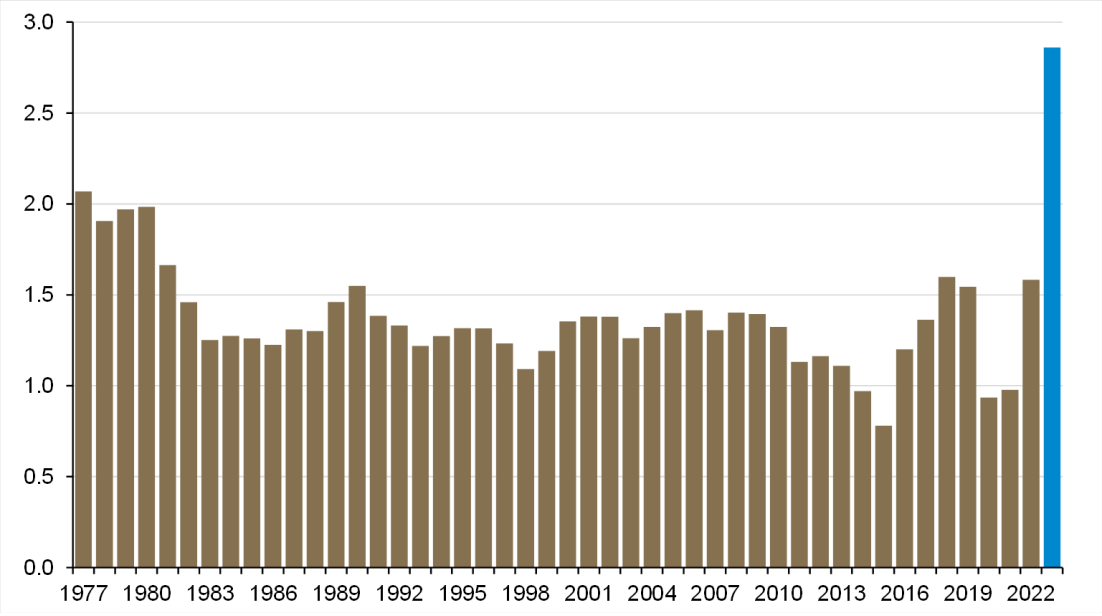

A bigger factor, however, is that the overall population of working-aged people in Canada has surged over the last year against a resumption of immigration flows — the number of people in Canada aged 15 or older has increased by 871,000 this calendar year-to-November, which is a record both in absolute terms and relative to the size of the Canadian population (+2.9% which is more than double the average of the previous 46 years).

Population aged 15+, Canada

(year-to-November percent change)

The sheer volume of added people to the workforce has been a driving factor of the rise in unemployment — labour demand remains pretty solid, but it has not been able to keep up with the increase in the supply of workers. And while job vacancies remain elevated3, today’s Labour Force Survey2 released from Statistics Canada noted that “immigrants who had arrived in the previous five years faced challenges finding work related to their post-secondary credentials or work experience acquired abroad” — this is a long-standing issue that needs to be addressed by various levels of government and licensing bodies so as to better integrate skilled workers into the Canadian economy.

This is all well and good, but why does this matter? Well, mainly because it suggests that the rising unemployment rate is not giving off the same blaringly negative signal that we have seen in previous cycles and, therefore, does not warrant the same type of policy response.

That the supply constraints in the Canadian job market are easing not through job loss is a very welcome development for policymakers. It eases pressures (and the latest Business Outlook Survey4 from the Bank of Canada indicated that businesses were seeing fewer and less intense labour shortages), which, in turn, mitigates “cost-push” inflationary impulses and helps with the central bank’s inflation focus, but is not resulting in widespread economic hardship that comes with job loss (which would carry negative implications for spending and investment).

Signs of moderating economic growth momentum, a downward trajectory in underlying inflation rates and indications of less tightness in labour markets all support the idea that the Bank of Canada is likely done with its tightening cycle (i.e., policy rates are not likely to increase further) — but the indications that activity is not collapsing, and that the unemployment rate increases are more a function of abnormally strong labour supply than falling demand, likely mean that the Bank of Canada will not be as proactive in unwinding its policy tightening as markets are currently assuming (the overnight index swaps given better-than-even odds of a rate cut in March and 100bps worth of cuts are fully priced over the next year).

1 Bank of Canada, Bank of Canada increases policy interest rate by 100 basis points, continues quantitative tightening, July 13, 2022, https://www.bankofcanada.ca/2022/07/fad-press-release-2022-07-13/

2 Statistics Canada, The Daily, Labour Force Survey, November 2023, https://www150.statcan.gc.ca/n1/daily-quotidien/231201/dq231201a-eng.htm?HPA=1, December 1, 2024

3 Statistics Canada, The Daily, Job vacancies second quarter 2023, Job vacancies decrease for the fourth consecutive quarter, https://www150.statcan.gc.ca/n1/daily-quotidien/230919/dq230919b-eng.htm, September 19, 2023

4 Bank of Canada, Business Outlook Survey—Third Quarter of 2023, Results of the third-quarter 2023 survey, Vol. 20.3, https://www.bankofcanada.ca/2023/10/business-outlook-survey-third-quarter-of-2023/, October 16, 2023

Written by: David Onyett-Jeffries

David Onyett-Jeffries is Vice President, Economics & Multi Asset Solutions, at Guardian Capital LP (GCLP) and provides macro-economic guidance to GCLP and its affiliates—Alta Capital Management LLC and GuardCap Asset Management Limited.

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. Guardian, Guardian Capital and the Guardian gryphin design are trademarks of Guardian Capital Group Limited, registered in Canada.