We are living longer and, naturally, we want our retirement income to also age well—that is, for our investments to […]

In the decumulation phase, particularly early in retirement, investors have a reduced ability to recover from drawdowns (which is when the value of what you own in your portfolio drops).¹

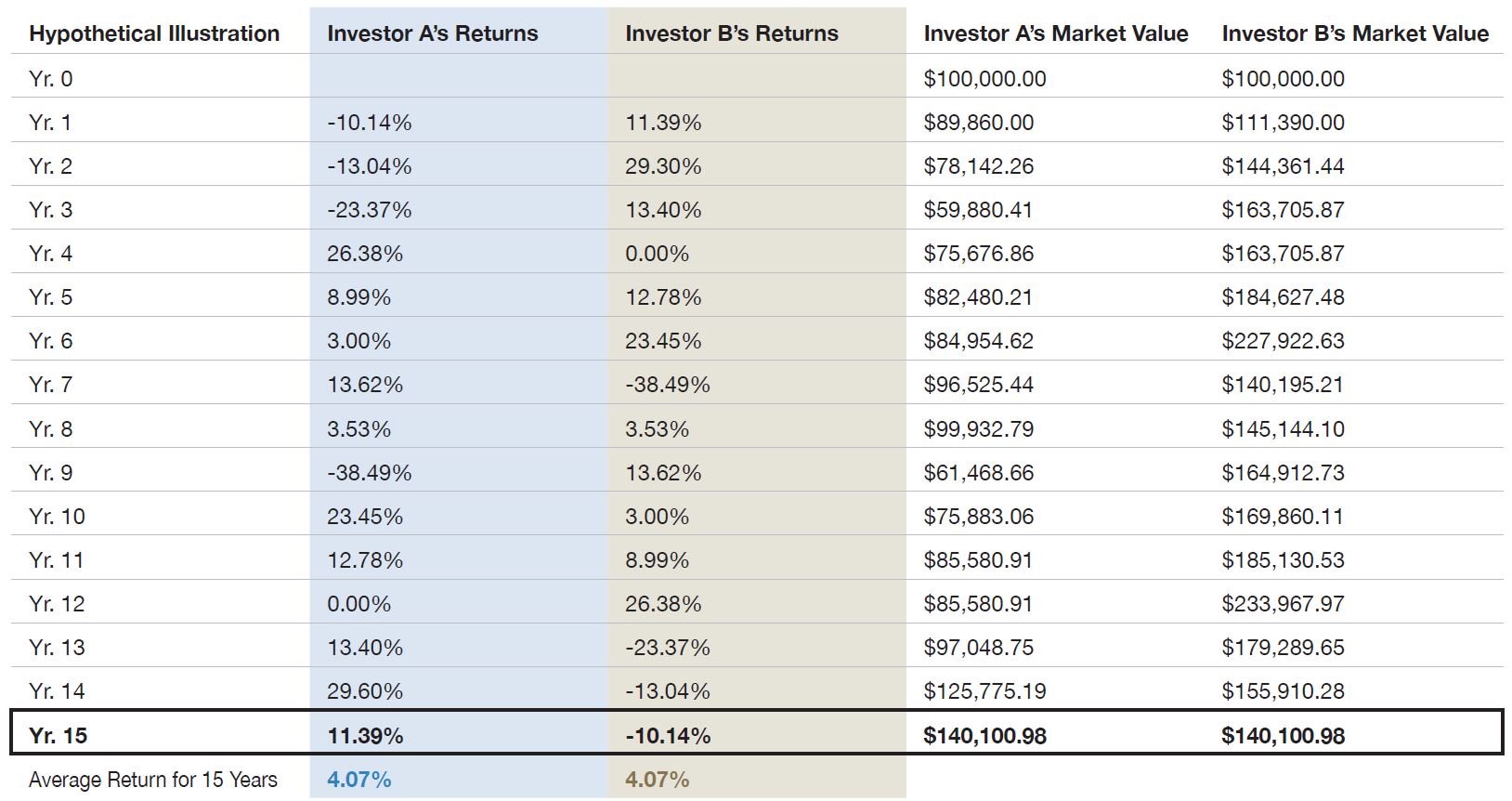

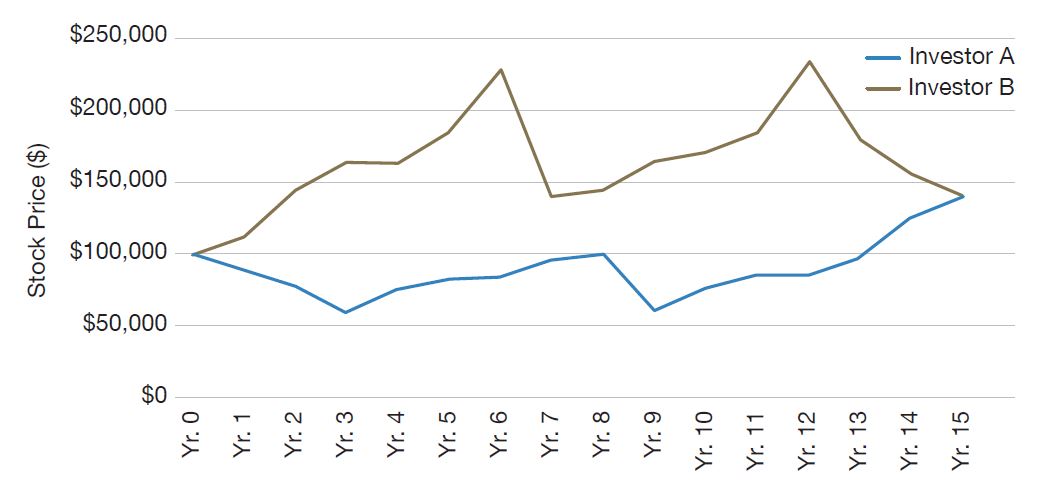

INVESTOR A – Experiences market declines early in both the accumulation (prior to retirement) and decumulation (retirement) phases. His average return throughout is 4%.

INVESTOR B – Did not experience market declines until later in both phases. Her average return throughout is also 4%.

Simulated Example – For Illustrative Purposes Only

The use of hypothetical, simulated returns comes with inherent risks and limitations. Simulated returns are not the returns of any particular account or portfolio, they are produced with the benefit of hindsight through the retroactive application of a model. No representation is being made that any investor will, or is likely, to achieve gains or losses similar to those illustrated.

