Decision by Committee (February 8, 2024) This commentary is authored by the Guardian Capital LP Asset Mix Committee (AMC)1 The […]

Decision by Committee (April 11, 2024)

This commentary is authored by the Guardian Capital LP Asset Mix Committee (AMC)1

The general global macroeconomic backdrop has improved since the AMC last met in February. The dataflow points to continued underlying strength in the US economy underpinned by a resilient consumer, while there are signs of a broadening out in underlying growth momentum with some nascent signs of pickup in Europe and China.

As well, progress continues to be made with respect to bringing inflation down to more benign levels across regions, though underlying price pressures are proving to be somewhat stickier in the US than the rest of the world, in part reflecting the fact that the American economy is less sensitive to interest rates and is experiencing more verve.

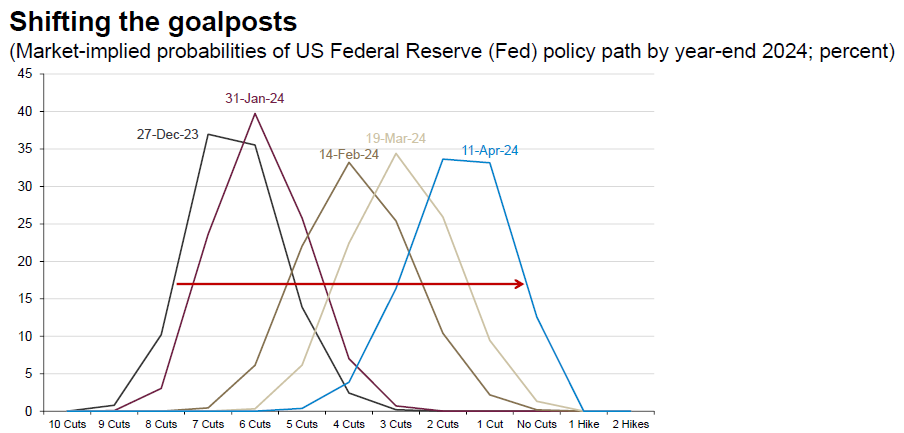

Rising concerns that inflationary pressures in the US may persist longer than previously assumed, combined with the fairly broad-based strength of the US economy, has driven a further repricing on the path of policy rates stateside, with the roughly seven 25 basis point cuts by the end of 2024 that were priced into the market at the end of last year now more than halved (less than three now in the profile).

Source: Guardian Capital based on data from CME FedWatch2

While the likes of the Bank of Canada and European Central Bank (among other central banks) still appear primed to move away from their restrictive policy stances and toward something more “neutral” in the coming months, the shift in expectations for the US Federal Reserve’s policy path has put notable upward pressure on global rates.

The rise in market yields has served as a headwind for fixed income performance, but the reversal of what was viewed as overly optimistic expectations for rate cuts that prevailed last year creates a better balance of risks in the market.

That said, the key risk at the moment is that inflation expectations begin to drift higher and become unmoored from central bank targets. So, while the base case is for rates to remain range-bound near-term, before moving lower later this year, there is potential upside risk.

Against this, and with the bond yield curve still inverted, there is a continued preference of the AMC to remain below benchmark duration and maintain a bias toward high-quality corporate credit in its Fixed Income allocation.

Equity markets, in contrast, have done a good job, so far, in absorbing the impact of higher interest rates, sustaining the momentum established last year and turning in strong performance.

From a broad market perspective, earnings have held up well, with analysts’ expectations seeing fewer downward revisions than they typically do through the earnings season. This, however, largely reflects the impact of a narrow subset of US Information Technology companies, while earnings elsewhere have been effectively flat. That means that the US-led global gains, so far this year, have largely been the result of valuation multiple expansion that suggests that a lot of upside has been priced into the market — this is being echoed by the subdued volatility that seemingly is ignoring the ongoing geopolitical tensions.

The improving momentum outside of the US, combined with comparatively more compelling valuations and the likelihood of earlier rate cuts, has started to attract investors but there remains a belief among the AMC that the US could sustain its premium thanks to its firmer outlook, which supports the AMC’s decision to maintain current Equity exposures.

The expectation that the US will lag peers in cutting rates has put upward pressure on the US dollar that looks likely to persist — this will serve as an added headwind for performance in Emerging Markets (EM), an area that was already being viewed cautiously largely due to the uncertainty around China, given its approach to domestic and international policy. As a result, the AMC decided to pare its exposure to EM.

