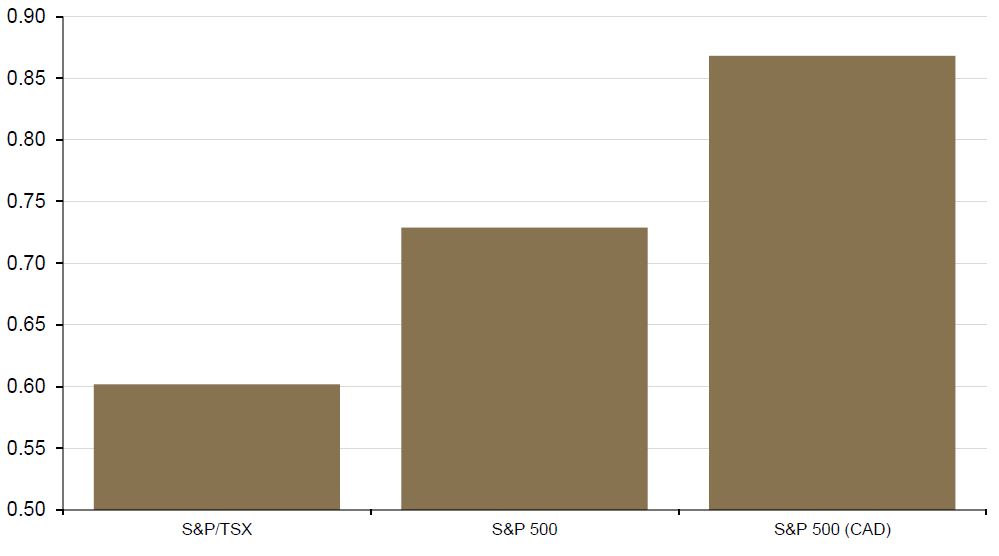

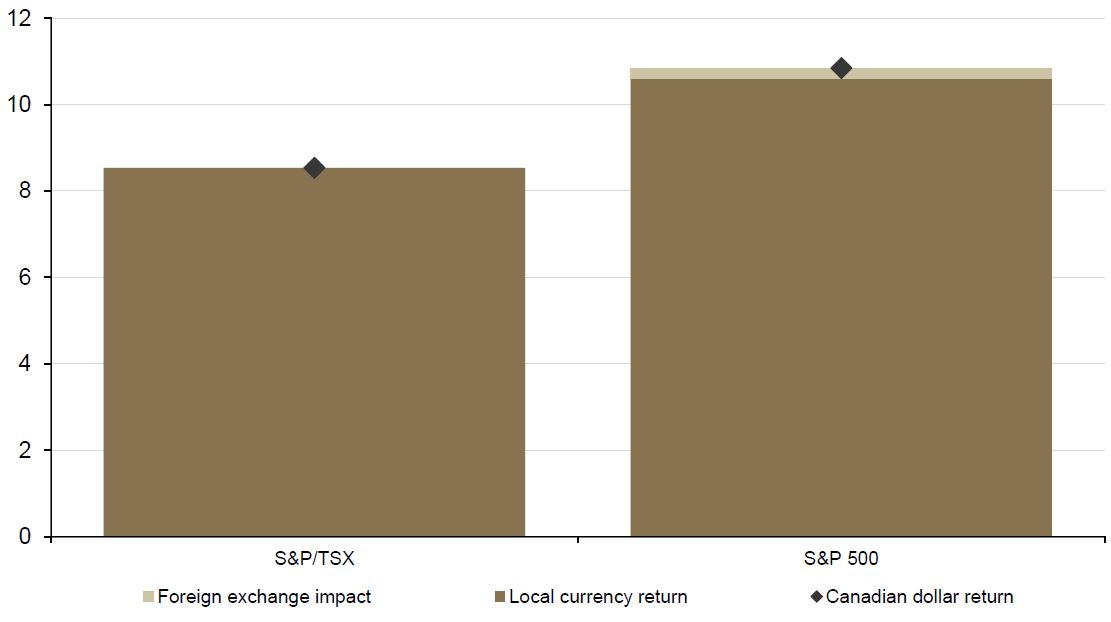

Any Canadian investor holding foreign currency-denominated assets over the past year has seen the impact that the sharp appreciation of the Canadian dollar has had on their portfolio’s bottom line. The 46% total return on the S&P 500 Composite Total Return Index (S&P 500) since last April, in US dollar terms, ends up being a more modest, though still solid, 29% gain when translated back into loonies.