1. Accumulation – During your prime working years, when you focus on accumulating significant levels of assets to support your retirement. Decumulation – During your retirement years, when you are no longer adding money to your nest egg, but instead subtracting from those assets to continue living the lifestyle to which you are accustomed.

The use of hypothetical performance data does not represent the results of any actual account

Even with these early market drawdowns impacting Investor A’s returns, with 4% average rate of return over the period, both investors’ portfolios end up in the same place after 15 years. Such drawdowns can be recovered from during an investor’s accumulation years – if investors leave their money invested and do not make withdrawals during this time.

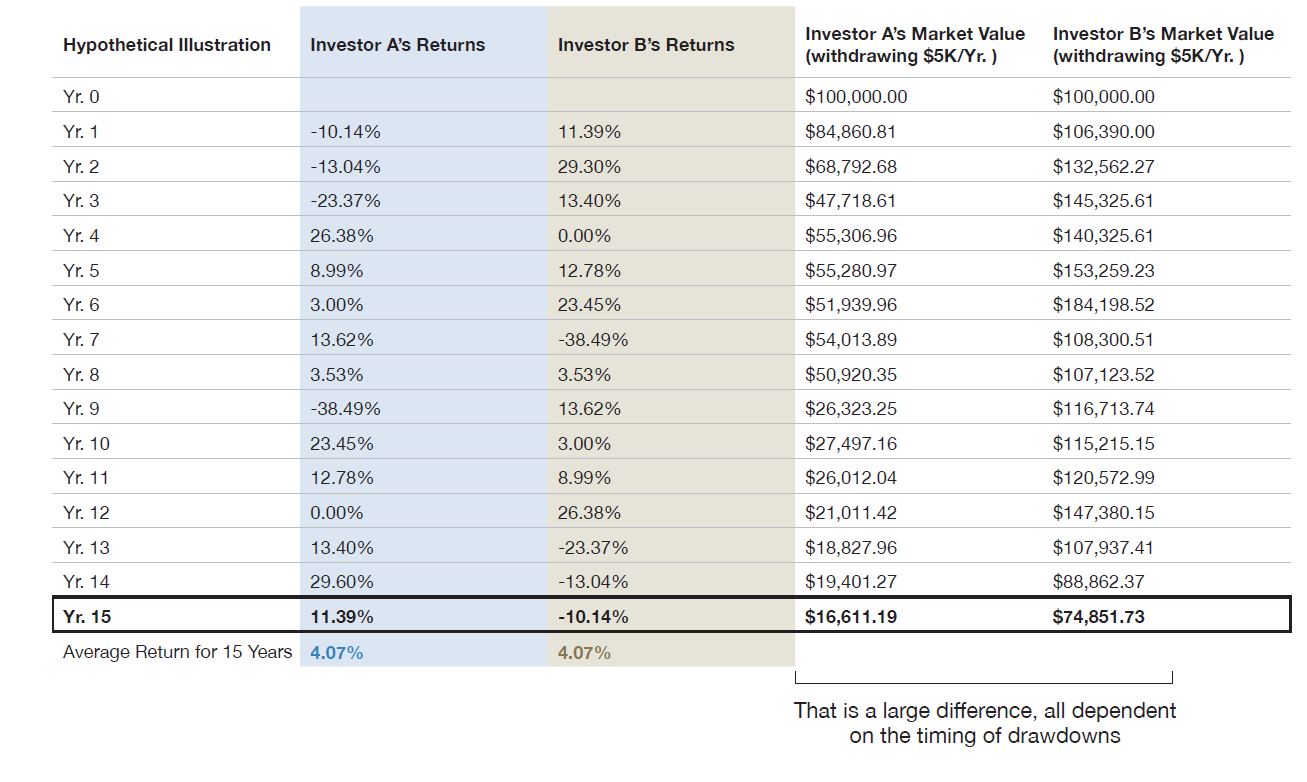

Simulated Example – For Illustrative Purposes Only

The use of hypothetical, simulated returns comes with inherent risks and limitations. Simulated returns are not the returns of any particular account or portfolio, they are produced with the benefit of hindsight through the retroactive application of a model. No representation is being made that any investor will, or is likely, to achieve gains or losses similar to those illustrated.