The consensus views on Canada, in contrast, have turned more favourable given the market’s exposure to commodities, particularly oil for which the price has firmed against rising geopolitical tensions that appear unlikely to subside soon, its proximity to and trade relationship with the US, and the looming prospects of easier monetary policy that could underpin optimism that worse case domestic scenarios can be avoided.

The AMC decided to increase its allocation to Canadian Equity to reduce its underweight relative Strategic Asset Allocations, with an emphasis on strategies more exposed to Energy and other more cyclical sectors. The increase to Canadian Equity was funded by the reduction in EM allocation and a drawdown of portfolio cash balances — for the latter, the prospect of declining domestic short-term interest rates makes deploying cash more compelling.

As a result of these decisions, the AMC’s Strategic Asset Allocations have modestly increased their overweight to Equity and reduced the allocation to Cash, while Fixed Income was left unchanged at its current market weight. Equity allocations are biased toward global quality growth; Fixed Income allocations are skewed toward corporate credit and modestly below benchmark duration.

The AMC will continue to monitor economic and market developments closely in the coming weeks and stands ready to tactically exploit opportunities that may present themselves.

Asset Mix Committee Summary Views3

Conservative Asset Allocation

| Benchmark* | New Target Allocation** | Changes from pre-decision positioning** | |

| Equity | 30.0% | 34.2% | +0.2 |

| Canadian Equity | 17.5% | 17.1% | +0.4 |

| Canadian Equity | 7.2 | +0.1 | |

| Canadian Growth Equity | 5.0 | +0.1 | |

| Canadian Focused Equity | 4.7 | – | |

| Canadian Equity Income | 0.2 | +0.2 | |

| Global Equity | 12.5% | 17.1% | -0.2 |

| Global Dividend Growth | 5.7 | – | |

| US All Cap Growth | 4.0 | – | |

| Fundamental Global Equity | 3.9 | – | |

| Emerging Markets Equity | 2.1 | -0.2 | |

| US Equity Select | 1.0 | – | |

| International Equity Select | 0.4 | – | |

| Fixed Income | 65.0% | 62.5% | – |

| Canadian Bond | 48.0 | – | |

| Investment Grade Corporate Bond | 12.5 | – | |

| Short Duration Bond | 2.0 | – | |

| Cash | 5.0% | 3.3% | -0.2 |

*Benchmark= portfolio strategic asset allocation **Figures may not add up due to rounding

Growth Asset Allocation

| Benchmark* | New Target Allocation** | Changes from pre-decision positioning** | |

| Equity | 70.0% | 76.4% | +0.5 |

| Canadian Equity | 40.0% | 37.8% | +1.0 |

| Canadian Equity | 14.9 | +0.25 | |

| Canadian Growth Equity | 13.3 | +0.25 | |

| Canadian Focused Equity | 9.1 | – | |

| Canadian Equity Income | 0.5 | +0.5 | |

| Global Equity | 30.0% | 38.6% | -0.5 |

| Global Dividend Growth | 13.6 | – | |

| Fundamental Global Equity | 9.6 | – | |

| US All Cap Growth | 9.0 | – | |

| Emerging Markets Equity | 3.5 | -0.5 | |

| US Equity Select | 2.0 | – | |

| International Equity Select | 1.0 | – | |

| Fixed Income | 25.0% | 21.1% | – |

| Canadian Bond | 17.3 | – | |

| Investment Grade Corporate Bond | 2.5 | – | |

| Strategic Income | 1.3 | – | |

| Cash | 5.0% | 2.5% | -0.5 |

*Benchmark= portfolio strategic asset allocation **Figures may not add up due to rounding

1 Guardian’s Asset Mix Committee (AMC) consists of investment professionals and asset class specialists and is charged with overseeing the development and management of multi-asset investment portfolios, specifically addressing asset mix composition/allocation and areas for advice or communication to such clients as it relates to the makeup of their

portfolio.

2 CME Group, CME FedWatch Tool, accessed April 11, 2024. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html. The CME FedWatch Tool analyzes the probability of FOMC rate moves for upcoming meetings.

3 These Asset Allocations represent the Asset Mix Committee’s tactical views given their assessment of market conditions and performance expectations.

This commentary is for general informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the date of publication and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. Index returns are for information purposes only and do not represent actual strategy or fund performance. Index performance returns do not reflect the impact of management fees, transaction costs or expenses. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy.

Guardian Capital LP manages portfolios for defined benefit and defined contribution pension plans, insurance companies, foundations, endowments and investment funds. Guardian Capital LP is wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.

Published April 17, 2024