Summary It has now been seven months since the initial wave of COVID-19 caused the world to go on lockdown. […]

In our Fall Economic Outlook, we commented that while COVID-19 and the resurgence of its spread presented a clear and downside risk to the expectations for the speed and trajectory of global growth going forward, there was an obvious source of upside risk to expectations: ending or mitigating the ongoing pandemic sooner rather than later.

On Monday November 9, financial markets offered a glimpse of what that upside could look like, with the announcement of a potential vaccine. Two companies developing a COVID-19 vaccine stated the first interim analysis of their Phase 3 global trials provided evidence of effectiveness in preventing infection. While researchers have cautioned a potential vaccine may result in a 60% – 70% effective rate (the reduction of the disease in a vaccinated group of people compared to an unvaccinated group), the preliminary results of this trial show a potential efficiency rate above 90%, a significantly better outcome than expected.

Given the desire to reduce the spread of COVID-19, a return to a more “normal” lifestyle, and to fully re-open economic activity, the news was met with jubilation by financial markets. Risk assets such as equities and corporate bonds rallied sharply across the globe while investors sold positions in safe haven assets (like government bonds and gold) that have generated strong performance through this tumultuous year.

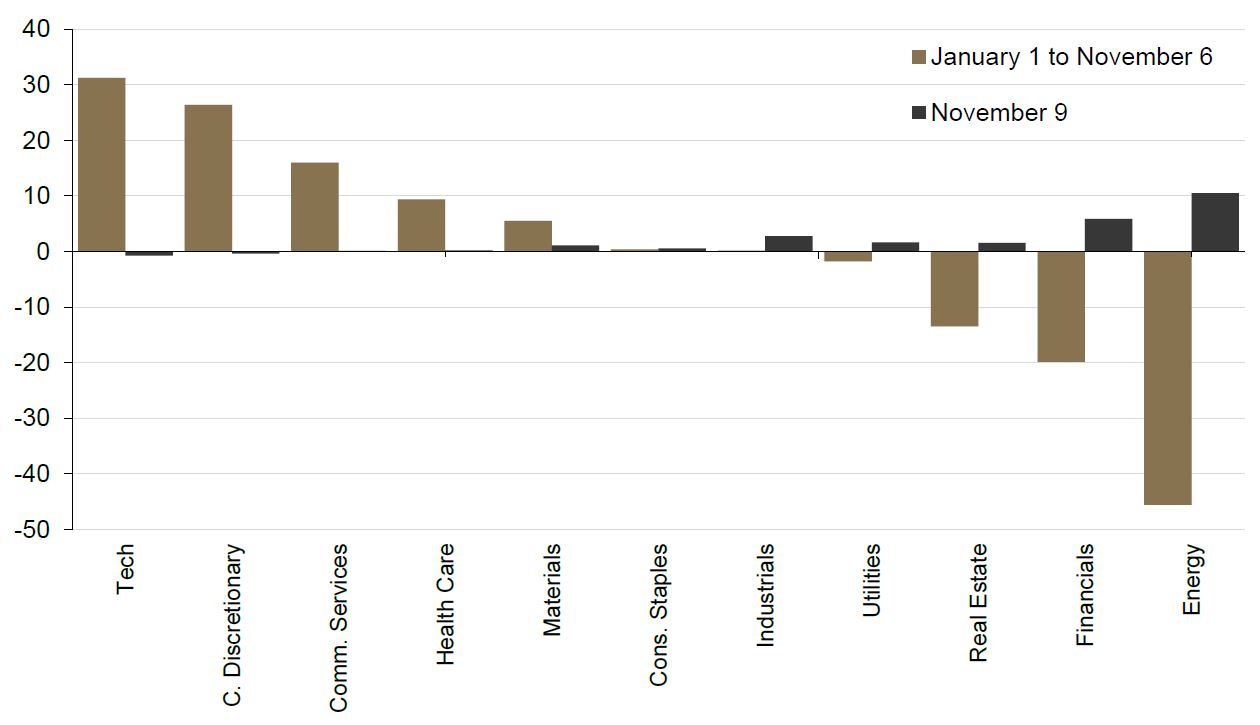

Speaking of strength, it was interesting to see that though equity markets as a whole had a solid day with strong performance, the gains were far from uniform on a sector basis. Indeed, Energy and Financials led the gains on November 9, while Information Technology and Consumer Discretionary were down on the day — this represented a complete inversion of the market sector leaderboard year-to-date.

MSCI All Country World Index sector performance

(percent change)

Source: Bloomberg, Guardian Capital as at Nov 9, 2020

Against the rising hope of a conclusion to the pandemic coming sooner rather than later, this seeming rotation among market leaders makes sense. The market recovery over the last 7½ months has largely been a story of a handful of haves: companies in industries that were better positioned to succeed, especially those in “internet-enabled” sectors like Information Technology, Communication Services and e-Commerce segments of Consumer Discretionary, have been soaring. In contrast, others continue to struggle to keep their head above water, as pandemic-induced restrictions impair their ability to function.

