Decision by Committee (January 12, 2023): Narrowing the duration gap Interest rates have moved markedly higher over the last 12 […]

A year ago, the outlook was positive. The anticipated move back to “normal,” that is, pre-pandemic levels of activity, would underpin sustained economic growth rates above the past decade’s trends. Moreover, while inflation was on the rise, it was still viewed as “transitory,” a by-product of the onset of the pandemic that would be unwound as the broader reopening of the global economy continued.

As a result, central banks, while acknowledging that crisis-era levels of policy stimulus were no longer warranted, were in no hurry to raise rates and were broadly expected to move only gradually once they did. As such, market yields remained near-historic lows — and the persistently low borrowing costs would represent another support for the global economic cycle as it transitioned from “recovery” mode into “expansion.”

This anticipated macro backdrop would drive robust profit growth, giving a fundamental lift to risk assets. While valuations for these securities were elevated and represented a potential performance headwind, they were arguably justified by the low-rate environment, which not only raised the values of the output of discounted cash flow models, but meant that there was no alternative for investors looking to generate any real return. Accordingly, investors were upbeat and willing to continue chasing momentum.

Of course, inflation quickly proved to be anything but transitory. The imbalance between strong demand and constrained supply was exacerbated by supply chain pressures that persisted due to renewed public health restrictions early in the year (particularly in China) and the shock to commodity prices brought about by Russia’s invasion of Ukraine.

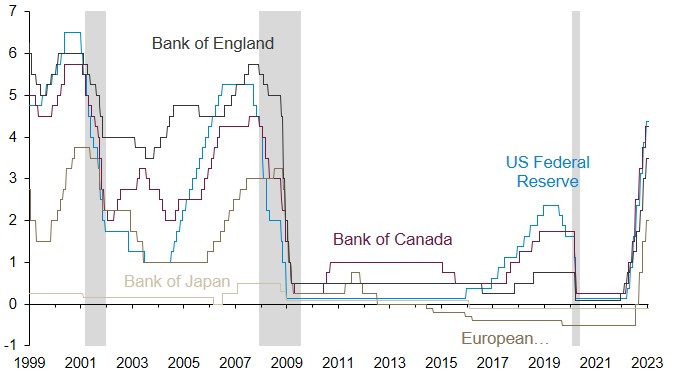

In response to the upward shift in inflation expectations, monetary policymakers felt pressure to move quickly and aggressively to get ahead of the curve and prevent price pressures from spiraling ever-higher at significant, longer-run costs to the global economy.

Suddenly, markets that had largely been permitted to ignore inflation and the cost of capital over the last decade were forced to recalibrate — first slowly, then all at once as the breadth and the magnitude of central banks’ responses to firm readings for pricing and underlying economic activity expanded.

Central bank policy interest rates

(percent)

Shaded regions represent periods of US recession; source: Guardian Capital based on data from Bloomberg to December 31, 2022

The sharp upward adjustment in rates devastated fixed income securities, as the complete lack of yield on offer meant there was no cushion to soften the blow to total return from the plunge in bond prices (bond prices and yields move inversely).

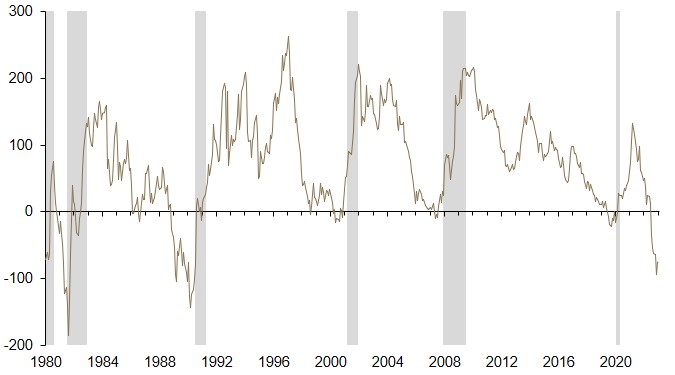

But while interest rates rose everywhere, not all rate increases were created equal. Short-term interest rates felt the impact of central bank decision-making and mirrored policy hikes the most. Longer-term rates, however, registered relatively smaller increases, as markets began to anticipate that the effect on the real economy of the aggressive rise in rates would drive policymakers to reverse course sooner rather than later. The net result was an inversion of the yield curve at a magnitude not seen in more than three decades.

Spread between Government of Canada treasury 10-year and 2-year note yields

(basis points)

Shaded regions represent periods of US recession; source: Guardian Capital based on data from Statistics Canada and Bloomberg to December 2022

The combination of tighter financial conditions, elevated inflation and persistent geopolitical uncertainty created clouds over the outlook and saw forecasters echo the bond market in raising risks of an economic downturn. The resulting downgrade to of global growth expectations weighed on the prospects for earnings, serving up another body blow to equity markets that were already reeling from the impact of the rates — just as low rates boosted valuations, higher rates drove multiple compression, particularly among the high-flying growth stocks.

