One year ago – March 11, 2020, the WHO officially declared COVID-19 a global pandemic, and the world changed. The combination of lower infection numbers and economic rebounds means the next 12 months appear significantly better than the last 12.

Equity Markets

Lapping the one-year anniversary of the global pandemic, developed equity markets continued along the rising trend of recent quarters to start 2021. The MSCI EAFE Index rose 2.1% and the S&P 500 Index gained 4.8% in the quarter, both in Canadian dollar terms, amid signs of improving economic growth and the abatement of the “second wave” of Coronavirus infections. Home turf was the best place to be for Canadian equity investors this quarter, with the domestic S&P/TSX Composite Index rising 8.1% to start the year. Every sector in Canada rose in value except Materials, as gold stocks followed the price of bullion in moving lower. Additionally, within all regions, the quarter was marked by a reversal within the markets, as prior market leading sectors ceded territory while the Energy and Financials sectors, notable laggards for many quarters, performed best of all. The Canadian dollar continued its recent strengthening trend against the US dollar, although the gains this quarter had a relatively modest impact on international market returns for Canadian investors.

In a broad sense, equity market activity is running at heightened levels in recent months. Acquisition deals funded by Special Purpose Acquisition Companies (SPACs) are coming at a rapid-fire pace and account for the majority of public offerings in recent months. Trading volumes on the Toronto Stock Exchange are exactly double the levels of one year ago. Individual traders managed to push shares of certain stocks, such as GameStop, up as much as 15-fold before giving up a substantial portion of these gains by quarter end. Several major deals were announced within Canada, such as Rogers Communications bidding for Shaw Communications and CP Rail bidding for Kansas City Southern. These forces are collectively serving to push equity valuation levels steadily higher across all developed markets. The sizeable economic stimulus policies enacted over the past year could provide ample firepower to propel this further, but investors need to remain wary of an undercurrent of rising interest rates that might curtail equity valuations in more extended conditions.

Fixed Income Markets

Fixed income markets turned negative in the first quarter of 2021. While economic news was broadly constructive, concerns around the speed and extent of inflationary pressures saw selling in mid- and longer-dated debt securities, leading to negative performance on the asset class as a whole.

Canadian government bonds and investment grade bonds returned (5.6%) and (3.5%), respectively, in the first quarter, while high-yield bonds returned 2.2%. Market segments performed differently, with the FTSE Short-term, Mid-term, and Long-term duration indices returning (0.6%), (4.5%), and (10.7%), respectively.

Both the Bank of Canada (BoC) and the US Federal Reserve (Fed) expressed interest and concern around the growth of inflation. The BoC reaffirmed their interest in “holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved.”

The Fed reiterated that, “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. ” Market participants are reasonably expecting inflation to increase, putting pressure on real, post-inflation yield expectations.

Economic uncertainty persisted in the first quarter of 2021, and will continue until vaccination programs have outraced infection rates and COVID-19 variants. The base case is steadily improving, and ‘green shoots’ can be seen in many corners of the global economy, though central banks and investors are mindful of the pent-up demand and the potential for excess inflation, whose cure (much higher rates of interest) may be worse than the disease at this stage of the nascent recovery.

Commentary

The announcement of an initial successful vaccine trial last November provided an undeniable lift to the outlook not just for the global economy, but also for the spirits of billions of people. The prospect of returning to the “pre-crisis” way of life was just out on the horizon, the beginning of the end suddenly within the collective gaze.

The subsequent rollout of vaccine administration programs (granted, some more successful than others) and the indications that inoculation is indeed having the desired effect — even as case counts again are drifting higher from recent lows — as well as the approvals of several other vaccines for use, has further boosted expectations of a better quality of life being within reach sooner rather than later. It seems the beginning of the new beginning is at hand.

While these developments are clearly positive — notwithstanding some persistent near-term softness as re-openings are delayed amid the renewed rising case counts — there are some resultant adjustments to this more sanguine forecast horizon that have proven less than ideal for financial markets.

The increasingly likely prospect of the return to the pre-pandemic “normal” means that “worst case scenarios” are becoming lower probability outcomes of this whole period. Moreover, the signs of surprising resilience of the global economy through the last round of lockdowns, underpinned by the continued abundance of government support for households and businesses, suggest that the speed of the pickup in activity later this year is likely to be something closer to the “best case scenario” than assumed even a few months ago.

In other words, concerns over a prolonged unemployment-induced lack of demand have been replaced by expectations of an imminent wave of stimulus and savings-driven pent up spending and investment being unleashed at a time when supply chains are still trying to play catch up from earlier shutdowns.

This shift is most evident in market expectations for inflation, which went from effectively pricing in protracted disinflation or even deflation, to a return to more normal longer-term levels in rapid fashion.