Total return, last 12 months

(per cent)

Based on data to April 30, 2021; source: Bloomberg, Guardian Capital

So even though the S&P 500 outperformed the S&P/TSX Composite Total Return Index (S&P/TSX) 33% total return by more than 12 percentage points in local currency terms over the last 12 months, Canadian investors would have been better off just investing in the domestic market.

This recent performance begs two questions:

First, because of the currency movements and their potentially adverse impacts, is it even worthwhile for Canadians to hold investments denominated in other currencies?

Second, if you do hold these foreign investments, is it prudent to hedge currency exposure completely so that the negative shocks from a strengthening domestic dollar can be avoided?

With respect to the first question, having a well-diversified portfolio means not just being spread out across asset classes (stocks and bonds) and sectors (the industry sectors of the stock market; government and corporate bonds) but geographically diversified as well.

Canada’s stock market accounts for just 3% of global equity market capitalization and is heavily concentrated in just three sectors — Financials, Energy and Materials – which alone represent more than half of the S&P/TSX. Expanding into other markets allows for a better balance of risk exposures that can complement domestic holdings.

In terms of the second question, the hedging decision depends on several things, including investor time horizon and cash flow needs.

For investors with short-term objectives or a need for domestic currency cash flows (such as those in the decumulation phase of the retirement savings lifecycle), hedging foreign exchange exposures may be prudent as it reduces risk to performance from an adverse move in the currency. While it may well be the case that exchange rates tend to return to their long-term averages, short-term fluctuations can be large and persist for a while.

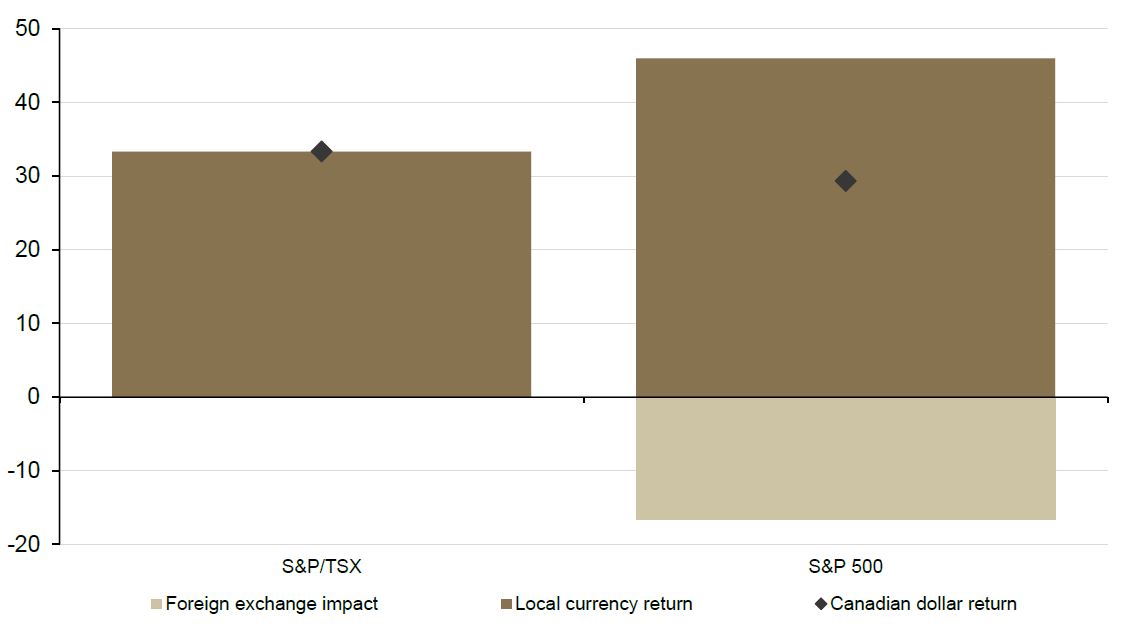

Canadian dollar exchange rate

(Canadian dollars per US dollar)

Shaded regions represent periods of US recession; data to April 30, 2021; source: Bloomberg, Guardian Capital

In these situations, the added cost of insuring against potential negative swings in the exchange rate (in terms of fees and opportunity cost of potential beneficial currency moves) may indeed be money well spent.

