“The real fortunes in this country have been made by people who have been right about the business they […]

Since the start of 2022, growing inflation and rising interest rates have contributed to a marked increase in market volatility. On top of that, the global economy is facing supply chain disruptions and geopolitical and macroeconomic uncertainty, which will likely remain part of the near-term environment. All of this has led to earnings multiple compression, which has contributed to some of the most significant declines for growth stocks seen in recent history.

With such a backdrop, how can investors immunize their portfolios against the challenges of the current environment?

We believe that investing in companies with consistent and growing dividends can provide core building blocks to grow your capital while managing risk in the current environment and over the long term, regardless of changing market conditions.

Dividends are payments made by a company on a regular, often quarterly, basis to return some of its profits to shareholders. However, dividends can do more than provide a stream of income. Investing in companies that can persistently grow free cash flow and raise dividends can also help reduce volatility and drive total returns while delivering sustainable income over the long term.

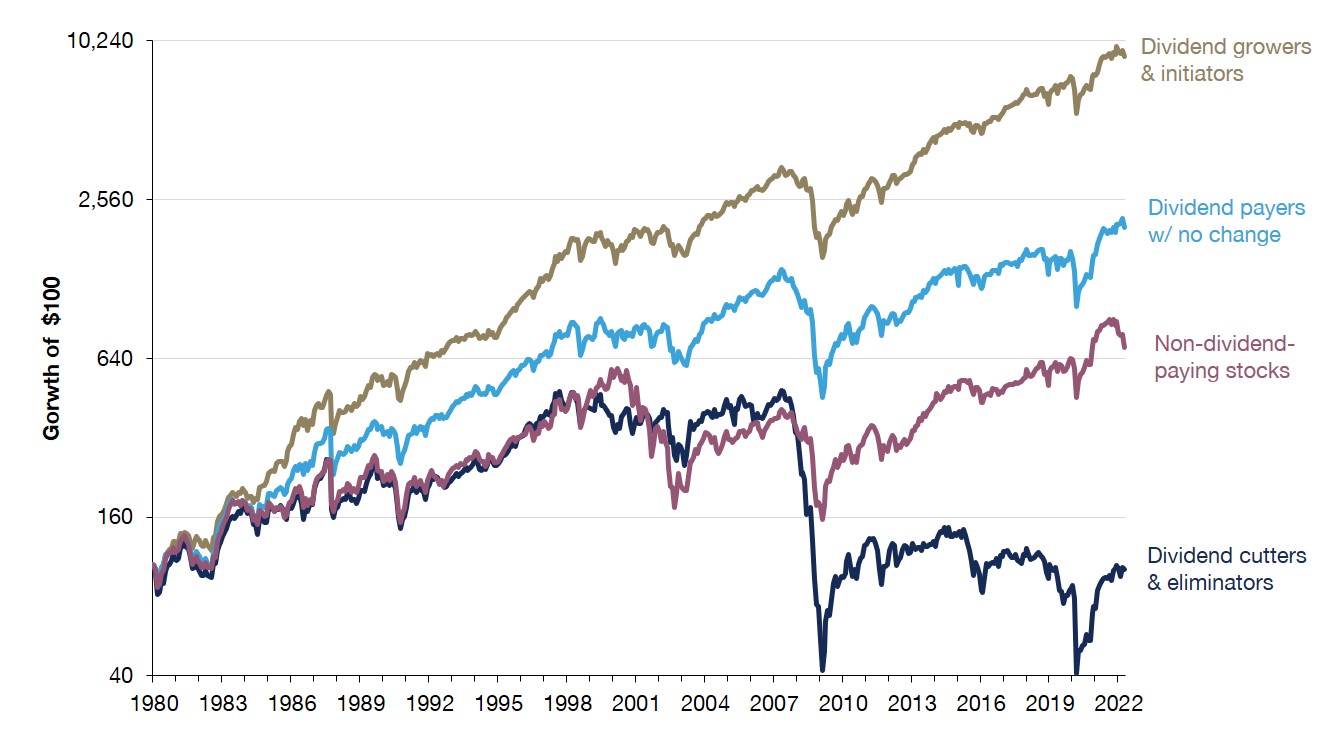

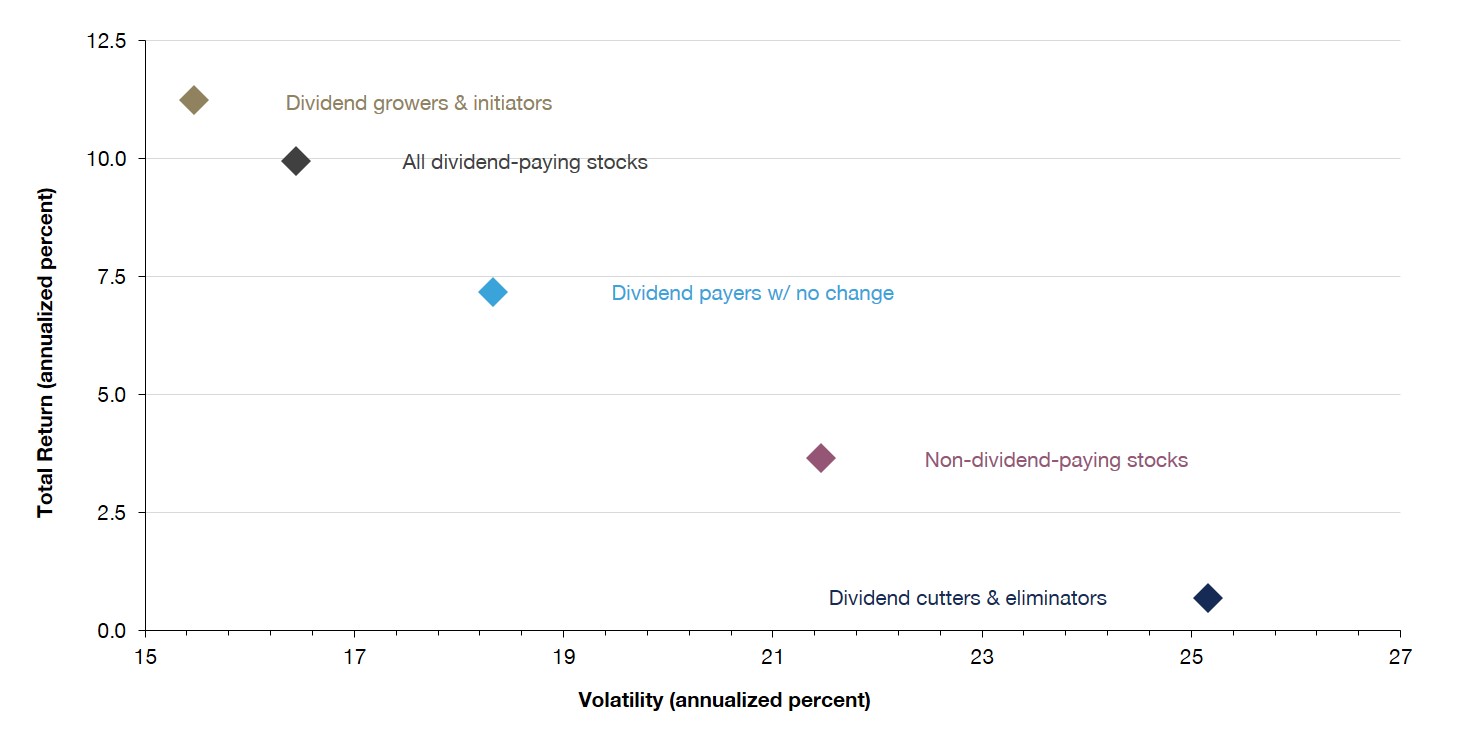

Companies that can grow dividends have historically led in performance…

…with lower volatility

© Copyright 2022 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo.

Source: Ned Davis Research for the period 01/31/73–4/30/22. In USD. This chart plots the historical total returns of S&P 500 Index component stocks based on their dividend policies. The various dividend policy categories are subsets of stocks within the S&P 500 Index, as defined by Ned Davis Research. Returns based on monthly equal-weighted geometric average of total returns of S&P 500 component stocks, with components reconstituted monthly. Standard deviation is a historical measure of the variability of returns relative to the average annual return. A higher number indicates higher overall volatility. The Standard and Poor’s (S&P) 500 Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks. Historical data is provided for illustrative purposes only. Past performance is not indicative of future results. Reproduced with permission of NDR.