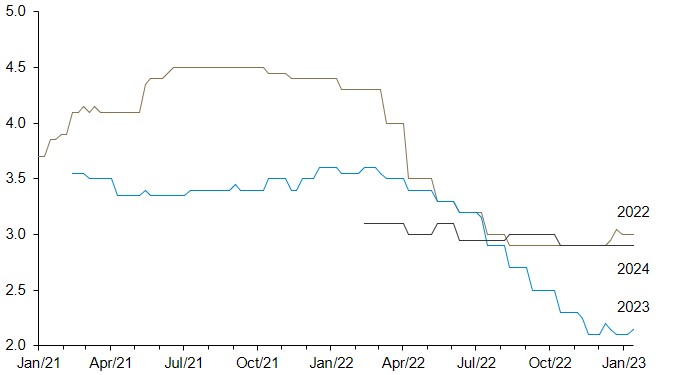

Consensus world real gross domestic product growth forecasts

(year-over-year percent change)

Source: Guardian Capital based on data from Bloomberg to January 13, 2023

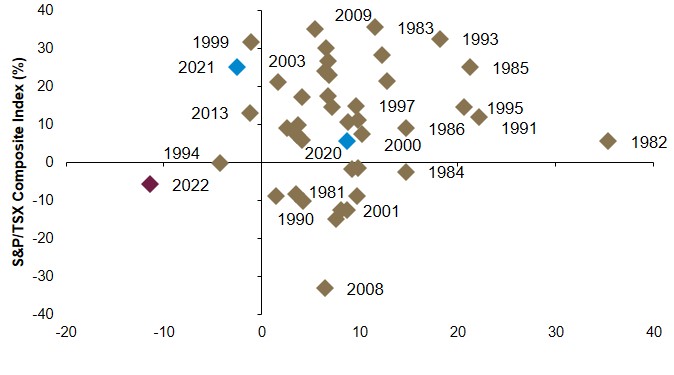

The end result was a historical outlier of a year. While equities have seen worse calendar years, bonds in aggregate have not throughout the history of fixed income indexes; this is just the second time in the last four decades that both Canadian benchmarks have declined at the same time (1994, however, saw only negligible declines in both asset classes), meaning that there was no cover anywhere for investors. The drawdown of -11.69% experienced by the broad Canadian fixed income market, represented by the FTSE Canada Universe Bond Index, in 2022 is the worst in its more than 40-year history. It is also the first time for two consecutive years of negative returns for the local bond market.

Asset class calendar year total return

(year-over-year percent change)

Source: Guardian Capital based on data from Bloomberg from January 1980 to December 2022

Lowering the bar

Shifting the focus to the year ahead, what stands out is that the macroeconomic and market setting is almost the polar opposite of what prevailed 12 months ago.

The current consensus view is that a global recession is effectively a certainty in the next 12 months, as the impact of high inflation and restrictive monetary policy stances work together to restrain demand. The baseline assumption at the moment, however, is that any resulting downturn is likely to be fairly short and shallow given the general underlying strength of household and business balance sheets, a notable contrast to the more recent recessionary experiences.

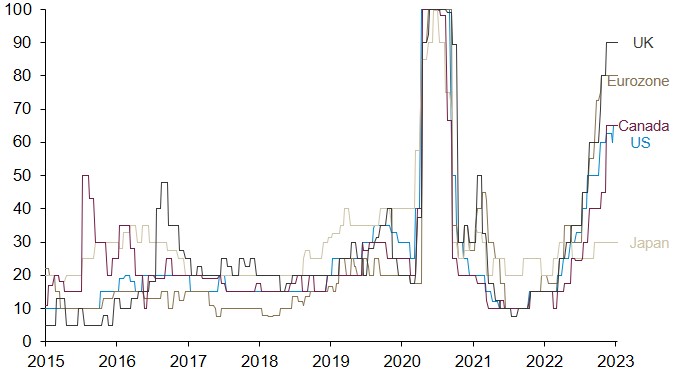

Consensus probability of a recession in the next 12 months

(percent)

Source: Guardian Capital based on data from Bloomberg to January 13, 2023

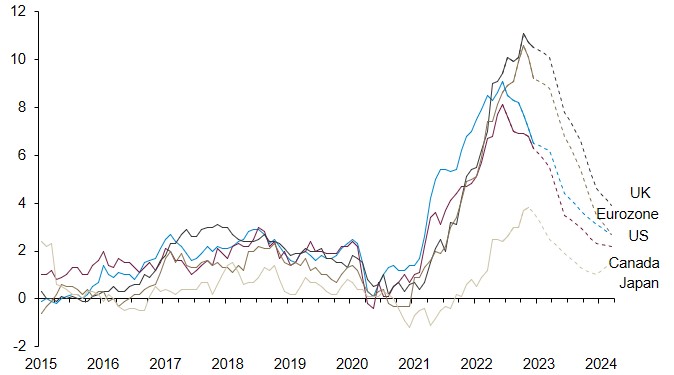

The anticipated downshift in demand growth combined with easing supply chain constraints suggests that inflation could continue its nascent moderating trend — price pressures, however, are expected to remain relatively elevated, which will likely keep central banks from unwinding their policy tightening in earnest in the year ahead barring some sort of exogenous shock to the system.

