Seeks to create wealth through investing in high-quality Canadian equities while managing sector concentration

Investors looking for exposure to the Canadian equity market face embedded challenges due to the imbalanced sector weights in the S&P/TSX Composite Index’s (“the Index”) composition.

Eggs in one basket

On several occasions in the past, the top three largest Canadian sectors (Materials, Energy and Financials) have had a combined weight of over 75% of the Index.

External influences

The highly cyclical nature of resource-extractive industries (Energy and Materials) results from their correlation to sometimes-volatile commodity prices.

Overlooking good companies

Sectors that tend to be underrepresented in the Index, such as Information Technology and Consumer Discretionary, typically have a higher return on invested capital.

By simply following the Index in their portfolio, investors could miss the opportunity to invest in promising companies, while also facing overexposure to resource price volatility.

Challenging the Constraints of Canadian Equities

The Guardian Canadian Sector Controlled Equity Fund reallocates exposure away from the Canadian resource sectors, to invest in other areas of the Canadian market that are in line with the investment team’s quality-oriented approach. Quality companies exhibit long-term growth potential, robust profitability, acceptable risk characteristics and a stewardship orientation that is consistent with sustainable value creation.

The Benefits of High-Quality Companies

Outperformance

Companies that exhibit robust profitability tend to regularly outperform companies with lower return on capital.¹

Reduced volatility

The highly cyclical nature of resource-extractive industries (Energy and Materials) results from their correlation to sometimes-volatile commodity prices.

Mitigating the downside

Quality companies are better at weathering the storm during recessionary conditions.³

With an underweight in extractive resource industries, the Fund is able to invest a larger weight in high-quality companies with the potential to generate enhanced returns at a lower risk over the long-term versus the Index.