A look at the returns of S&P 500 Index stocks sorted by dividend policy over the past 50 years shows that companies with growing free cash flow and dividends have outperformed over the long term with lower volatility relative to non-dividend payers or dividend cutters.

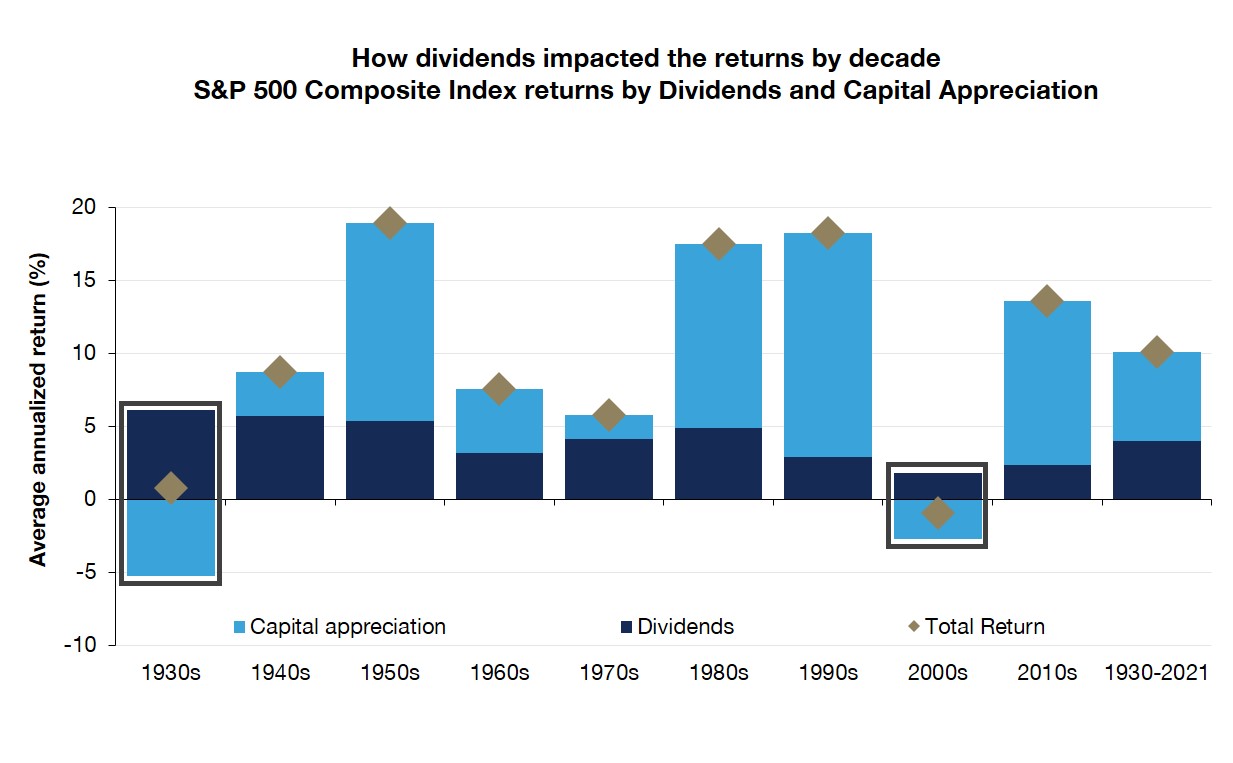

Dividend-paying stocks’ regular payments may help support returns when stock prices struggle and reduce the volatility of a stock’s total return. Dividends provide current income to investors and, during periods of volatility, this may provide a cash flow return to investors that offsets falling share prices. Think of it as a rent collection from companies in the form of dividends. In the 1930s and 2000s the S&P 500 Index price returns were negative, but returns from income almost completely offset the price decline.

Source: Robert J Shiller, Bloomberg, Guardian Capital as of Dec. 31, 2021. In USD. Past performance is not a guarantee of future results. For illustrative purposes only.

