Strategy Sessions

Investment trade-offs – we make them all the time. Rooted in sound academic and financial literature, we all understand the concept that in order to achieve higher returns, we may need to take more risks. However, one aspect of investing that has the ability to differ from this conventional thinking is options, which can alter the typical payoffs from investing. In particular, options can be used to introduce an element of asymmetry that is not commonly available with traditional asset allocation and portfolio approaches. Here too, some trade-offs between downside protection and upside participation need to be taken into account.

Options can be complicated for some, and as with other financial derivatives, can often conjure images of catastrophic financial disasters. That said, investment risks exist with any investment strategy when they are not deployed with care, diligence and a solid understanding of the range of potential outcomes.

I often joke that you really need to understand the Greeks when trading options, and I’m not referring to my cousins Jimmy, John and George! Rather, I mean the higher-order drivers or sensitivities that cause option prices to change relative to the underlying stock price, volatility, time and other relevant factors.

I promise that I won’t discuss any complicated formulas in this article (nor my cousins, thank goodness). Instead, I will provide an introduction to the different types of financial options, their payoffs, how we at Guardian combine them to create some interesting risk/reward relationships within a portfolio.

Let’s start with the basics. There are two types of options – Call Options and Put Options.

Call Options give the buyer the right, but not the obligation, to purchase a stock at a pre-determined price (strike price) up until a pre-determined date (expiry date).

The seller of the call options is obligated, upon exercise of the call option by the buyer, to sell the stock to the buyer at the specified strike price, up until the expiry date.

Put Options give the buyer the right, but not the obligation, to sell a stock – presumably to the seller of the put – at the strike price up until the expiry date. Likewise, the seller is obligated, upon exercise of the put option by the buyer, to buy the stock at the specified strike price up until the expiry date, presumably from the buyer. This might sound a bit complicated the first time you hear it, so here is a brief table that summarizes the combinations:

|

Buyer |

Seller |

| Call Option |

Right to buy stock |

Obligation to sell stock |

| Put Option |

Right to sell stock |

Obligation to buy stock |

There are also two common applications for options – speculation (with outright options) and hedging (in conjunction with owning a position in the underlying stock or a similar exposure).

Speculation (with outright options) to express a view on a stock price, with limited risk if incorrect:

The buyer of a call option will gain when the price rises above the strike price by the expiry date. The buyer of a put option will gain when the price declines below the strike price by the expiry date. With both types of options, the buyer will pay a premium (typically a fraction of the price of the stock) for the right contained within the option. The largest risk of loss these buyers face is that they can lose the premium paid.

Conversely, the seller of the call option can suffer unlimited losses if the stock price rises above the strike price up until the expiry date, and the seller of the put option will suffer losses if the price dips below the strike price up until the expiry date1. Here is a table that explains this aspect of options.

|

Stock Price |

Buyer |

Seller |

| Call Option |

Rises higher than strike price |

Gain = (stock price – strike price), less premium paid |

Loss = (stock price – strike price), net of premium received |

| Call Option |

Stays below strike price |

Loss = premium paid |

Gain = premium received |

| Put Option |

Stays above strike price |

Loss = premium paid |

Gain = premium received |

| Put Option |

Falls below strike price |

Gain = (strike price – stock price), less premium paid |

Loss = (strike price – stock price), net of premium received |

Hedging (in conjunction with owning the underlying stock) to limit risk from underlying stock position:

An investor who owns the underlying stock already may buy a protective put option to hedge the downside risk of their stock position.