Inflation, typically thought of in only negative terms, is (in moderation) a normal and good force, so much so that central banks spent the better part of the post-Financial Crisis decade trying, and failing, to engineer it. The negative power of inflation is only seen when it leaps its guardrails and efforts to put the genie back in the bottle can involve taking particularly bitter medicine.

The increased need for investors to be compensated for the impact that inflation has on eroding the future purchasing power of money has been a prominent factor in longer-term market interest rates rising fairly sharply to levels last seen before the pandemic hit. Interest rates on bonds with shorter maturities, however, are still materially below pre-crisis levels, due to the fact that short-term policy rates have been slashed by central banks and held at these lows. However, while the central banks can wield control at the short end of the yield curve, the market has more control in the longer end, which is why the yield curve has steepened.

As such, and given the inverse relationship between interest rates and bond prices, the rise in market yields has been undeniably bad for holders of longer-dated fixed income, for whom the past quarter was one of the worst in the last three decades.

The rising rate environment has also been a headwind for equities, as the value of a stock is derived from the cash flows that the underlying company is able to generate both now and in the future; higher interest rates reduce the present value of those future cash flows. As a result, those companies that are valued predominantly based on their future prospects have been impacted more by the up-move in the rates market, which has driven a rotation in areas where the growth-oriented parts of the market that had previously flourished over the last year have underperformed their peers (which has factored in the more value-centric Canadian equity market being ahead of its American counterpart over the last 12 months, a phenomenon not seen since the end of 2016).