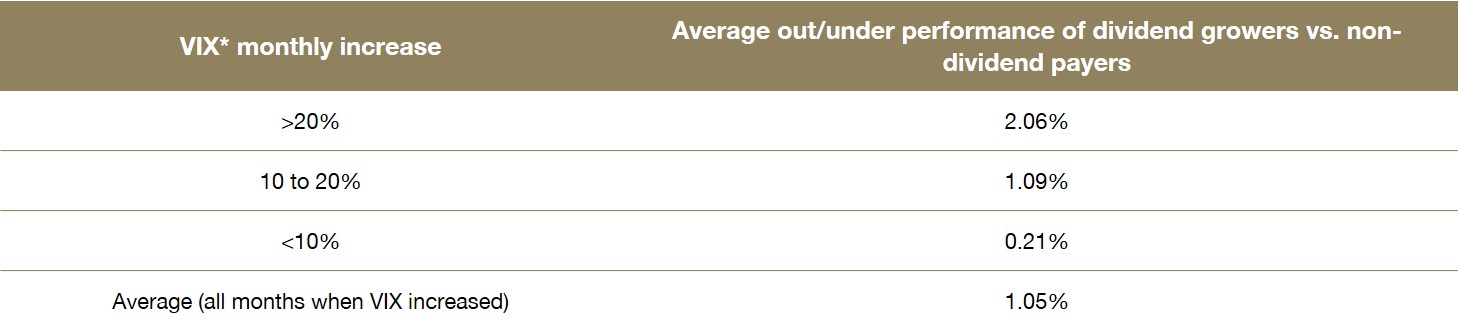

In addition, companies with the financial strength necessary to support dividend growth tend to experience less volatility in stock prices and have outperformed during volatile markets.

Dividend growers vs. non-payers: Excess returns during months when volatility increased

* VIX refers to the Chicago Board Options Exchange’s CBOE Volatility Index

Source: Ned Davis Research, Bloomberg, Guardian Capital, from January 31, 1990 to April 30, 2022. In USD. Dividend growers vs. non-payers performance during months when the CBOE Volatility Index (VIX) increased. Chart illustrates the average historical performance of S&P 500 Index component stocks based on their dividend policies. The various dividend policy categories are subsets of stocks within the S&P 500 Index, as defined by Ned Davis Research. Past performance is not a guarantee of future results. For illustrative purposes only.

A steadily growing dividend is often a sign of a company’s durability, stability, and confidence in its underlying business. The mere fact that a company pays a dividend typically means it is profitable and has excess free cash flow, qualities that may help to bolster its stock during challenging times. This is especially important today when the market has many unprofitable or marginally profitable companies.

| Hallmarks of dividend growth and resilience A company’s dividend policy can be one of the clearest indicators of a management team’s confidence in the future growth prospects of their business. In order to continuously pay a dividend, a company must generate profits above and beyond the operating needs of the business. They are also incentivized to be more careful with their use of cash. Because of this, companies with a commitment to dividends often also demonstrate traits that make them more resilient in challenging macro environments, such as: |