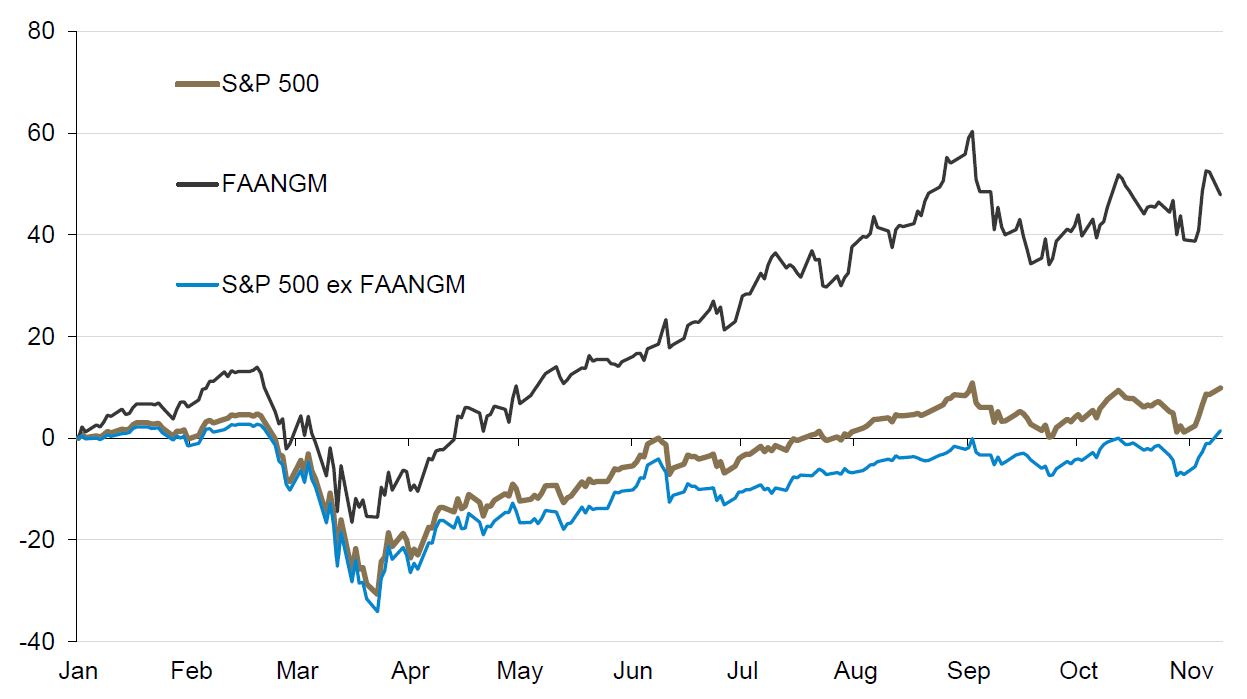

A notable example is in the US. Coming into the week, the S&P 500 Composite Index was up nearly 9%. Excluding the six mega-cap stocks (which were jointly up in excess of 50%), the rest of the index was actually down 1% — though, yesterday’s performance brought this group of laggards back fully into positive territory for the year for the first time since February.

S&P 500 Performance With and Without FAANGM

(year-to-date percent change)

FAANGM=Facebook, Amazon, Apple, Netflix, Google (Alphabet) and Microsoft

Source: Bloomberg, Guardian Capital data to November 9, 2020

The presence of a vaccine will remove various impediments to the operation of many businesses, improving their relative prospects and, rightly, should support the valuations of their equities. As a vaccine becomes more of a reality, the negative tail risks priced into the market (i.e. failure to develop a vaccine) will fade further. That would appear to suggest ample scope to play some catch up, meaning there may well be more days like Monday in the near future.

Still, here is where an economist earns his title as a dismal scientist.

While the news on a vaccine was clearly a welcome development, it does not really change anything just now.

For starters, results presented on Monday do not represent a full and finalized study — the Phase 3 trials are ongoing and additional data could affect the results. Moreover, there is much information about the vaccine that is still unknown, such as its effectiveness in preventing severe cases or preventing those vaccinated from serving as carriers, how long it will protect against the virus or any longer-term side effects — and the results have not gone through the peer review process. In other words, this still represents a work in progress rather than a finished product.

However, should everything continue on a positive path, the expectation is that the vaccine will be submitted to the US Food and Drug Administration for Emergency Use Authorization soon after the required safety milestones are achieved (currently expected to occur the third week of November and is consistent with earlier guidance from the company).

If and/or when that target is hit, and it ultimately receives authorization, it does not mean production of the vaccine will be sufficient to meet all demand in short order. The press release¹ stated there is an expectation to produce up to 50 million vaccine doses globally in 2020 and up to 1.3 billion doses in 2021. This realistically makes the broad distribution of a vaccine a story for later next year — and aligns with the timeline currently expected in the marketplace, so alone is unlikely to be enough yet to spin the dial with macro forecasters.

The bottom line is that this development is clearly positive for all of us looking to put the pandemic experience into the rearview, and does warrant some optimism (which can help price out the more extreme downside risks), but the enthusiasm should be somewhat tempered as the reality is there is still a long row to hoe.