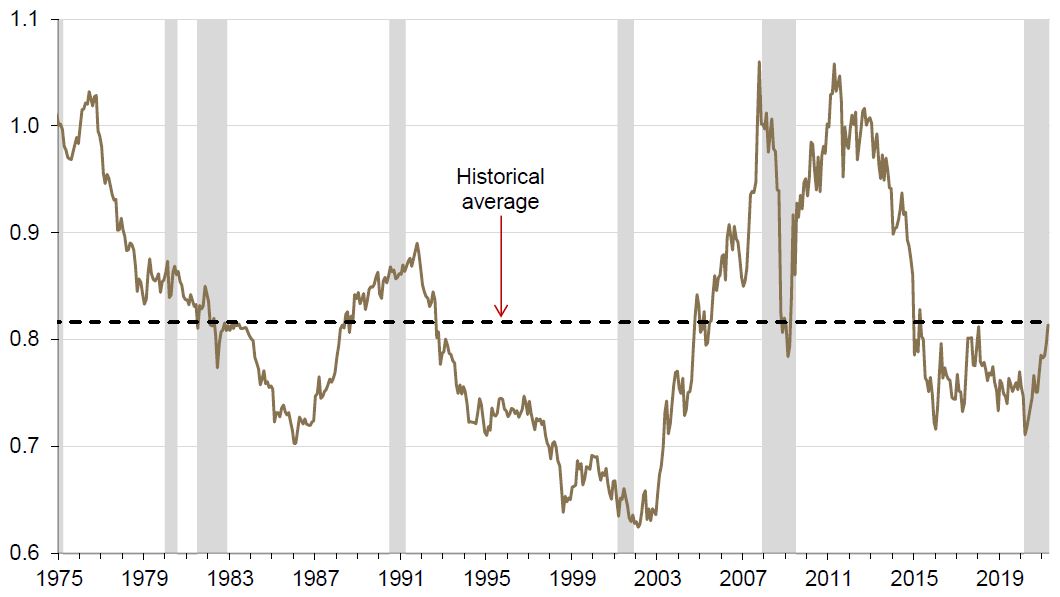

For those with longer investment horizons (such as those in the accumulation phase of their investment journey), short-term movements in exchange rates matter much less — currencies may exhibit high volatility over shorter periods, but over longer timelines they have been shown to be considerably more stable.

Canadian dollar exchange rate volatility

(Canadian dollars per US dollar)

Based on data from January 1, 1975 to April 30, 2021; source: Bloomberg, Guardian Capital

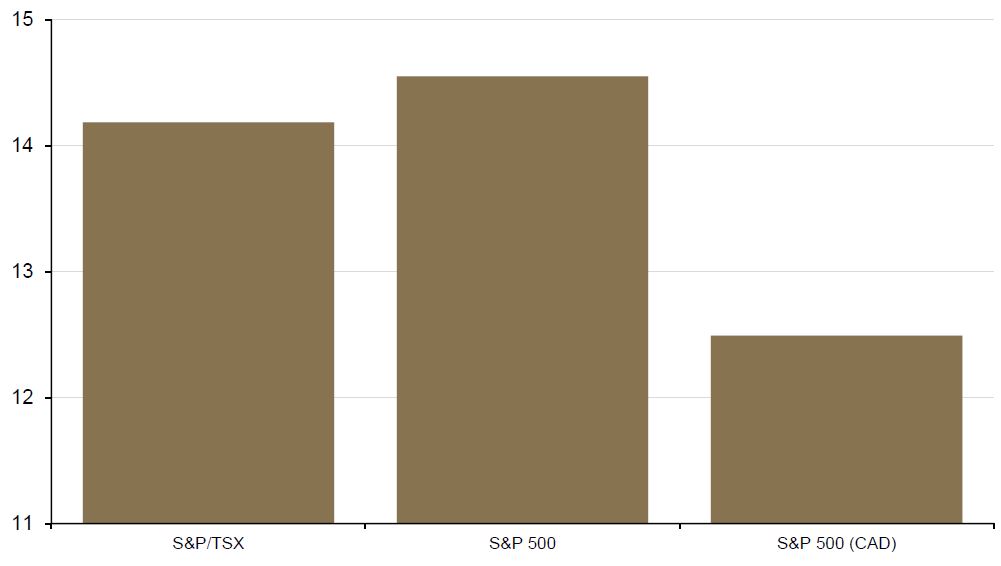

For example, over last 30 years the currency had effectively no effect on overall investment performance. Canadian investors with exposure to the broad US stock market would have experienced better overall portfolio performance than by strictly holding the Canadian stocks, without any adverse impact from converting those returns back into Canadian dollars