|||

|

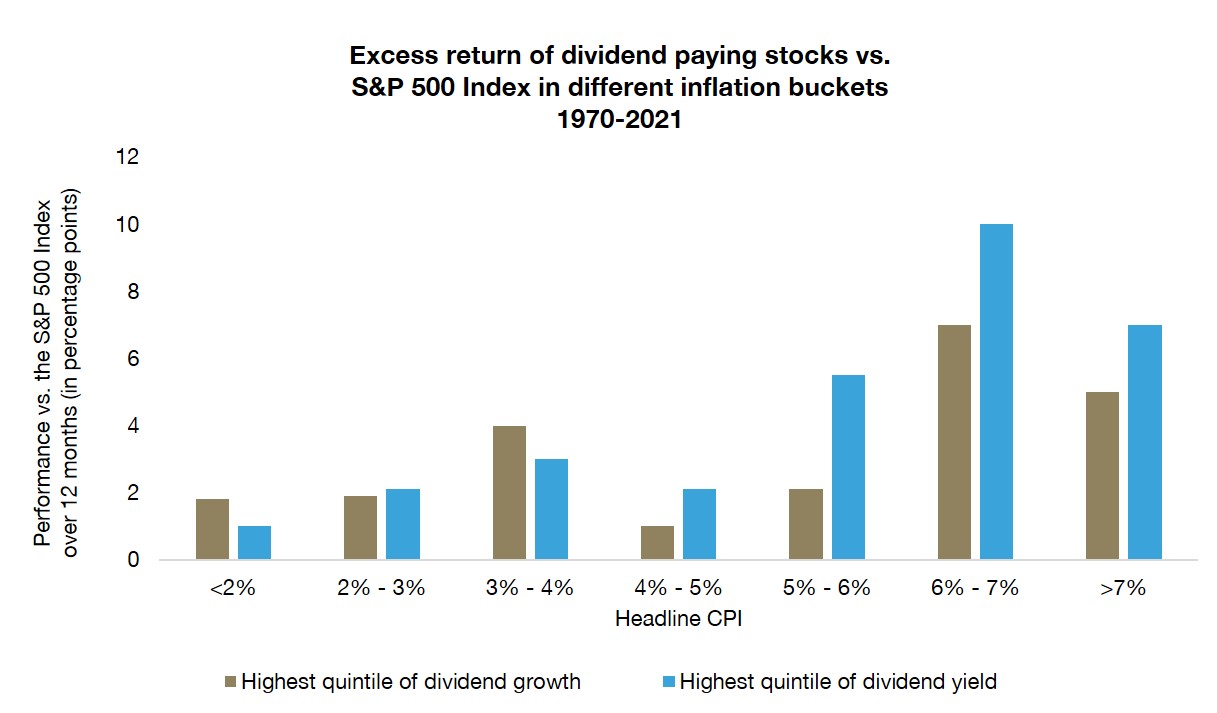

Dividend growers and payers have historically outperformed relative to non-dividend payers and dividend cutters during periods of high inflation and rising interest rates.

Source: Goldman Sachs Global Investment Research. In USD. Performance is calculated using 12-month median returns. Highest quintile of dividend growth is based on trailing 12-month dividend growth. Reproduced with permission of Goldman Sachs. Past performance is not a guarantee of future results. For illustrative purposes only.

© Copyright 2022 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo.