Since the value of the protective put option rises when the stock price falls, the investor will be insulated from losses on the underlying stock position, although this may not be exactly dollar for dollar. The protective put option effectively insures the investor from large losses in the underlying position until the expiry date. Similar to insurance, the investor pays a premium for this protection.

|

Stock Price Falls |

Stock Price Rises |

| Stock plus protective put |

Protected from losses for the difference between stock price and strike price, less premium paid on put option. |

Participate in all gains, less premium paid on put option. |

Alternatively, an investor can add incremental yield by selling a call option on a stock they already own. This is referred to as covered call overwriting. The premium received from selling the covered call option can be used to subsidize some of the losses if the stock’s price falls. However, if the stock price rises above the strike price – at maturity or when the option is exercised – the seller of the covered call option is obligated to sell the stock at the strike price and forfeits the price appreciation above that strike price. Here is a table to better explain this.

|

Stock Price Falls |

Stock Price Rises |

| Covered call overwriting |

Value of stock declines and option premium collected offsets some of the losses. |

Participate in gains up to the strike price and collect option premium. |

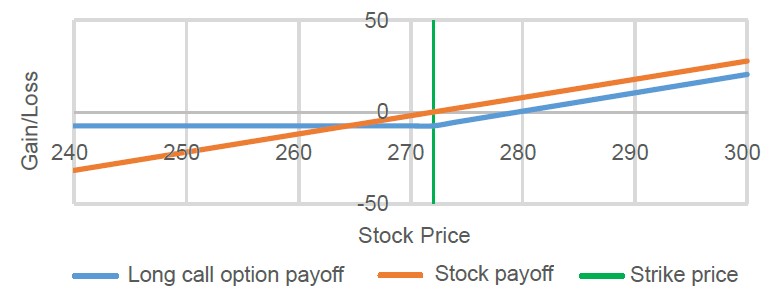

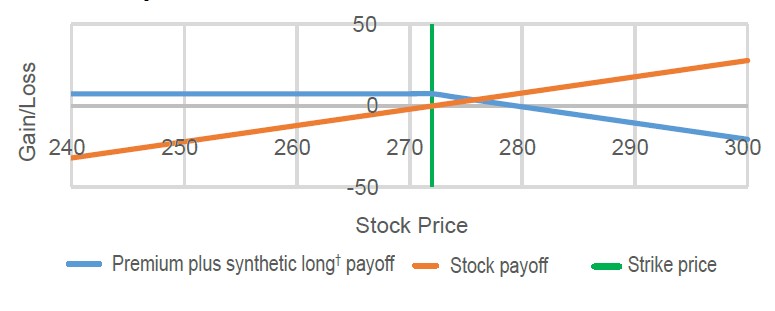

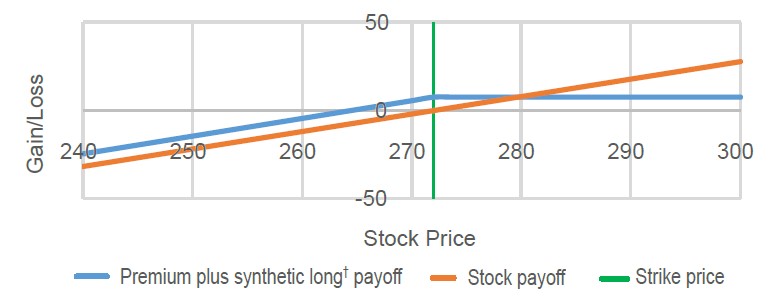

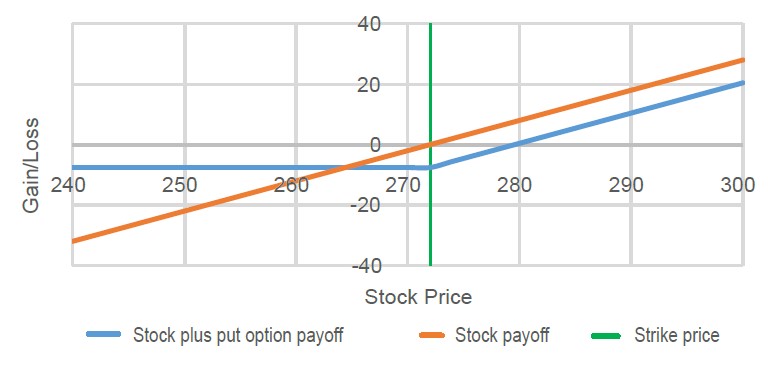

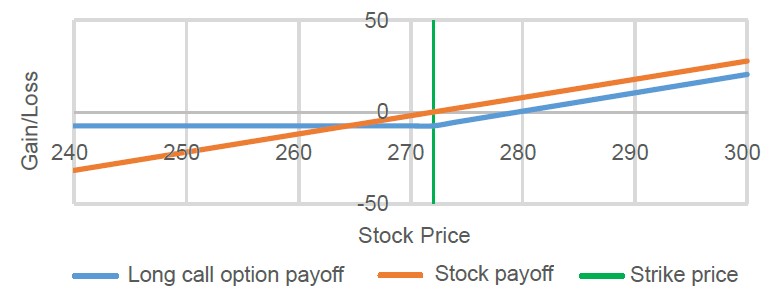

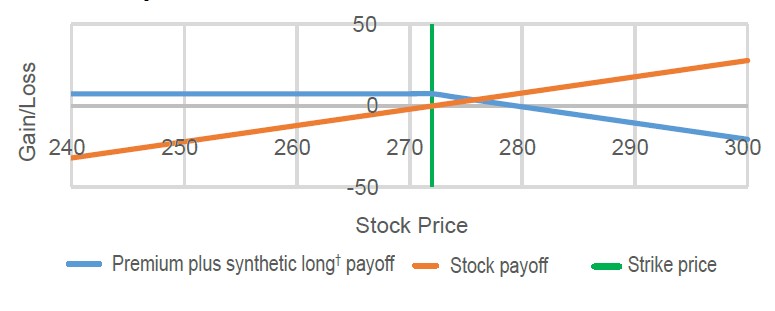

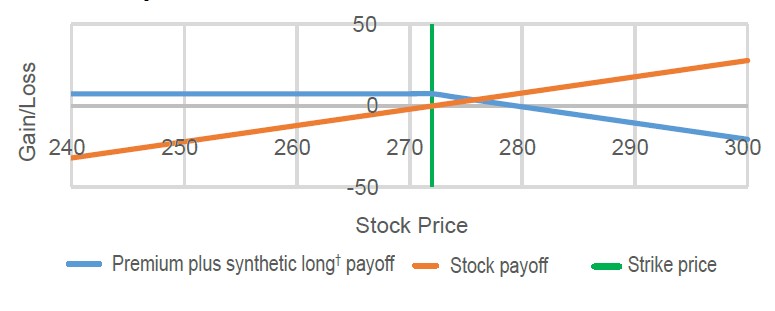

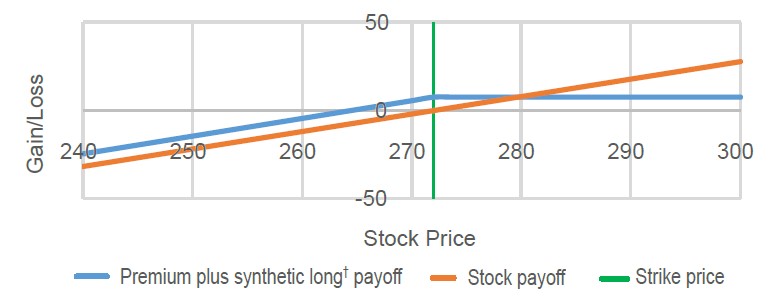

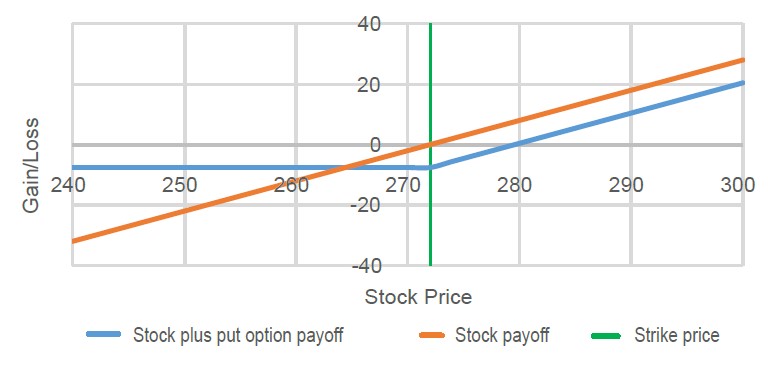

Now, what’s an option primer without a hockey stick payoff diagram? We are Canadian after all, eh! The next few diagrams provide a visual illustration of the payoff from combining various option positions with the underlying security.