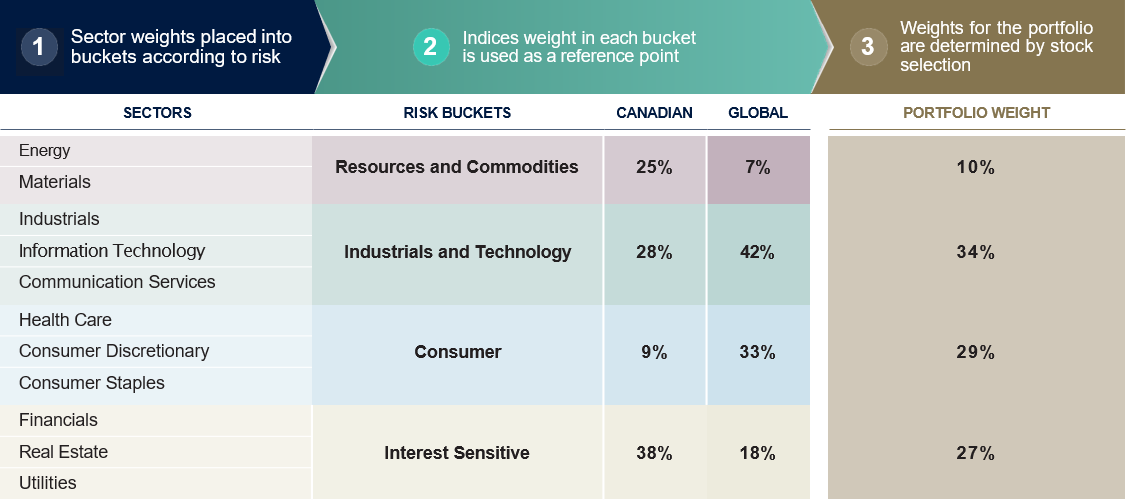

Investment Process

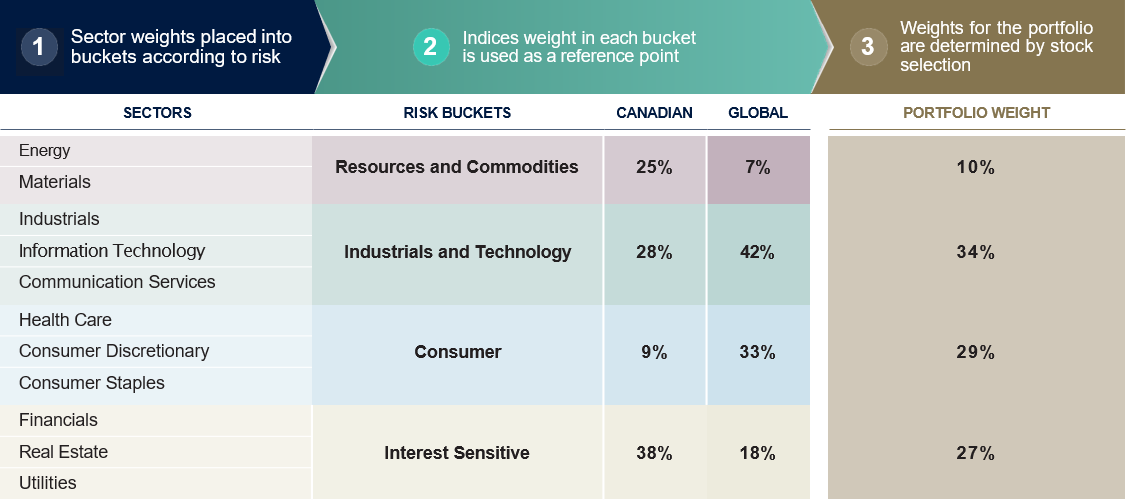

To determine the applicable sector weights in the Fund’s portfolio, target ranges are constructed using the Canadian and Global sector weights as guidelines.

Illustrative Example Only *

* The Fund’s security and sector allocation will be actively managed and may not reflect the constituents or weights shown in the chart above. The chart shown is used only to illustrate an example of the investment process and is not intended to reflect actual holdings of the Fund.

Access the Solution

Guardian Canadian Sector Controlled Equity Fund – ETF Units

Investing in the Canadian equity market with lower exposure to potentially volatile Canadian resource sectors.

TICKER: GCSC

Management fee: 0.50%

Highly Experienced Professionals Leveraging Decades of Knowledge

Guardian’s Canadian Equity Investment Team consists of highly experienced investment professionals. Their long-term, high-quality investment philosophy has been unchanged for over two decades. The two lead portfolio managers are:

Ted Macklin, CFA

Managing Director Canadian Equity

Guardian Capital LP

Sam Baldwin, CFA

Senior Portfolio Manager Canadian Equity

Guardian Capital LP

1 Matthews, B., & Holland, D., Was Warren Buffet Right: Do Wonderful Companies Remain Wonderful?, HOLT Wealth Creation Principles, June 2013, Credit Suisse HOLT.

2 Schroders QEP Global Equity Team, Why Quality stocks offer higher return and lower risk, Schroder Investment Management North America Inc., 2014.

3 Guardian Capital LP, Diamond Quality: The Benefits of Identifying Quality Stocks, Guardian Perspectives, April 2019.

Please read the prospectus before investing. Important information about the Guardian Capital exchange traded fund (“ETF”) is contained in its prospectus. Commissions, management fees and expenses all may be associated with investments in ETFs. You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on the Toronto Stock Exchange (“TSX”). If the units are purchased or sold on the TSX, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated. This document is intended as a general source of information. It is not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting or tax, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment.

Every effort has been made to ensure that the information contained in this document is accurate at the time of publication, but is subject to change at any time, without notice, and Guardian is under no obligation to update the information contained herein. Certain information contained in this document has been obtained from external sources which Guardian believes to be reliable, however we cannot guarantee its accuracy. Guardian Capital LP is the Manager of the Guardian Capital mutual funds and ETFs and is a wholly- owned subsidiary of Guardian Capital Group Limited, a publicly traded firm, the shares of which are listed on the Toronto Stock Exchange. For further information on Guardian Capital LP and its affiliates, please visit www.guardiancapital.com