Consumer price inflation

(year-over-year percent change)

Dashed lines represent consensus forecasts as at January 13, 2023; source: Guardian Capital based on data from Bloomberg to December 2022

Indeed, despite growing signs of inflation coming off the boil and rising recession risks, central banks appear likely to continue to push interest rates higher through the early part of the New Year before shifting to the sidelines, with recent rhetoric suggesting policymakers are content to maintain rates on the restrictive side of neutral for the foreseeable future.

Marking to market

So, while the outlook to start last year was one of optimism and potentially growing tailwinds, the macroeconomic path for the months’ ahead looks to be lined with challenges and lingering headwinds.

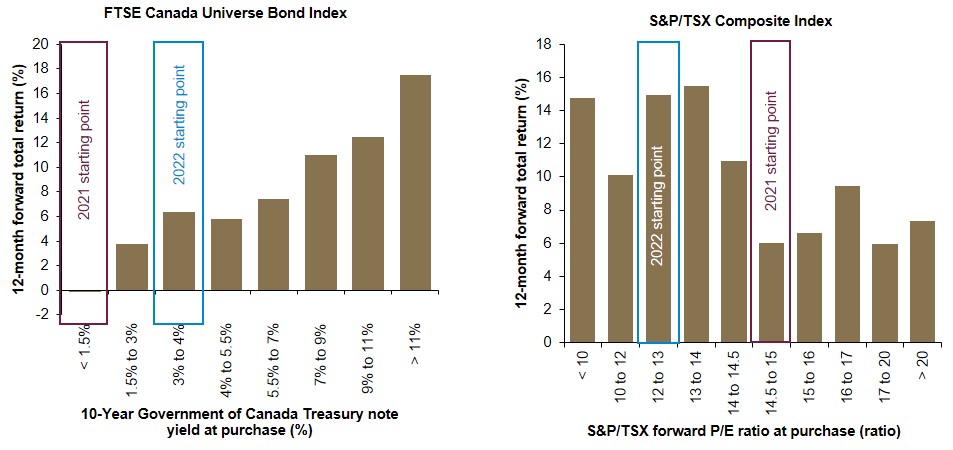

The combination of this backdrop and 2022’s hard reset across asset classes has resulted in last year’s optimism and expensive assets being replaced by pervasive pessimism and more moderate valuations, which, somewhat ironically, makes for a more constructive outlook for performance for both stocks and bonds than prevailed a year ago. Nothing is guaranteed in investing, but history shows returns tend to be materially better when valuations are off their extremes and at more middle-of-the-road levels.

Average 12-month forward return by valuation at purchase

(percent, Canadian dollar basis)

Source: Guardian Capital based on data from Bloomberg from January 1980 to December 2022

That said, the persistence of risks and uncertainty surrounding the outlook suggests that volatility is likely to remain heightened for the foreseeable future, with any improvement over the last 12 months’ dismal performance unlikely to come in a straight line — and there is still the real prospect of further declines.

The pessimism over the outlook and lower bar of general expectations priced into the market, however, would appear to suggest that the balance of risks for the year ahead is currently skewed more towards the upside, with that asymmetry particularly acute in bond markets.

While consensus views suggest interest rates could remain rangebound around current levels as policymakers hold fast against slowing growth and inflation, we now believe there appears to be more room for rates to move lower from current levels than higher. Returns will, therefore, be driven by yields on offer, with the shape of the curve and wider credit spreads supporting a continued bias in asset mix toward shorter-duration securities and corporate credit, as the yield carry provides significant support to total returns if there is further spread widening, especially for corporate bonds with maturities of 10-years or less.

Central bank tightening cycles are approaching their conclusion, and any upside surprise to inflation would likely result in marginal further rate increases — the probability of a repeat of last year’s surge is low and the yields now available, particularly at the front end of the yield curve, provide an adequate cushion to absorb the hit.

In contrast, if inflation comes down faster than currently anticipated or economic activity slows more markedly than forecast, not only would expectations of further rate increases be pared but the prospect of faster moves away from the now-restrictive policy stances could increasingly be priced into the market.

The bottom line is that while the challenging economic outlook provides little reason to anticipate a reprieve from the heightened uncertainty that has become the norm since the onset of the pandemic and therefore warrants caution, the broad valuation adjustment across asset classes and persistent emphasis on downside risks in the market suggest that there is scope for improved performance prospects for investors as the calendar (mercifully) rolls over to 2023.

This commentary is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. Guardian, Guardian Capital and the Guardian gryphin design are trademarks of Guardian Capital Group Limited, registered in Canada.