As shown on the charts on page 3, the x-axis represents the price of the underlying security (stock) and the y-axis represents the gain/loss of the holding (profit andloss – P&L) for the underlying stock, the option, or thecombination of the underlying stock plus the one or moreoptions used in the strategy. The orange line representsthe typical payoff of an underlying security (stock). Whenthe stock price rises, the investor makes money (gain),and when the stock price falls, the investor loses money(loss). The blue line represents the payoff of the option orthe combination of the underlying stock plus the one ormore options used in the strategy.

Buy Call Option

When the stock price rises, the option buyer experiences full participation on the upside (net of premium paid), but when the stock price remains below the strike price, the buyer’s downside is limited to premium paid.

Sell Call Option

If the stock price stays below the strike price, the seller will experience a gain limited to premium collected, but if the stock price rises above the strike price, the seller will have unlimited loss (net of premium collected).

Buy Put Option

If the stock price stays above the strike price, the buyer’s loss is capped at premium paid, but when the stock price declines below the strike price, the buyer will experience a gain (net of premium paid).

Sell Put Option

If the stock price stays above the strike price, the seller will experience a gain limited to premium collected, but if the stock price declines below the strike price, the seller will have losses (net of premium collected).

Stock Plus Put Option

Combining the protective put option with an existing stock position provides a floor against a decline in the stock price, but maintains full participation on the upside (net of premium paid). Losses are limited to premium paid when the stock price falls below the strike price.

Stock Plus Covered Call

Combining a covered call option with an existing stock position caps upside at the strike price (plus premium received), with losses on the downside partly offset by the premium collected.

Not only can put and call options be used on their own or in conjunction with underlying stocks, they can also be combined to deploy cost effective strategies that aim to reduce risk and improve the risk adjusted return.

One such example is known as a collar strategy, which includes owning a position in a stock, then overlaying a protective put option position and a covered call option position, which can be used to create a more cost effective protection strategy. In other words, this combines THREE different elements, not just an option and a stock. This combination of positions provides a floor on the downside with a cap on the upside (which is customizable depending on the strike prices selected), and will minimize the cost due to the off setting of covered call option premium received and the equal protective put option premium paid. Here is a table that explains this idea, and a diagram that illustrates the payoff.

|

Stock Price Falls |

Stock Price Rises |

| Collar strategy |

Protected from losses for the difference between stock price and strike price on the protective put option. |

Participate in gains up to the strike price on the covered call option. |

Stock Plus Covered Call

Once again, as in the prior diagrams, the x-axis represents the change in price of the underlying security, and the vertical y-axis represents the gain/loss of the combination of the underlying security plus the two options (long put and short call options) used in this strategy. Downside is limited to the strike price of the protective put option and the upside is capped at the strike price of the covered call option. As the collar strategy is built and defined in such a way that the premiums paid/received perfectly offset each other, the money you pay to BUY the put options that protect your portfolio are funded by the call options you SELL, giving away some upside but minimizing your costs.

Application of Option Strategies Within Mutual Funds/ETFs

With many investors shifting from their working (accumulation) years to their retirement (wealth decumulation) years within their investment portfolio, their priorities will begin to shift towards generating a reliable and sustainable income. Two important priorities that this cohort of investors have expressed is 1) preservation of capital and 2) persistent income.

Historically, fixed income and coupon-bearing bonds have played an important role in the retirement decumulation phase of the investment life cycle, back when we had mid-single digit yields and returns. However, given the

generational lows in yields and the expectation that interest rates will remain low for the foreseeable future, investors may feel that they have no choice but to take on more financial risk to meet their investment needs.

As a result, equities will likely have to play an important role in their portfolio asset allocation, even during the decumulation years. The challenge, of course, is that equity markets can experience sudden and large drops,

which can be detrimental to an investor’s retirement nest egg. Herein exactly lies the application of a protective collar strategy that aims to provide explicit downside protection, perhaps at the expense of some upside. This is precisely the objective of the collar strategy and the importance of understanding option strategies – especially if you are heading into retirement.