The use of hypothetical performance data does not represent the results of any actual account

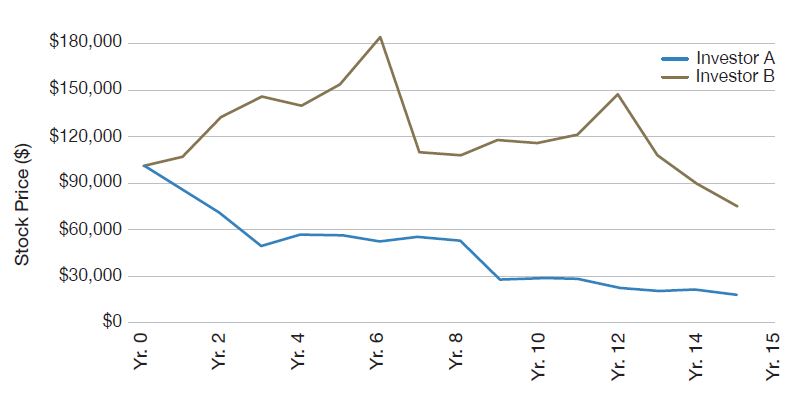

Early market drawdowns during Investor A’s decumulation years, when these investors are assumed to be in retirement and withdrawing a steady income of $5,000 annually from their investment, have now had a profoundly negative affect. So much so that, even with the same average return of 4% over the 15-year period as Investor B, Investor A is left with only ~16% of his original capital. As for Investor B, who did not experience that early market drawdown on their portfolio returns, she was left with ~74% of her original capital.

SEQUENCE OF RETURNS

Simply put, “Sequence of Returns”, as a concept, states that during the retirement (decumulation) years when an investor is withdrawing from their “nest egg”, particularly early on, the risk of negative impact from market drawdowns is amplified. Just as we saw Investor A’s retirement income fall severely behind Investor B’s simply due to a market decline early in the former’s decumulation years, compounded by the regular withdrawal, so we each face the same risk by implementing a poor investment strategy (or no strategy at all) during our retirement years.

Sequence of returns risk is just this; the threat that market drawdowns during these decumulation years can severely hamper an investor’s retirement income in the years they need that income most, particularly because these drawdowns are combined with the regular withdrawals needed to fund their retirement.

PORTFOLIO LONGEVITY

Guardian Capital’s Chief Retirement Architect, Professor Moshe A. Milevsky believes, “An investment portfolio in the decumulation phase of an individual’s financial lifecycle can be thought of as a living and breathing organism; one with a finite lifespan.” This is why Professor Milevsky has introduced a concept labelled portfolio longevity, based on how long a portfolio (or nest egg) can be expected to last under certain conditions.

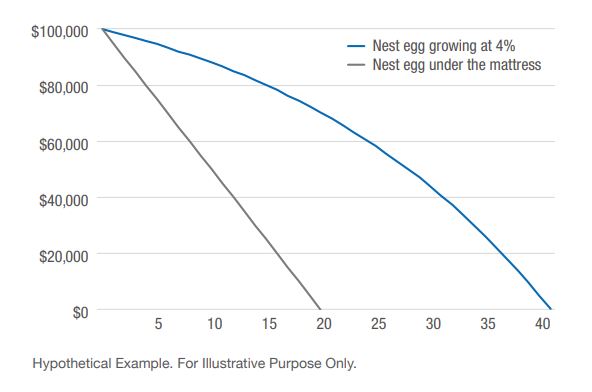

We can see in the chart below titled Increase the Longevity of the Nest Egg the difference in lifespan of a nest egg that is earning 4% at a withdrawal rate of $5,000, and one which is earning nothing (which is basically what the banks are paying in interest rates currently) at that same withdrawal rate.

Increase the Longevity of the Nest Egg

ASSUMPTIONS: Nest Egg (M) = $100,000

Withdrawal Rate (w) = $5,000, Return (g) = 4%

LOWER VOLATILITY, CAPITAL PRESERVATION AND SUSTAINABLE INCOME

Investors moving from the accumulation phase to the decumulation phase now have different investment objectives, and the strategies they choose to invest during the retirement years in should reflect this.

Sequence of returns risk means that retirees need to look for ways to reduce volatility in an effort to avoid missing retirement goals. This in turn requires a focus on capital preservation. With traditional assets as expensive as they are, interest rates near record lows and equities near their highs, traditional balanced funds may not provide the historical returns or capital preservation that investors have come to expect or require for their income needs.

So what should investors in the decumulation phase be looking for in a strategy?

|

Higher Yield |

|

|

Reduced Risk |

|

|

Tax Efficient Income |

It’s your retirement and your hard-earned money. Aim to protect it with strategies tailored for decumulation.