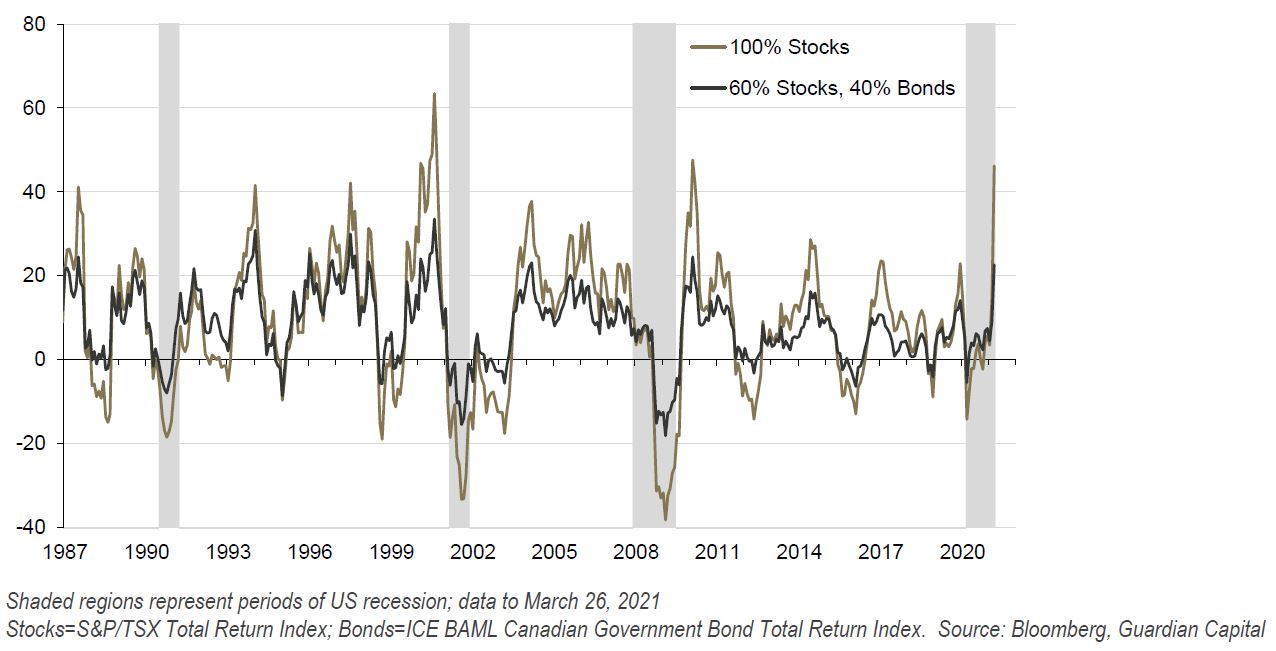

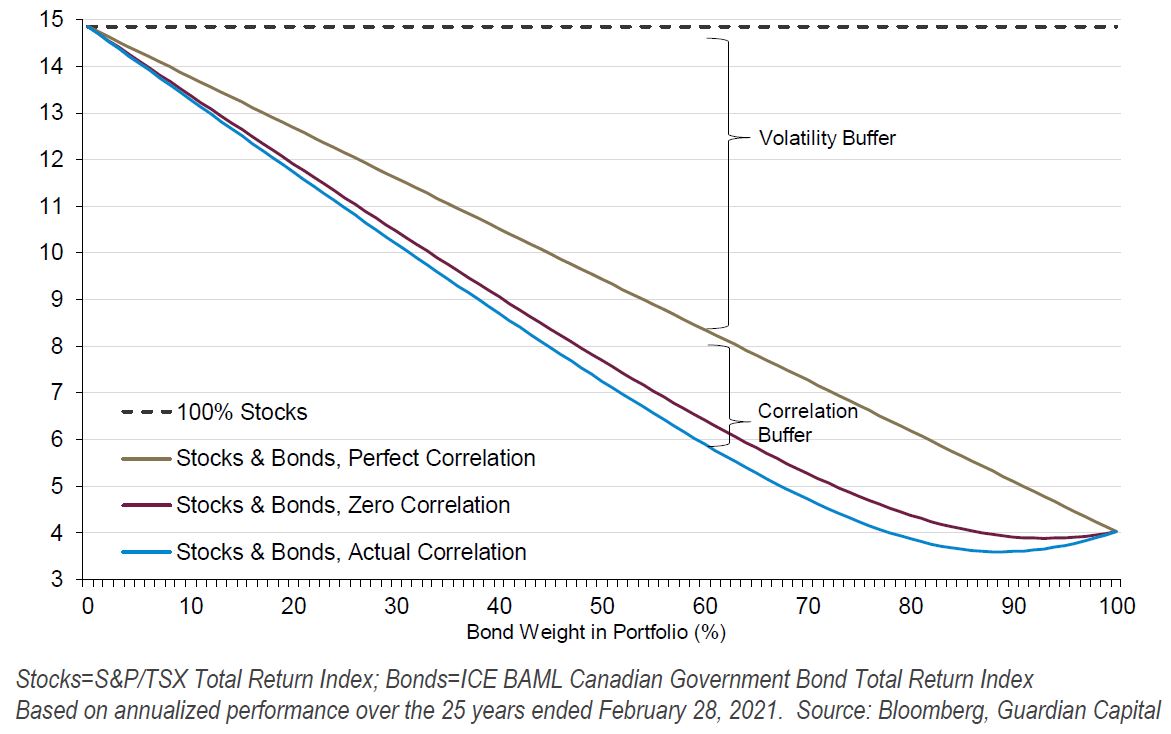

The increased correlation in movements in stocks and bonds — prices for both asset classes moving together — in recent months diminishes the diversification benefits of a balanced portfolio, which combined with the weakness in bonds (that may potentially persist as market interest rates edge higher still) raises questions as to the purpose of holding bonds at all. Why place bets on a losing proposition?

For one, bonds still offer tremendous diversification benefits for a stock portfolio by virtue of their comparatively lower degree of volatility — the presence of bonds, even if perfectly correlated with stocks, would still effectively halve portfolio volatility in a traditional 60/40 portfolio.

(expected standard deviation of portfolio returns, annualized rate)

Secondly, it may be the case that correlations have increased of late, but the diversification benefits are most notable when things take a turn for the worse — for example, while the S&P/TSX Composite Price Index plunged almost 40% from February 19 to March 23 last year, the ICE Bank of America Merrill Lynch Canadian Government Bond Index was actually up 3% over that span (and the broad Canadian Bond universe was down a marginal 1%). The ability of bonds to offer this “disaster insurance” for portfolios that helps to mitigate large and unexpected declines clearly provides investors’ value — all while also receiving income.

Finally, rising interest rates only really impact those looking to trade their fixed income holdings. For investors intent on holding bonds until maturity, there is no real impact (the par value and coupons are fixed). Further, rising interest rates actually serve to benefit these investors since they are able to reinvest the proceeds from maturing bonds at higher coupon rates, resulting in higher cash flows on future purchases.

In other words, while performance of the fixed income portion of balanced portfolios may disappoint over the near term, should the increasingly buoyant economic forecasts come to fruition, it is best for those with a long time horizon to think of them as an equivalent to the vaccines that appear ready to let the quality of life improve drastically in the coming months. They may provide a bit of short-term discomfort, and there is the temptation to forge ahead without them, but in the long term, the advantages can benefit a portfolio. There will undoubtedly be an equity sell-off in the future, but investors rarely eschew stocks simply because their near-term prospects turn negative. The benefits of buying stocks at a discount are obvious — everyone loves to buy things on sale. While bonds are currently “on sale,” none of the benefits of income, diversification and capital protection have disappeared. They remain, as ever, an important part of investment portfolios.

(portfolio total return; percent, rolling 12-month basis)