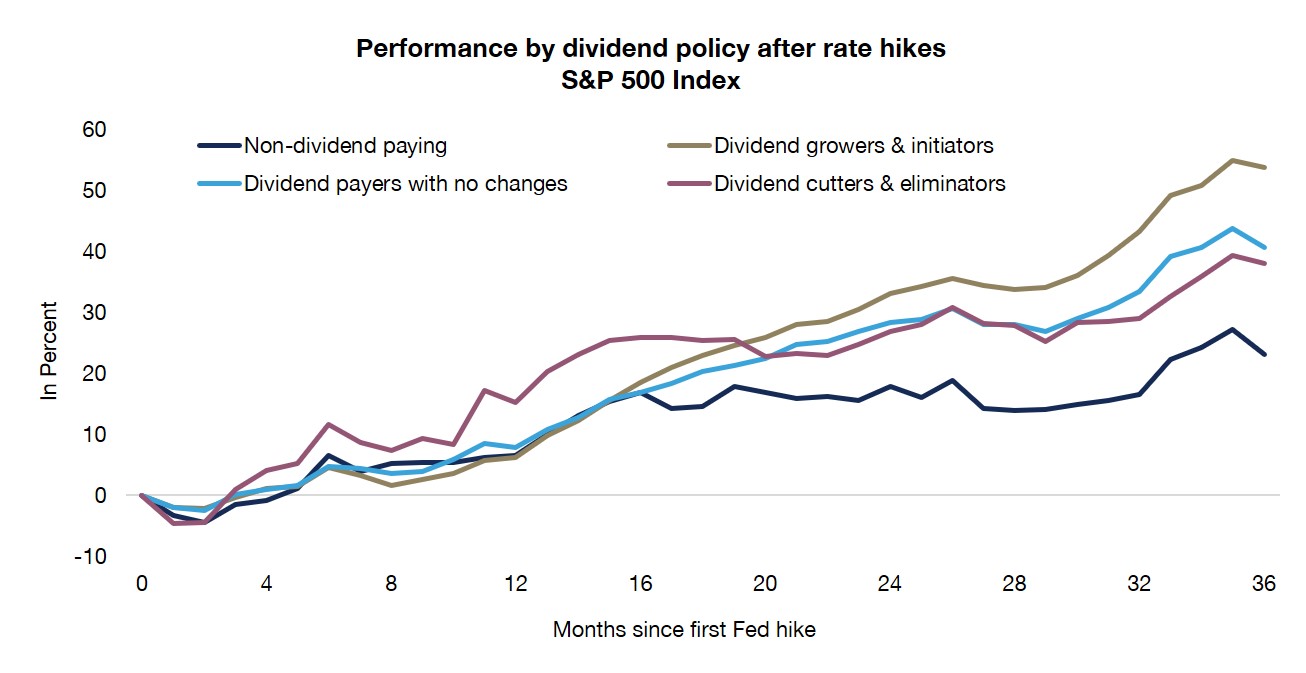

Source: Ned Davis Research, Guardian Capital LP. In USD. Data is the average monthly performance in the months following the first Fed rate hike of a tightening cycle. Includes rate hike cycles starting May 1983; March 1988; February 1994; June 1999; June 2004; and December 2015. Past performance is not a guarantee of future results. For illustrative purposes only.

We believe a company’s ability to provide sustainable dividend growth is one of the cornerstones of wealth building, and it becomes even more important during inflationary periods. As inflation erodes the value of a dollar, growing dividends can help to maintain purchasing power.

With high inflation and interest rates on the rise, cash flow visibility has become very important, and companies that can continue to grow their earnings and dividends in this environment may be more resilient against inflationary concerns. These high-quality companies generally have well-established competitive advantages and pricing power that enable them to adapt and grow their income to keep up with inflation.

With rising interest rates in mind, dividend-paying companies supported by positive fundamentals, balance sheet strength, ample free cash flow and management teams committed to sustainable dividend growth, can serve as investments that are generally less sensitive to changes in the cost of capital and interest rates.

The search for dividend income might start with companies that pay the highest yields for many investors. These companies can be sound investments, but the high yield can also be a warning sign. For one, companies that have very high dividends to start may not be able to grow or sustain them. Just because a company has paid dividends in the past doesn’t mean it will be able to increase or even maintain the dividend in the future. In addition, these high-yielding companies, also known as bond proxies, may be more sensitive to interest rate risk.

Rather than investing based on yield alone, we believe the focus should be on companies with strong dividend growth, a quality payout and sustainable cash flow growth. As we have noted above, the charts on pages 1 and 2 illustrate that dividend growers have a history of being rewarded by the market over time. But these charts also show that, in addition to identifying dividend growers, it is equally essential to avoid companies that are cutting or eliminating their dividends.

To spot this difference, it’s important to enlist investment professionals who may be able to identify companies that are likely to increase their dividends in the current market environment as well as those likely to cut them. We believe an approach that focuses on quality companies with consistent earnings growth, rising cash flows and dividends can keep investors away from these more volatile areas of the market while simultaneously providing the benefit of their long-term growth throughout changing market conditions.

All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. The outlook and opinions expressed in the communication are not to be used or construed as investment advice or as an endorsement or recommendation of any security discussed herein. This information is provided as of the published date and is subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. For more information on the financial terms used in this document, please refer to the Glossary of Terms on our website at: https://www.guardiancapital.com/investmentsolutions/ glossary-of-terms.

This document is intended as a general source of information. It is not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting or tax, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Every effort has been made to ensure that the information contained in this document is accurate at the time of publication, but is subject to change at any time, without notice, and Guardian is under no obligation to update the information contained herein. Certain information contained in this document has been obtained from external sources which Guardian believes to be reliable, however we cannot guarantee its accuracy. This document may not be reproduced or redistributed without the consent of Guardian Capital LP.

This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation. The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader.

This document includes information concerning financial markets that was developed at a particular point in time. This information is subject to change at any time, without notice, and without update. This document may also include forward looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are all associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result.

Guardian Capital LP is a wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP, please visit www.guardiancapital.com. Guardian, Guardian Capital and the Guardian gryphin design are trademarks of Guardian Capital Group Limited, registered in Canada.