Total return over the last 30 years

(annualized per cent change)

Based on data to April 30, 2021; source: Bloomberg, Guardian Capital

With that in mind, the costs for protecting against adverse movements in the currency (which erode investment returns) appear less worthwhile — though, the protection from unfavourable movements still can provide value for those investors trying to limit overall risk exposures for shorter time horizons.

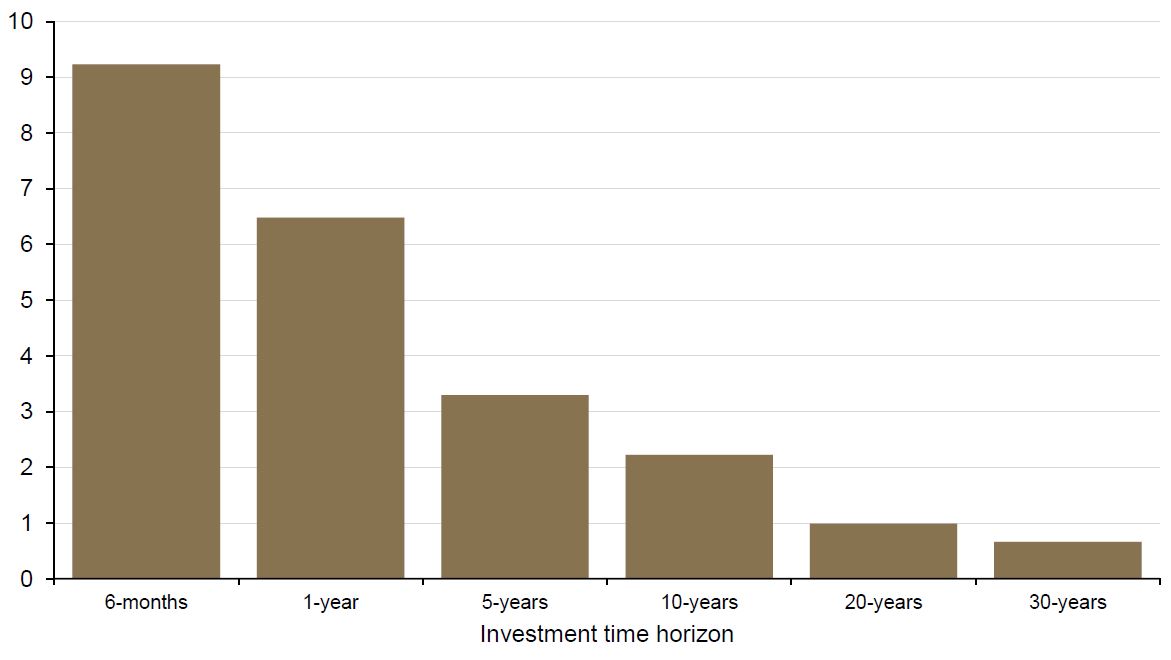

A final thing to consider is that not only would a Canadian investor’s portfolio see the diversification benefits from holding American stocks, not hedging the currency actually has the effect of reducing the overall volatility of those US dollar returns as well — the exchange rate itself, since it is not perfectly correlated with the US stock market, plays a role in dampening the overall volatility of total returns.

Volatility of total return over the last 30 years

(annualized per cent)

Based on data to April 30, 2021; source: Bloomberg, Guardian Capital

For example, by maintaining the currency exposure over the three decades, investors could have reaped the performance benefits while also seeing lower volatility. In other words, not hedging has resulted in better risk-adjusted returns over long time horizons — though it does leave positions more susceptible to short-term fluctuations.

Ratio of total return to volatility over the last 30 years

(ratio)