With fixed-income yields at historical lows and a trend of dividend cuts as a result of the coronavirus relief packages from governments around the world, it will become more difficult for investors to obtain the desired level of cash flow from their investments.

For example, given the persistent nature of the cash flow generated from option premiums in a covered call overwriting strategy, it can be utilized to deliver a higher level of persistent income. It’s like renting your beach house to earn some extra cash flow. You trade off the cash collected for the use of the property and, to collect the most rent, you will typically forfeit the use of the property when it’s most desirable to use it. This is similarly the case with a covered call strategy, whereby you will forfeit some of the upside when markets are up the most, in order to generate income from the premium received.

The theoretical basis for why this strategy generates strong investment returns is rooted in something a bit more technical, sometimes referred to as the “Implied Volatility Risk Premium.” Broadly speaking, this concept is rooted in the observation that implied volatility (the insurance price you pay) is persistently higher than realized volatility (the insurance cost), and this can be exploited. Since implied volatility is a key input into the pricing of options, it can be harvested to produce persistent yield through time.

The chart below (Fig. 1) shows the historical relationship between implied (white line) and realized (yellow) volatility; as you can see, implied is typically above realized.

Fig. 1: Implied and Realized Volatility

Hopefully this primer on put options, call options and collar strategies will give you a better understanding of how they may be used to generate a “smoother ride” for an investment portfolio, and may be a consideration for the decumulation phase as you ride into the enjoyable years of retirement.

Dino Bourdos is Head of Investment Solutions and lead portfolio manager of Guardian’s Directed Outcomes strategies. He joined Guardian Capital LP (GCLP) in 2018 to build on existing strategies while creating new and innovative investment solutions. Prior to joining GCLP, Dino held the position of Managing Director, Portfolio Management, and was the leader of the Derivatives and Equity Index team at a large Canadian financial institution. He graduated with a BA, Economics from the University of Toronto. He qualified as a CMT through the Market Technician Association, holds the CIM designation and is a CFA Charterholder.

The author would like to thank Professor Moshe A. Milevsky, Guardian’s Chief Retirement Architect, for his valuable contributions to this paper through his insightful additions, provocative comments and smart edits. Professor Milevsky is a world-renowned speaker, commentator and expert in the realm of retirement finance. He is frequently sought out by governments and practitioners to help educate about (and craft solutions to address), modern challenges in the retirement income market.

Dino Bourdos, CIM, CFA

Head of Investment Solutions

Guardian Capital LP

For a definition of the key financial terms used throughout this document, please visit our website and review our

Glossary of Financial Terms.

1 American-style options allow the buyer to exercise the option at any time during the life of the option, whereas European-style options only allow the buyer to exercise at maturity. “Options typically require the actual security underlying the contract to be delivered when exercised (physical delivery), whereas in some cases the gain/loss incurred with the option will be settled in cash (cash settlement). With exchange-traded options, this is pre-specified in the standardized settlement terms.

2 The use of hypothetical, simulated or backtested performance data is accomplished thr ough the retroactive application of a model and does not represent the results of any actual account. Hypothetical performance is prepared with the benefit of hindsight and the calculations are subject to inherent limitations. No representation is being made that any investor will, or is likely to, achieve gains or losses similar to those illustrated. There are frequently material differences between hypothetical performance results and the actual results achieved. Hypothetical performance calculations cannot account for the impact of financial risk on actual trading.

This document is for educational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. The data presented in this document is intended to provide you with an illustration of how a portfolio constructed based on the structure described might have performed under such circumstances. No representation is being made that any portfolio will, or is likely, to achieve gains or losses similar to those illustrated. The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document may include information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Certain information contained in this document has been obtained from external sources which Guardian believes to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is a wholly-owned subsidiary of Guardian Capital Group Limited, a publicly traded firm, the shares of which are listed on the Toronto Stock Exchange. For further information on Guardian Capital LP and its affiliates, please visit www.guardiancapital.com. Published May 2021.